Low investment, high inflation major hurdles for next govt: CPD

Raising investment and taming inflation will be the main economic challenges for the next elected government, private think tank Centre for Policy Dialogue (CPD) said yesterday.

“If investment does not rise, job opportunities will not increase, people’s incomes will stagnate, and inequality will deepen. That is why investment must be the top priority,” Fahmida Khatun, executive director of CPD, said at an event regarding the state of the Bangladesh economy for the first half of the fiscal year 2025-26 (FY26) in Dhaka.

She said that with inflation remaining stubbornly high for the past couple of years, real wages have declined, making both inflation control and investment revival critical challenges for the next government.

Fahmida said that under the current circumstances, marked by political transition and uncertainty, the scope for strong investment inflows remains limited.

Long-standing constraints such as inadequate infrastructure, policy uncertainty, bureaucratic red tape, burdensome tax policies, high financing costs and weak contract enforcement have continued to discourage new investment, she added.

Energy shortages, particularly disruptions in gas supply, remained a major constraint on industrial activity, raising production costs and undermining business confidence, she also said.

Lower energy supply, higher prices and elevated financing costs have collectively increased the cost of doing business, she added.

The CPD executive director continued that the next government must also ensure continued implementation of the Smooth Transition Strategy (STS) prepared for Bangladesh’s graduation from the least developed country (LDC) status and place dedicated emphasis on digitalisation and automation of all investment-related services.

ECONOMY UNDER INTERIM GOVT

Assessing the interim government’s macroeconomic management, Khatun said it assumed office at a time when foreign exchange reserves were falling, inflation was rising, and most macroeconomic indicators were deteriorating.

“This freefall was stopped. Foreign exchange reserves have started to rebound, the exchange rate has stabilised, and hundi has been controlled, bringing some degree of comfort,” she said.

However, she added that although reform initiatives had begun in several sectors, much more remains to be done, noting that one and a half years were insufficient to fully revive the economy. “The next government would need to continue the reform agenda.”

Despite the relative stabilisation, CPD warned that the economy remained vulnerable to falling into a debt trap.

Prof Mustafizur Rahman, a distinguished fellow of CPD, said debt servicing has now become the second-highest expenditure item in the national budget, surpassing education, which previously ranked second after public sector salaries.

“This debt-driven economy is creating the risk of falling into a debt trap,” he said, citing examples from several LDCs.

He recommended focusing on raising direct tax collection.

Also speaking on the matter, CPD’s Khatun said external borrowing remained necessary for infrastructure development but stressed the importance of proper fund utilisation alongside stronger tax collection.

Although the National Board of Revenue (NBR) tax collection rose by 15 percent during July-November of FY26, CPD said the revised target, raised by Tk 55,000 crore for the full fiscal year, was not achievable. It said the rationale behind setting such a high target remained unclear.

Due to the fiscal deficit, reliance on bank borrowing increased during the first three months of FY26, CPD added.

On inflation, CPD said price pressures had become structural rather than temporary. The interim government relied mainly on monetary tightening and fiscal restraint, but these measures had shown limited success in containing food inflation, which is driven largely by supply-side constraints.

Climate shocks, production shortfalls, rising input costs, import dependence, market rigidities and the role of intermediaries have all contributed to higher prices, CPD also said, calling for stronger supply-side interventions.

Food inflation disproportionately affects low-income households and exacerbates poverty and inequality. To examine the issue, CPD conducted a market survey covering 10 essential commodities.

The survey found that perishable vegetables carried significantly higher gross profit margins for retailers. Beef recorded the highest absolute margin at Tk 49 per kilogramme (kg), followed by fish at Tk 33 and chicken at Tk 18.

A total of 50 retailers across 10 markets in the Dhaka Division were surveyed for each commodity.

Retailers cited limited bargaining power, dominance of intermediaries, artificial supply manipulation and syndication, particularly in potatoes, as key reasons for price variation.

More than half of the retailers reported having to pay additional fees or commissions beyond the purchase price when procuring commodities, with the exception of green chilli, eggs, and chicken, from wholesalers or urban warehouse owners.

These intermediaries increased procurement costs without adding value, with the burden ultimately passed on to consumers, said CPD.

RECOMMENDATIONS FOR NEXT GOVT

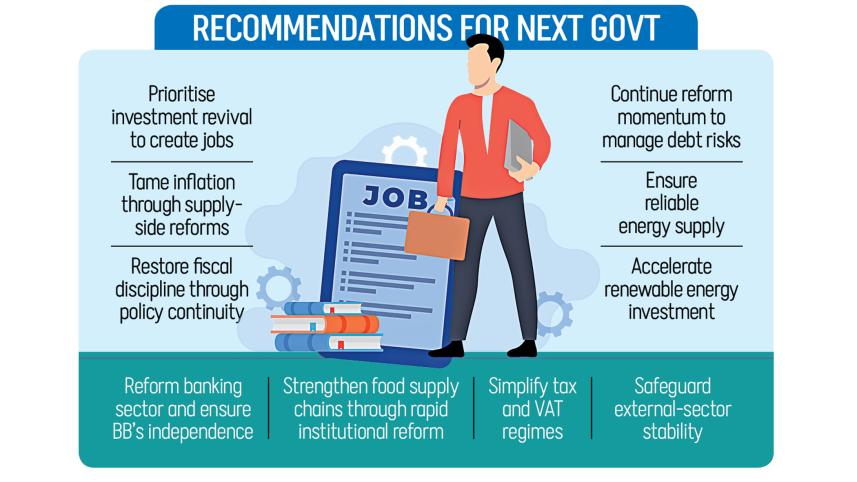

The private think tank made several recommendations on various issues for the next elected government, including restoration of fiscal discipline, reducing inflation, better coordination among agencies, banking reforms, resolving the energy crisis, bringing in investment, and sustaining external-sector resilience.

It said restoring fiscal discipline while safeguarding growth and social stability would require policy continuity, institutional credibility and good governance to rebuild macroeconomic stability and investor confidence.

On bringing down commodity prices, it added that monetary tightening alone cannot resolve inflation rooted in supply-side rigidities, weak competition and market distortions.

Reforming food supply chains must therefore become a national priority. “Stabilising food prices is not only an economic necessity but also a social and political imperative.”

Rapid institutional reform and stronger inter-agency coordination are needed to build a resilient food security system, CPD said.

It also pointed out that the banking sector remains one of the economy’s most fragile pillars.

To that end, CPD called for swift implementation of reform legislation, restoration of Bangladesh Bank’s independence and consistent application of the bank resolution framework. It also stressed the need for a modern insolvency regime supported by specialised courts to resolve issues related to distressed assets efficiently.

To boost private investment, CPD said tax and VAT regimes must be simplified, investment-related services fully digitalised, access to gas and electricity ensured, interest rates gradually eased as stability improves, and anti-corruption and legal reforms strengthened.

In the power and energy sector, CPD said recent reforms have produced mixed results.

The next phase, it said, should prioritise renewable energy, reduce reliance on imported LNG by strengthening domestic gas exploration, phase out inefficient power plants, modernise the national grid and ensure transparency and accountability.

The external sector provided an important anchor of stability in the first half of FY26, CPD also said. Sustaining this resilience will require export diversification, productivity gains and lower business costs and lead times, it noted.

A coherent strategy, supported by skilled human resource development and stable remittance channels, will be essential to navigate the post-LDC era, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments