Sonali Bank seeks Tk 6,600cr bond against unpaid loans to sugar corporation

State-owned Sonali Bank has urged the government to issue bonds against unpaid loans to the Bangladesh Sugar and Food Industries Corporation (BSFIC) to address the lender’s capital shortfall.

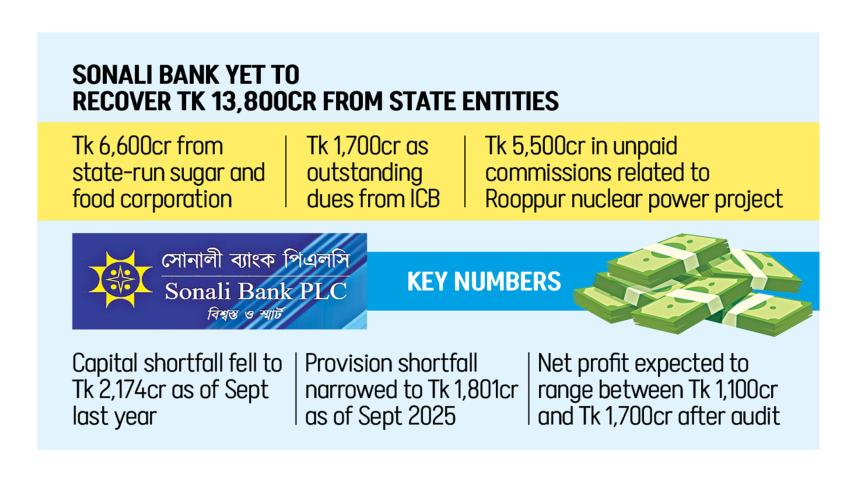

The state-owned corporation, which manages 15 sugar mills, owes the bank Tk 6,600 crore.

Another state-owned agency, the Investment Corporation of Bangladesh (ICB), owes Sonali Bank Tk 1,700 crore. The bank is also awaiting receivable commissions of around Tk 5,500 crore tied to the Rooppur Nuclear Power Project.

“We have been able to reduce our capital shortfall over the past few years, and we will have no shortfall if these loans are recovered,” Sonali Bank Managing Director Md Shawkat Ali Khan said at a press briefing at the bank’s Dhaka headquarters yesterday.

At the end of September 2025, the bank’s capital shortfall stood at Tk 2,174 crore, down from Tk 5,949 crore in December 2024, according to figures presented by Md Iqbal Hossain, the bank’s chief finance officer.

Provision shortfalls also fell to Tk 1,801 crore from Tk 4,632 crore over the same period.

Sonali Bank must maintain provisions of Tk 3,000 crore against dues from BSFIC, and Tk 1,300 crore for ICB investments.

Officials said these shortfalls are the main driver of the bank’s capital gap.

Other factors cited include loans to Orion Infrastructure, delayed government compensation, and unrecovered commissions of Tk 5,500 crore against letters of credit totalling Tk 94,246 crore issued for the Rooppur project.

At the conference, Khan highlighted the bank’s improved financial structure, crediting reforms, targeted planning, and strengthened loan recovery efforts.

He said, “Public confidence in Sonali Bank is very high. It is because of this trust that people deposit more funds.”

“Sonali Bank is now much more careful in selecting borrowers. Our depositors are a blessing for us,” Khan said, noting that no incidents similar to the Hallmark scandal have occurred since.

Operating profit rose 41 percent year-on-year in 2025 to Tk 8,017 crore. Audited net profit is expected to fall between Tk 1,100 crore and Tk 1,700 crore. The bank’s non-performing loan ratio fell to 16 percent at the end of the year, with plans to reduce it below 9 percent by 2026.

Md Shawkat Ali Khan claimed that no such incident has occurred at Sonali Bank since the Hallmark scandal – a massive loan scandal involving more than Tk 3,500 crore

“Sonali Bank is now much more careful in selecting borrowers. Our depositors are a blessing for us,” he said.

The bank’s operating profit rose 41 percent year-on-year in 2025 to Tk 8,017 crore. Audited net profit is expected to fall between Tk 1,100 crore and Tk 1,700 crore.

Khan also said the bank’s non-performing loan ratio fell to 16 percent at the end of the year, with plans to reduce it below 9 percent by 2026.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments