Conventional banks lead remittances as Islamic lenders recover ground

Conventional banks continued to dominate remittance inflows between November 2023 and November 2025, even as Islamic banks recorded a noticeable recovery in market share over the past year, according to a recent Bangladesh Bank (BB) report.

During the two-year period, total remittances sent through the banking system increased, peaking at $3.30 billion in March last year. Conventional banks handled the bulk of these inflows throughout the period, with their dominance strengthening after the initial months.

Islamic banks performed strongly early on but failed to sustain their market share over the longer term, allowing conventional banks to expand their share of remittance inflows.

However, Islamic banks improved their performance in recent months. Their share of workers’ remittances rose from 21.46 percent in November 2024 to 25.63 percent in November 2025, suggesting a partial recovery after a period of weakness.

In value terms, remittances through Islamic banks increased from $472 million in November 2024 to $740 million in November 2025. Over the same period, conventional banks’ remittance inflows rose from $1.73 billion to $2.15 billion.

In its report titled Islamic Banking and Finance Statistics (IBFS), the central bank said the recent rebound in Islamic banks’ performance was partly due to improvements in governance and management at several shariah-based banks.

These steps, BB says, helped restore confidence among expatriate workers, although conventional banks remained the main channel for remittances.

Overall, remittances through conventional banks rose sharply from $1.17 billion in November 2023 to $2.15 billion in November 2025, an increase of about 84.31 percent. In contrast, remittances handled by Islamic banks declined slightly over the same period, falling from $764 million to $740 million, or about 3.09 percent.

The central bank added that the recent recovery in Islamic banks’ market share highlights the need for further policy support and operational improvements. As workers’ remittances are crucial for foreign currency reserves and foreign exchange transactions, additional reforms may be needed to strengthen depositor confidence.

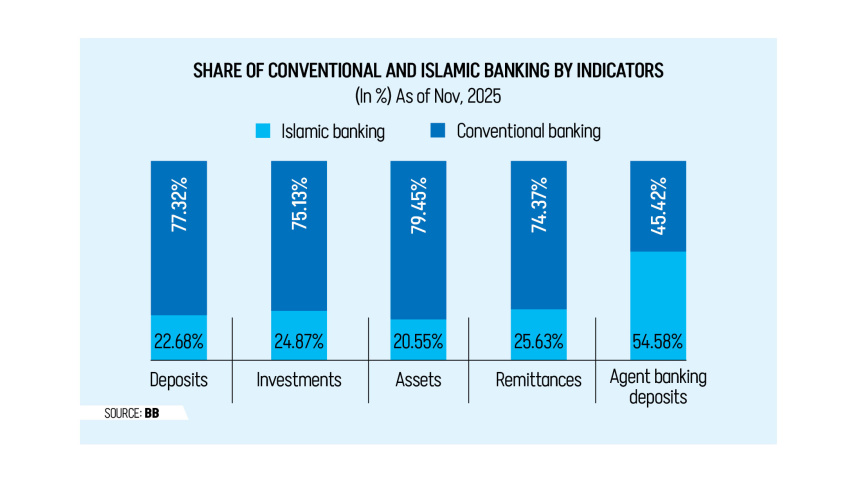

The report also showed mixed trends in other areas. Islamic banks’ share of total deposits fell slightly from 23.09 percent in November 2024 to 22.68 percent in November 2025, while conventional banks held the remaining 77.32 percent.

In investments, Islamic banks marginally increased their share from 24.50 percent to 24.87 percent, but conventional banks continued to dominate with a 75.13 percent share.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments