RMG exporters oppose move to curb yarn imports

Local apparel exporters have opposed the commerce ministry’s recommendation to remove duty benefits on certain yarn imports under the bonded warehouse facility.

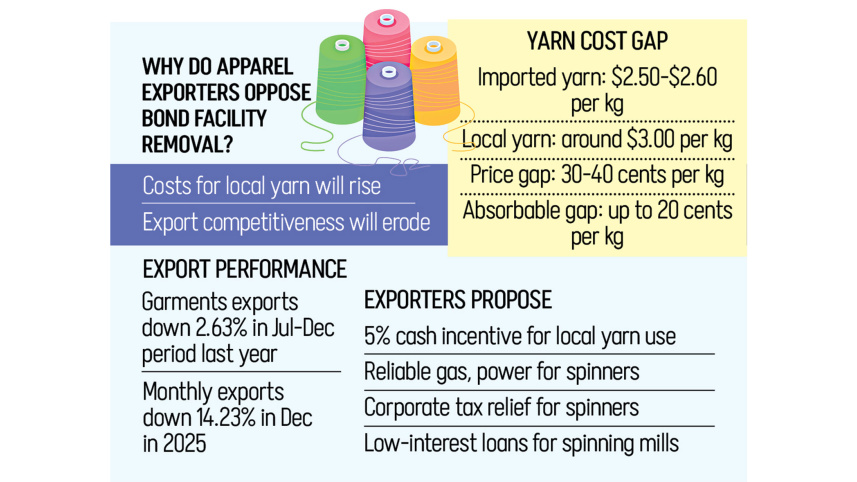

They argue that such restrictions would force them to spend more on locally produced yarn, which eventually will reduce the global competitiveness of the country’s ready-made garments at a time when export growth is slowing.

The commerce ministry recently recommended the National Board of Revenue (NBR) to scrap duty benefits on imported yarn of 10 to 30-count, a medium-to-coarse range widely used in knitwear production.

The move is meant for protecting local spinners, who claim they were sitting on Tk 12,000 crore of unsold stock as of December last year amid a surge of Indian yarn.

At a joint press conference at Pan Pacific Sonargaon Dhaka yesterday, leaders of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) said local spinners should expand capacity and modernise production rather than depending on an “artificial duty shield”.

BGMEA Director Faisal Samad said they are relying more on Indian yarns because of their competitive prices. “In this case, shorter lead-time is not a major factor,” he said.

Leaders at the press conference criticised the commerce ministry for not consulting with them before making the decision. They said that officials of the Bangladesh Trade and Tariff Commission (BTTC), which operates under the commerce ministry, held meetings with them.

BKMEA President Mohammad Hatem said that no decision on duty withdrawal was made during discussions with BTTC officials.

The garment-makers said they would be willing to purchase local yarn even if it cost 20 cents more per kilogramme. Currently, the price differences range from 30 to 40 cents per kilogramme.

Acting BGMEA President Selim Rahman said the price of widely used 30 count yarn ranges from $2.50 to $2.60 per kilogram internationally, compared with $3 per kilogram for locally produced yarn.

In fiscal 2022-23, imported yarn from India cost Tk 428.37 per kilogram, yet the same quantity sold locally at Tk 389.18 per kilogram. Rahman said spinning mills are running below capacity due to gas shortages, which limit their ability to meet demand.

He warned that withdrawing the bond facility would harm garment shipments. Apparel exports fell by 2.63 percent in July-December this fiscal year, with a 14.23 percent decline in December alone.

Rahman urged local millers to modernise production to diversify yarn types and meet buyer demand.

On Sunday, apparel exporters sent a letter to the finance ministry elaborating on their concerns and mentioning almost the same demands they made yesterday.

At the press conference, garment manufacturers also proposed a number of alternatives to support the domestic spinning sector.

They suggested a 5 percent cash incentive for using local yarn to protect the $25 billion invested in the primary textile sector from being undercut by cheaper Indian imports.

The exporters also urged the government to ensure adequate gas and power supply to industrial units, as most spinning mills are running at just 60 percent capacity due to utility shortages.

They called for corporate tax rebates for export-oriented yarn producers and low-interest loans to reduce production costs and improve competitiveness.

BKMEA Executive President Fazlee Shamim Ehsan called for urgent talks with the government to reach a workable solution.

Previously, on December 29, the Bangladesh Textile Mills Association (BTMA) asked the BTTC to either suspend the bonded warehouse benefit or impose a 20 percent tariff on widely used imported yarn.

A commerce ministry letter to the NBR said that Bangladesh will need a two-stage transformation of garment items for entering key markets such as Europe, Australia, the UK, the USA, and Japan after graduating from least-developed country status in November.

To maintain GSP Plus privileges in the post-LDC era, local value addition will need to reach 40 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments