Bank Asia ramps up retail-SME drive, bets on digital banking

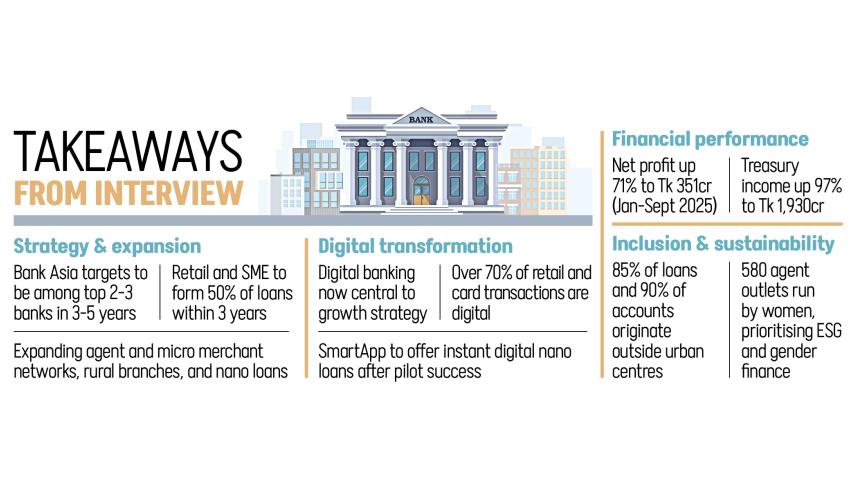

Bank Asia plans to accelerate the expansion of retail and SME lending, strengthen its presence at home and abroad, widen its agent network, and continue leading digital innovation in the coming years. The private bank wants to expand SME and retail loans to at least 50 percent of the total portfolio within the next three years.

To achieve this, Bank Asia is crafting a business ecosystem through an integrated approach. At the same time, it is reinforcing its risk management and credit monitoring frameworks to ensure responsible expansion.

"We are focusing on strong, reputable clients with proven track records and solid business fundamentals while closely reviewing marginal accounts in our existing corporate portfolio and taking targeted actions to address early warning signals," said Sohail RK Hussain, managing director of Bank Asia PLC.

He shared the plan in an interview with The Daily Star, marking the 26th anniversary of the bank. It began operations on November 27, 1999.

Hussain, who led two leading private commercial banks prior to joining Bank Asia, said the lender has tightened the alignment between facility approvals and the borrower's business fundamentals, and placed greater emphasis on post-disbursement monitoring to ensure credit is used as intended.

"Ultimately, our objective is clear: to support sectors with genuine growth potential while safeguarding asset quality and maintaining a well-balanced, resilient loan portfolio," he said.

As of September 2025, Bank Asia's loans and advances stood at Tk 28,908 crore, while deposits and other accounts totalled Tk 44,615 crore, according to its quarterly report.

The private commercial bank logged Tk 351 crore in net profit in the January-September period of the current financial year, surpassing its full-year earnings in 2024. The profit surge was driven by stronger treasury operations, improved cost efficiency, lower tax expenses, and a strategic shift in lending and digital priorities.

Hussain said the bank aims to position itself among Bangladesh's top two or three banks within the next three to five years-- not only in size and profitability but also in efficiency, asset quality, governance, capital strength, sustainability, and inclusion.

The bank is making a "deliberate strategic shift" towards SME and retail lending, targeting these segments to account for at least half of its total loans within the next three years. He said these groups offer more sustainable long-term growth and a more diversified risk profile.

To support this transition, the lender is strengthening its market positioning, redesigning products around customer needs, restructuring teams, and enhancing internal delivery channels.

"We plan to further expand our presence both at home and abroad through new branches, agent networks, and overseas offices, while continuing to lead in innovation and digital transformation."

He said promoting financial inclusion, gender-sensitive finance, and environmental, social, and governance (ESG) practices will continue to be at the heart of its operations.

"In essence, Bank Asia aspires to be a technology-driven, customer-centric, sustainable, well-governed, and inclusive financial institution, creating lasting value for all stakeholders."

Hussain said the lender will continue to expand its agent banking and micro merchant networks across the country, with a strong focus on rural areas.

Bank Asia has established an agent banking network spanning 64 districts across the country, with more than 5,000 agent outlets, ensuring convenient access to banking services in remote and underserved areas.

To further extend the service to the doorstep of customers, it has innovated the micro merchant channel and onboarded 28,800-plus micro merchants to date, he added.

"Our substantial rural presence -- 89 percent rural agents, 90 percent rural accounts, 83 percent rural deposits, 85 percent rural loans, and 64 percent female account ownership -- demonstrates our dedication to financial inclusion through agent banking," he said.

Some 580 agent outlets are owned by women.

"We plan to open more rural branches and sub-branches and introduce tailored deposit products, as well as small, micro, and nano loan facilities for CMSE and agricultural customers," he said. "We are also digitising lending, account opening, and remittance processes and developing value-based products such as an insurance-linked remittance product."

Digital banking has become central to Bank Asia's growth strategy. More than 70 percent of card and retail transactions are now digital, and the Bank Asia SmartApp has become the primary banking channel for many customers, he added.

In the interview, Hussain also spoke about challenges of the financial sector. To him, weak governance remains one of the most critical concerns. "Over the years, lax oversight, undue influences, political interference, and poor risk management practices have weakened the health of many banks and financial institutions.

"Secondly, past lenient loan classification and generous rescheduling policies allowed banks to understate the true extent of their non-performing loans. With the central bank tightening regulations under the interim government, the real picture has now come to light," he said.

Hussain also spoke about the increased non-performing loan (NPL) ratio of his own bank.

He said NPLs at Bank Asia crossed double digits but said the bank maintains a strong provisioning buffer. Its loan-loss provisions stand at Tk 3,679 crore, and provision coverage has improved to 86.39 percent.

"The rise in NPLs is largely due to the tough economic environment-customers have struggled with the prolonged domestic slowdown as well as external shocks such as Covid-19 and recent geopolitical unrest. The stricter loan classification rules introduced on April 1, 2025, also contributed to the temporary spike."

He said the bank has taken a disciplined approach.

"We avoided arbitrary rescheduling, instead insisting on equity injection, additional collateral, and proper repayment plans. We are also using legal measures where necessary, including filing cases and securing asset attachments. With these corrective actions underway, we expect our NPL ratio to decline and our loan book to be significantly cleaner by next year."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments