A year of reform and resistance in the tax sector

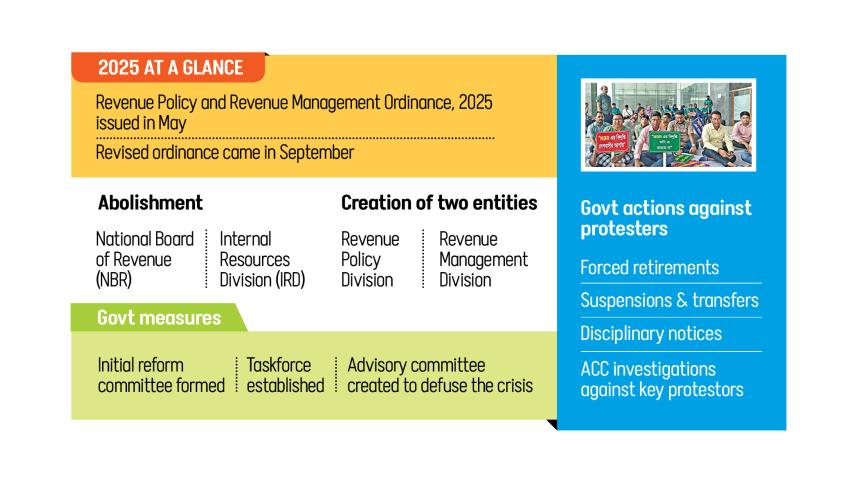

Protest, turmoil, and punishment -- these three words defined Bangladesh's revenue sector in 2025, a year marked by the split of the National Board of Revenue (NBR), a major source of government income.

Following a mass uprising in August last year, the interim government launched long-awaited reforms aimed at separating tax policy-making from tax administration to improve efficiency, accountability, and revenue collection.

A five-member advisory committee was first formed to guide the reforms. Although the committee submitted a report on restructuring the NBR, the government did not make it public.

In mid-May, a 'controversial' ordinance dissolved the NBR, dividing its functions into two new bodies: the Revenue Policy Division, responsible for drafting tax laws and handling treaties, and the Revenue Management Division, tasked with enforcement and collection.

The reform followed international best practices by separating policy from implementation and was linked to conditions under Bangladesh's International Monetary Fund (IMF) support programme.

The decision, however, faced strong opposition within the NBR. Officials and employees feared losing power, career uncertainty, and erosion of their cadre status.

Their main grievance was a provision allowing general administration cadre civil servants to lead the new divisions, potentially sidelining experienced revenue officers.

They claimed the reform was rushed and imposed with little consultation, turning a long-promised overhaul into a year of turmoil that severely disrupted tax administration and caused significant revenue losses.

In response, NBR staff formed the "NBR Reform Unity Council," demanding the repeal of the ordinance and the public release of the advisory committee's report.

The protests quickly spread nationwide, starting with pen-down work abstentions and escalating to phased shutdowns between May 14 and June 29. The unrest paralysed import and export operations and large segments of the revenue administration.

At one point, protesters also demanded the removal of NBR Chairman Md Abdur Rahman Khan.

To address the crisis, the government formed another advisory committee led by Energy Adviser Muhammad Fouzul Kabir Khan, which recommended amendments to the ordinance.

In September, the government revised the ordinance, allowing revenue officials to hold top and senior positions in the Revenue Policy Division.

At the same time, authorities cracked down on the protests with forced retirements, suspensions, transfers, and disciplinary notices, creating fear and bitterness within the institution.

Several officials -- including current members, commissioners, and the president and general secretary of the protesting platform -- faced punitive measures, while the Anti-Corruption Commission launched inquiries into leaders of the protests.

These actions not only slowed the revenue machinery but also increased frustration and discontent among staff.

By the end of the year, the revenue sector remained shaken, even though overall revenue collection had improved.

UNFINISHED REFORM PROPOSALS

When the ordinance was issued, the interim government abruptly dissolved the initial five-member advisory committee before it could submit its comprehensive report. A week later, a new nine-member National Taskforce on Tax Restructuring was formed, led by economist and Policy Research Institute (PRI) Chairman Zaidi Sattar.

The taskforce is tasked with recommending ways to raise the tax-to-GDP ratio and proposing short- and long-term policies for a business- and trade-friendly tax system that supports economic growth.

As of yesterday, the government has not yet completed the separation process, although Finance Adviser Salehuddin Ahmed said it would be done by the end of the year. NBR Chairman Md Abdur Rahman Khan added that the interim government aims to finalise the process during its tenure.

Economists and tax experts say the NBR conflict has revealed deeper structural weaknesses, stressing that political stability and clear policies are crucial to restoring confidence in the revenue system.

Towfiqul Islam Khan, additional research director at the Centre for Policy Dialogue, said, "The real challenge is not announcing reforms, but implementing them. We talk about reforms, but operationalisation is far from reality. Key issues remain unresolved, so implementation will inevitably take time."

He questioned claims that the reforms would be completed quickly, saying, "The claim that everything will be done by December is not credible."

Khan raised concerns about the transparency of the reform process. "A committee formed to guide the reforms was dissolved before submitting its final report, and the progress of another committee remains unclear," he said.

"The reform process is moving forward in a non-transparent manner, without accountability," he added.

Khan warned that the lack of political engagement could weaken the sustainability of the reforms and noted that internal disruptions within the revenue administration following the protests remain a serious issue.

As of November, the NBR is still short of its five-month target by Tk 23,000 crore. This comes at a time when Bangladesh's tax-to-GDP ratio remains low compared with regional standards, and the revenue system relies heavily on indirect taxes like VAT and import duties instead of broad-based direct taxes.

The next government, following national elections, will inherit a revenue authority facing internal dissent, ongoing institutional restructuring, and the broader challenge of meeting fiscal targets in a strained macroeconomic environment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments