BB aims to cut bad loans to 25% by March

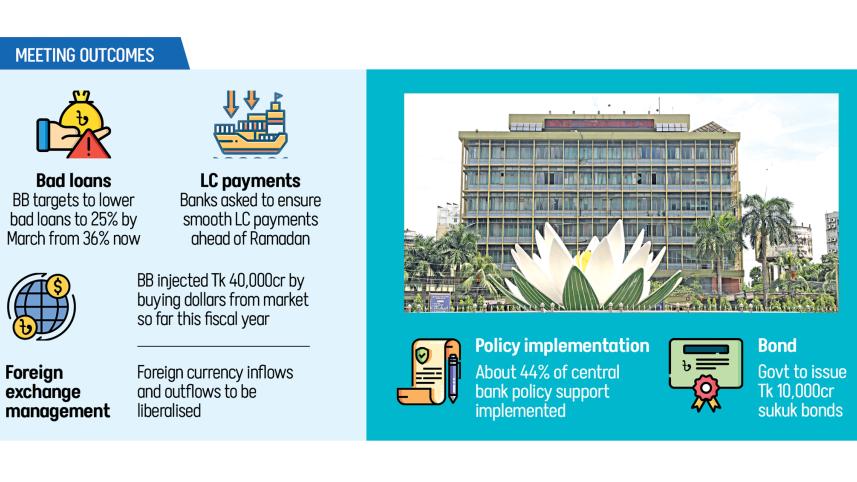

The Bangladesh Bank (BB) has set a target to reduce non-performing loans (NPLs) to 25 percent from the current 36 percent by March, according to senior bankers.

In a meeting held at BB headquarters yesterday, banks were instructed to cut the volume of bad debts through loan rescheduling, accelerating legal recovery and implementing a comprehensive follow-up process for defaulters.

A delegation from the Association of Bankers, Bangladesh (ABB), led by its Chairman Mashrur Arefin, attended the meeting. It was chaired by BB Governor Ahsan H Mansur, with deputy governors, executive directors, and other senior officials of the central bank also present. Nazma Mobarek, secretary of the Financial Institutions Division, attended as well.

The meeting included a presentation on monetary policy and the country’s broader economic situation.

Central bank officials said the governor expressed dissatisfaction with banks’ efforts to tackle defaulted loans, despite various initiatives by the government and the central bank.

Defaulted loans in the banking sector rose to Tk 6.44 lakh crore, nearly 36 percent of total loans disbursed, by the end of September 2025, according to BB data.

In September 2024, the ratio of bad loans stood at 16.93 percent of total outstanding loans. It means that the share of NPLs had roughly doubled within a year.

This is the highest level since 2000, exposing vulnerabilities in the banking system and raising concerns about financial governance.

Under the central bank’s policy support, around 300 companies, including some of the largest defaulting conglomerates, applied for loan rescheduling or restructuring facilities worth around Tk 2 lakh crore during the first nine months of 2025.

In January last year, the BB formed a five-member committee, led by the executive director of the Department of Offsite Supervision, to provide policy guidance for restructuring or rescheduling corporate loans affected by circumstances beyond borrowers’ control.

The committee completed its tripartite meetings with borrowing companies and their financing banks on September 30.

Sources present at yesterday’s meeting said about 44 percent of the approved policy support has been implemented so far, with Islami Bank Bangladesh and United Commercial Bank performing at satisfactory levels.

Bankers expressed optimism that they would be able to reduce bad loans by March.

Speaking on condition of anonymity, a chief executive of a private commercial bank told The Daily Star that the meeting also discussed the foreign exchange market, noting that banks currently hold adequate foreign currency reserves.

“The BB governor asked banks to ensure smooth letter-of-credit payments ahead of Ramadan to maintain the food supply chain,” he said.

The CEO added that the central bank has injected around Tk 40,000 crore in local currency against its purchase of $3.50 billion over recent months.

At the meeting, bankers urged the BB to liberalise the inflow and outflow of foreign currency. The central bank asked the commercial lenders to make sukuk bonds tradable ahead of a planned government issuance of Tk 10,000 crore in sukuk bonds, according to sources.

During the meeting, the central bank instructed banks to run campaigns for the upcoming referendum at their head offices and branches.

The secretary of the Financial Institutions Division asked banks to carry out positive campaigns to raise public awareness about the referendum and encourage voter participation. Many banks have already begun outreach efforts at their branches.

The national election and the referendum on the July Charter are scheduled for the same day, 12 February. The interim government has already started campaigning for the referendum.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments