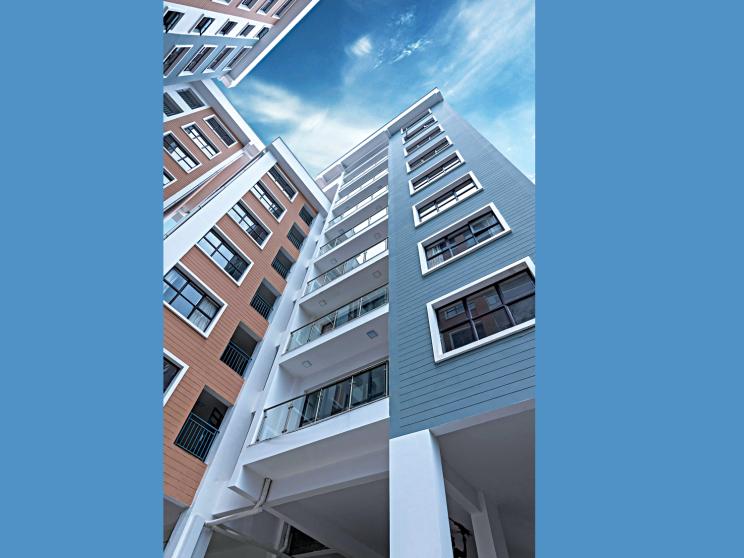

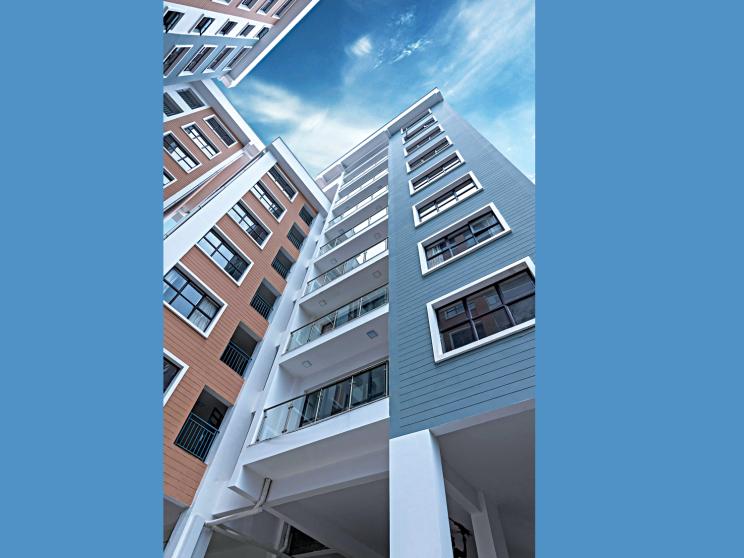

Urban growth and real estate

Bangladesh's major cities from Dhaka and Chattogram to Gazipur, Rajshahi, and Khulna are experiencing rapid expansion. Fueled by heavy infrastructure investment and a booming middle class, their skylines are rising as housing and mixed projects multiply. Government planning reflects this growth: the new Dhaka Detailed Area Plan (2022–2035) covers 1,528 sq km. The plan specifically includes fringe areas such as Tarabo, Bhulta and Purbachal to the east, Tongi–Gazipur to the north, Narayanganj to the south and Savar to the west. Flagship developments illustrate the trend: for example, the massive Purbachal township alone offers about 25,000 residential plots, and authorities plan 12,600 new rental apartments in Gazipur to extend the capital's housing capacity.

Growing middle-class housing demand

Bangladesh's swelling middle class is the chief driver of housing demand. In Dhaka and other cities, rising incomes have fueled a shift from standalone homes to vertical apartments. Many mid-income families now enter the market via smaller units or even second-hand flats, which can be 20–30% cheaper than new ones. "Second-hand apartments in Dhaka are often priced 20–30% lower than new constructions, making them accessible to a wider audience,"as stated by Khan Tanjeel Ahmed, General Manager of Business Intelligence at Bproperty.

Recent industry reports from national developer associations point to a persistent gap in mid income housing across urban centres, with demand concentrated in affordable and mid market segments. REHAB has noted that supply remains skewed toward high end developments in a few pockets, while many middle income households still find formal housing options limited. In Chattogram in particular, apartments remain notably cheaper than in Dhaka, contributing to robust demand there as well. This dynamic is echoed in regional cities: Rajshahi developers report that growing numbers of professionals and businesspeople are choosing apartment living, greatly expanding the pool of potential buyers. However, rising costs threaten affordability: in Rajshahi many note that COVID-19 and surging construction prices have pushed property prices "beyond affordability" for some buyers. In short, a "burgeoning middle class" has raised demand even for luxury units near central business districts, pushing developers to cater to both upscale and budget markets.

Gated communities and mixed-use projects

Developers are emphasising amenities, safety and convenience. Many new projects are gated or organised as planned communities with security, parks, and onsite services. Mixed use developments that combine residential units with offices, retail and leisure spaces are increasingly common, reflecting the middle class preference for convenience and lifestyle.

Beyond marketing, mixed use models can improve urban efficiency by reducing commute times and concentrating infrastructure investments. Planning authorities such as RAJUK and several private developers have begun highlighting sustainability measures in new projects, including storm water management and dedicated public spaces to improve liveability. In regional hubs buyers increasingly demand practical features such as parking, playgrounds and reliable water supply, prompting developers to include these in project design.

Shift of development outside Dhaka

Expansion is especially visible outside Dhaka's core. New highways and bridges are opening up districts for housing. The Padma Bridge is a prime example: by linking 21 southern districts to the capital, it triggered a "housing boom" along the Dhaka–Mawa–Bhanga expressway. Plots and gated neighborhoods now sprawl on both sides of this route, catering to buyers from Barisal and Khulna who want greener, affordable homes within an hour of Dhaka. Similarly, Dhaka's planned extensions cover Gazipur, Narayanganj, Savar and other towns. The government's plan for 12,600 flats in Gazipur highlights this trend. As Kamrul Ahsan Rubel, Senior Marketing Manager at Building For Future observes, "Dhaka is expanding in all directions, particularly along the Dhaka–Sylhet, Purbachal and Dhaka–Mawa highways. People from Chattogram tend to settle in Purbachal, while those from southern Bengal are increasingly drawn to Dhaka's periphery". Chattogram's market is likewise moving outward: major industrial projects like the Bangabandhu Industrial City and the Karnaphuli Tunnel are boosting housing in adjoining subdistricts Mirsarai, Anwara, Sitakunda. Even Rajshahi has seen its skyline transform: once mostly low-rise, it now has high towers, driven by in-migration from nearby districts and new developments. Similarly, Cumilla's housing market has boomed following major highway upgrades, shifting the city's character toward mid-rise projects. The expansion reflects a broad trend: planners project Bangladesh's urban population will surge from about 2 crore today to roughly 12 crore by around 2033, emphasising why cities are racing to add new housing.

Market dynamics and finance

Housing finance remains a key determinant of real estate growth. Banks and non bank lenders have scaled mortgage offerings, but high interest rates and stringent lending criteria still limit uptake for many middle income borrowers. Developers have therefore adapted by offering more staged payment structures and collaborating with mortgage providers to expand affordability. The second hand market continues to play a stabilising role by giving price conscious buyers alternative pathways into ownership.

As Bangladesh's cities evolve into modern, connected hubs, real estate remains both a barometer and a catalyst of progress. The challenge now lies in ensuring that this urban transformation remains inclusive, sustainable, and resilient—so growth uplifts not just skylines, but the quality of urban life itself.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments