Alarming decline in SME lending

The dip in bank lending to SMEs to a four-year low is another concerning indicator of the current state of the economy. During FY2024-25, banks disbursed Tk 2.05 lakh crore in loans to SMEs, a nine percent drop year-on-year, according to data from Bangladesh Bank. This marks a reversal of the upward trend in SME lending seen since 2021, following the slowdown caused by the Covid pandemic in 2020.

Unfortunately, SMEs have had little respite since the pandemic, as the war in Ukraine, political unrest, and last year's mass uprising have acted as one external shock after another. Given that small businesses are particularly vulnerable to such disruptions, these successive shocks have taken a serious toll, with nearly one-quarter of SMEs shutting down since the pandemic.

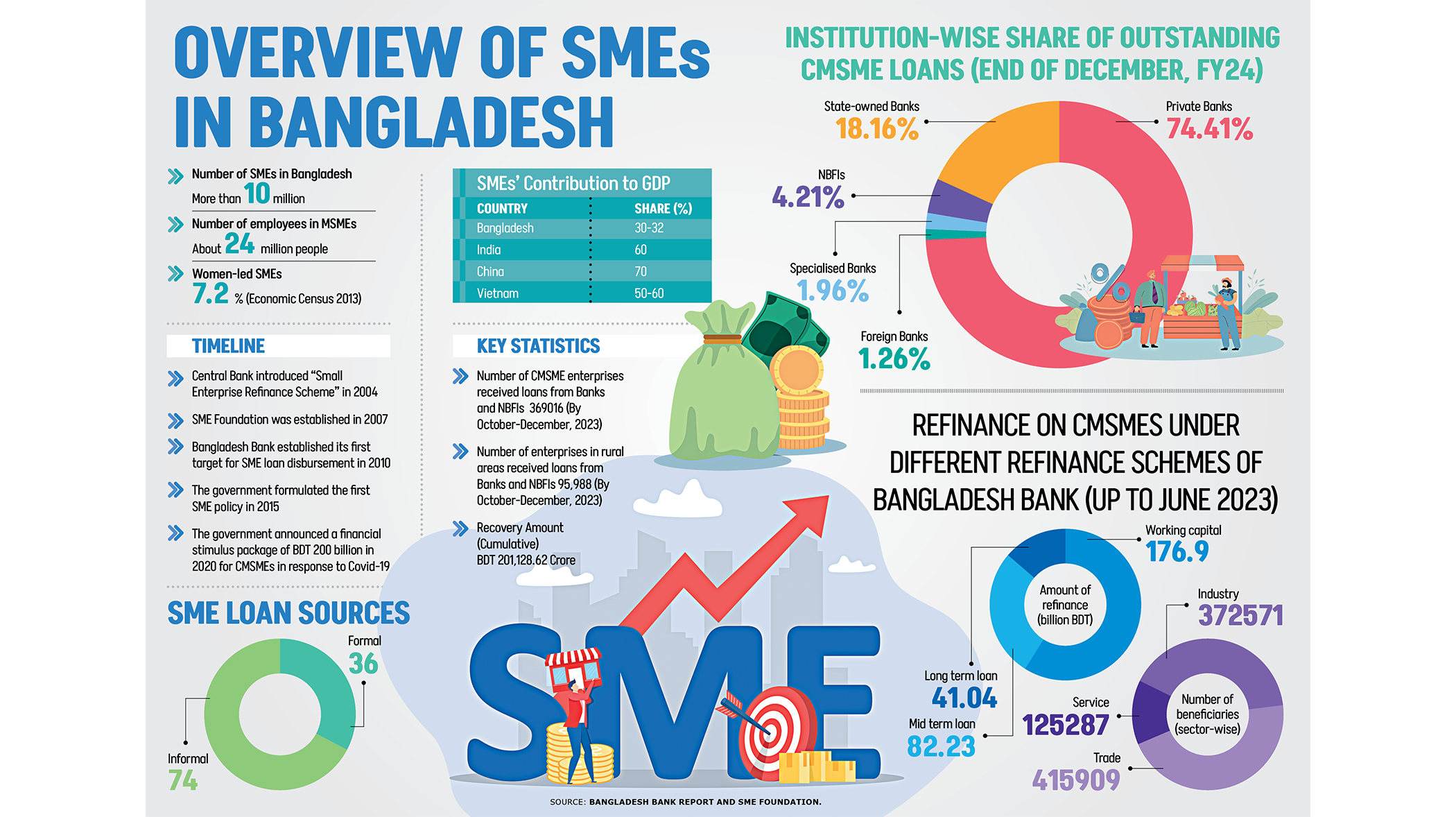

SMEs are often described as the backbone of the industrial sector. Bangladesh has around 78 lakh cottage, micro, small, and medium enterprises, which contribute about one-quarter of the country's GDP and provide employment to over 2.4 crore people across the country. With SMEs struggling to sustain operations—and many being forced to close—the job market has undoubtedly worsened, and economic growth has taken a significant hit. Investment is also likely to suffer, as reflected in the World Bank's recently lowered growth forecast for Bangladesh.

In addition to external shocks, the fragility of nearly a dozen banks has also constrained credit availability for small and micro businesses. Some 10-12 banks, including several shariah-based ones that were once very active in SME financing, are no longer participating in this sector. Many banks struggling with capital shortages and rising bad loans have become increasingly risk-averse. With private sector confidence remaining low for a prolonged period and ongoing uncertainty delaying new business plans and expansion, it is difficult to see a reversal of this trend without effective policy interventions.

Unfortunately, despite the finance adviser acknowledging back in early July that funding challenges are preventing SMEs from realising their vast potential, the interim government has so far failed to turn things around, as evidenced by recent data. This is particularly disappointing, given that the adviser himself also admitted that the country's economic growth still largely depends on the SME sector, which generates the highest employment. Given this reality, we must ask: why has the government not prioritised this matter more urgently? Is it unaware of the struggles of millions of jobseekers and the state of the overall economy at large?

To revive SME lending, the government must act on several fronts at once. It must take steps to ensure that banks feel secure in lending to SMEs. And refinancing windows with lower interest rates should be made readily available to banks and non-bank lenders specifically for SME loans. Most importantly, restoring confidence in the banking sector through stronger oversight and transparent restructuring of weak banks is essential—as without financial sector stability, no SME support programme will achieve its intended impact.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments