In Bangladesh, Visa sees huge digital opportunity

As Bangladesh moves towards a digital economy, it is prioritising cashless transactions.

Over the last five years, card-based transactions soared by 228 percent to reach Tk 41,407 crore in April 2025. Transactions through mobile financial services (MFS) are also surging.

But in reality, the progress is still modest, and the economy remains largely cash-dominated.

For Visa, one of the world's largest payment technology companies, this gap is not a challenge but a massive opportunity, according to Shruti Gupta, vice-president and head of Commercial and Money Movement Solutions (CMS) for India and South Asia.

During a recent visit to Dhaka, she emphasised the pivotal role Bangladesh could play in the company's growth plan for the South Asia region.

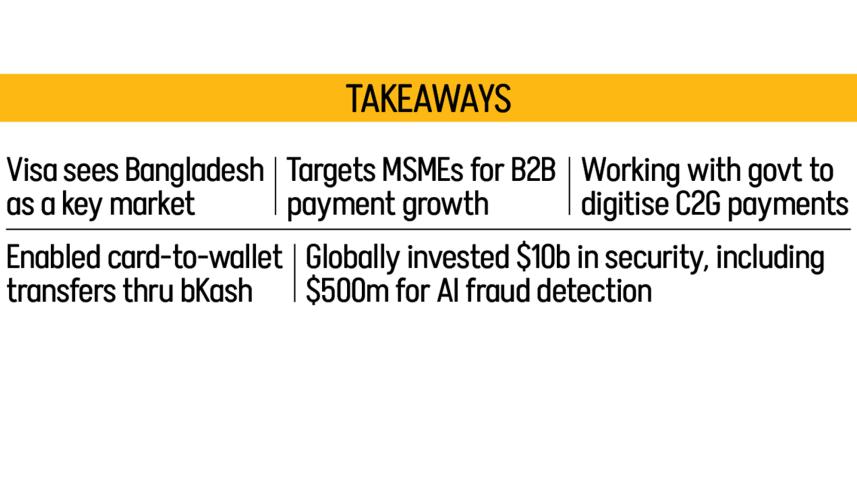

"Bangladesh is a key market for us, especially because a large part of the economy depends on micro, small and medium enterprises (MSMEs)," Gupta told The Daily Star in an interview during her visit. "Our vision -- to be the best way to pay and be paid -- aligns well with the government's push to reduce cash dependency and expand digital financial inclusion."

Visa's commercial and money movement division focuses on business-to-business (B2B) transactions, including domestic and cross-border payments.

Gupta explained how Visa is expanding beyond personal card products to provide tailored B2B solutions.

"We're not just selling a product, we're creating value. Whether it's a sole proprietor running a bakery or a medium-sized exporter, we give them tools to transition to digital commerce easily," she said.

A central part of Visa's strategy is increasing the "pull factor", making digital payment adoption worthwhile. "Unless you give a small business a reason to use a card -- for instance, savings, convenience, or better working capital management -- they won't adopt it," she added. "We simplify needs, amplify benefits, and magnify opportunities."

However, despite the evident potential, Bangladesh's regulatory environment presents structural limitations. For instance, individuals face an annual foreign spending limit of $12,000, and online transactions are capped at $300 per payment. These restrictions often make it difficult for businesses to expand or advertise abroad.

Sabbir Ahmed, Visa's country manager for Bangladesh, Nepal, and Bhutan, acknowledged these challenges. "The current limits are indeed restricting business usage."

He said Visa has made policy recommendations to the Bangladesh Bank, including the introduction of a separate travel quota for business purposes.

The idea is to allow business owners to spend abroad -- attend trade fairs, pay for digital advertising -- without exhausting their personal travel limits.

"Bangladesh Bank was very receptive to our policy recommendation to increase card usage in Bangladesh, and we are optimistic that some of these ideas, like business-specific quotas, will be taken under active consideration," said Ahmed.

Visa is also working to break down behavioural barriers to card use.

Asked if it is discouraging customers to make digital payments as many merchants still charge an additional 2 percent to 3 percent fee for card payments, Ahmed said Visa is not just pushing consumer-level change but also transforming the ecosystem by working with banks and retailers to normalise card acceptance.

But Visa's ambitions in Bangladesh go beyond domestic purchases.

"Cross-border money movement is a huge opportunity," said Gupta. "Whether it's parents sending tuition fees abroad, workers remitting money home, or businesses making cross-border payments, our Visa Direct service allows faster, cheaper, and more transparent transactions than traditional methods."

The Visa Direct service allows individuals to send funds to eligible Visa cards, typically within minutes, through various platforms like online banking, mobile apps, or even ATMs.

"This could revolutionise how Bangladeshis move money globally," said Ahmed, noting that four banks in Bangladesh have already signed up for the service.

Visa's offerings are structured around three pillars: consumer payments, commercial and money movement, and value-added services. On the commercial side, the company is pushing to make commercial credit cards a standard tool for MSMEs.

Gupta argued that this can close the credit gap, noting, "Commercial cards offer a credit period of 30–45 days, help build credit history, and serve as a gateway to more structured financing like overdrafts. SMEs deserve the same tools as individuals."

Visa is also working with the government to digitise Citizen-to-Government (C2G) payments. "From paying taxes online to remitting government fees digitally, these solutions increase transparency and reduce inefficiencies," said Gupta.

"One of the key issues with cash is the lack of traceability and the associated risk. Our aim is to bring transparency into the system. The more transparent the transactions, the higher the tax compliance -- and this is crucial for Bangladesh, which has one of the lowest tax-to-GDP ratios in Asia-Pacific," Ahmed explained further.

In this pursuit, Visa doesn't see itself in competition with MFS providers like bKash or other fintech entrants.

"If bKash were a competitor, we wouldn't have integrated our cards into their platform. But we did, because we're growing the ecosystem together," said Ahmed.

Visa has enabled card-to-wallet transfers and even supports QR-based Visa payments through bKash's network. "Cash is our competitor," he said.

Gupta said, "In every market we operate, we've taken this journey with partners, regulators, and customers. It's not a sprint. It's an ecosystem-building exercise."

A significant concern for Bangladesh's digital economy, however, is security. With increasing digital usage comes a spike in fraud. To that end, Visa has invested over $10 billion in security, of which $500 million is focused solely on AI-powered fraud detection.

Last year, Visa blocked over $40 billion worth of fraudulent transactions globally.

"In Asia Pacific, we estimate that a small business suffers around three fraud incidents a year. So our approach includes everything from real-time dashboards for businesses to admin-controlled category blocking on commercial cards," Gupta said. "This is particularly important for developing economies, where financial literacy is still maturing."

Visa's strategy also places emphasis on educating users and promoting responsible digital behaviour.

Gupta highlighted that Visa gives businesses control over how their employees use corporate cards, right down to which merchant categories can be accessed.

As Visa builds out its footprint, it is also actively engaging with stakeholders across sectors. The company recently hosted a commercial payments conclave in Dhaka, attended by representatives from Bangladesh Bank, major private banks, and MSME support organisations. The event also featured insights from HDFC Bank, one of India's largest private lenders, offering Bangladesh a look into what's possible when digital payments are scaled.

"The aim was to spark a conversation about how the financial ecosystem can come together to better serve MSMEs and accelerate the shift to digital payments," said Ahmed.

In her concluding remarks, Gupta emphasised Visa's long-term commitment.

"Bangladesh presents a tremendous opportunity. From 12 crore account holders, only 3.5 crore have debit cards, and just 23 lakh credit cards are in circulation. The potential to scale is massive. We are here for the long haul, with the right policies, partners, and technology."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments