Sluggish revenue to worsen credit crunch

Revenue shortfall widened further as sluggish tax collection persisted in the July-October period, stoking concerns of a credit crunch amid a surge in government borrowing from the financial sector and an economic slowdown.

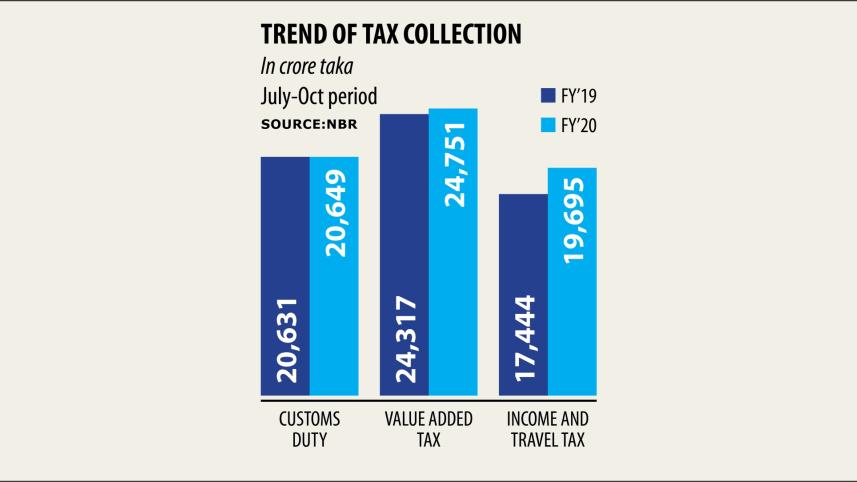

The tax authority logged 4.33 percent year-on-year higher revenue to Tk 65,096 crore from July to October this fiscal year, preliminary data from the National Board of Revenue showed.

The latest collection pointed to a slowdown from the same period in the previous fiscal year when collection was 6.74 percent up.

As a result, the NBR is Tk 20,220 crore shy of reaching its July-October target of raising Tk 85,317 crore. The tax authority fell short of about Tk 15,000 crore from its collection goal in the July-September period.

“The trend is very alarming. It would be tough for the government to sustain its expenditure unless revenue collection increases in line with economic growth,” said Nasiruddin Ahmed, a former chairman of the NBR.

The sluggish collection has already compelled the government to increase its borrowing from banks, which may further aggravate the already tight liquidity condition in the financial sector.

Until November 21 in the current fiscal year, the government borrowed 90 percent of its full fiscal-year target of Tk 47,364 crore from the banking sector, according to Bangladesh Bank data.

The government plans to borrow an additional Tk 4,555 crore in December to finance its increased expenditure in the face of revenue deficit.

Ahmed, a professor at the Brac Institute of Governance and Development under the Brac University, said if the revenue collection does not accelerate, the government’s borrowing from banks will increase further, crowding out the private sector.

The NBR data showed that collection of VAT, the biggest source of revenue, was up 1.79 percent year-on-year in July-October. Income tax, the second biggest source for funds for the government, grew 12.9 percent.

Customs tariff collection remained almost unchanged, partly because of a decline in imports.

But it was expected that the new Value Added Tax and Supplementary Duty Act of 2012 will boost revenue collection when it came into effect in July this year. The law has not produced the desired outcome owing to a lot of distortions it contains, Ahmed said.

The VAT rates of many items which were levied 15 percent in the past went down.

“This has affected VAT receipts,” said Ahmed, suggesting two VAT rates -- one for goods and another for services -- and faster automation of the VAT system to boost tax collection.

Prevalence of numerous exemptions and incentives is also responsible for the sluggish revenue generation, he said.

“The situation may turn worse unless urgent steps are taken,” said Ahmed.

Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue, said it is really worrisome to find that the tax collection has hardly increased in a year when a new VAT and SD law was implemented.

“The key question is why it is not increasing. Is it due to administrative incapacity or due to a lack of economic activity? Will we see a major slowdown in economic growth this year?

“The government must take a serious look at the overall health of the economy.”

Khan said the lack of tax revenue would constrain budget implementation.

“The bank borrowing is already high and it will cause instability in the macroeconomic management.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments