Japanese brands take the lead as motorcycle market recovers

Japanese motorcycle brands tightened their grip on Bangladesh’s two-wheeler market in 2025, capturing the bulk of new demand as consumers increasingly favoured reliability, fuel efficiency and long-term value over lower upfront prices.

Suzuki, Yamaha and Honda together accounted for 58 percent of total motorcycle sales during the year, according to industry data compiled by two leading manufacturers, reinforcing a shift that has been taking shape since the post-pandemic period.

Industry executives say the dominance reflects sustained consumer trust in Japanese engineering, particularly as the price gap with Indian brands has narrowed.

The expansion of Japanese market share came alongside a broader recovery in the motorcycle industry.

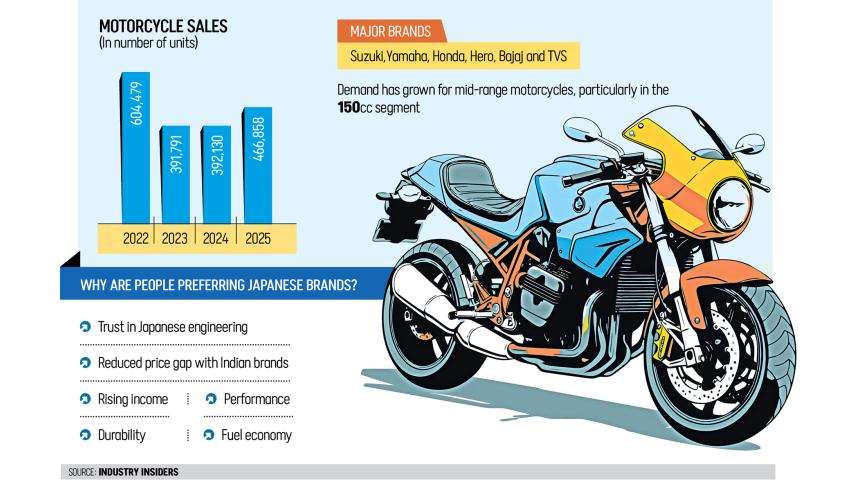

After two consecutive years of contraction, annual sales rose to 466,858 units in 2025, up 19 percent from 392,130 units the previous year, according to the compiled data.

The rebound followed a sharp 35 percent decline in 2023, when economic uncertainty and political instability disrupted demand. Despite the recovery, the industry is still short of its all-time high of 604,479 units sold in 2022.

Japanese brands have benefited from a clear shift in buyer behaviour

Within the revived market, Japanese brands were the primary beneficiaries.

Suzuki led overall sales with 93,838 units, securing a 20.1 percent share. Yamaha followed with 19.7 percent, while Honda captured 17.8 percent.

Indian brands Hero and Bajaj trailed closely, accounting for 18.1 percent and 17.6 percent of market share, respectively. Together, the five largest manufacturers accounted for more than 93 percent of total sales.

Industry insiders say the shift has been reinforced by changing usage patterns.

Demand has grown for mid-range motorcycles, particularly in the 150cc segment, as rising incomes and worsening urban congestion make performance, durability and fuel economy more important than entry-level affordability.

Japanese dominance was most pronounced in the second half of the year. Between July and December, total sales rose to 215,547 units from 189,853 a year earlier, with Japanese brands occupying the top three positions.

Yamaha led the period with a 22 percent share, followed by Suzuki and Honda, each with around 20 percent.

Hero posted a 36 percent sales increase to reach 38,198 units, gaining an 18 percent share.

Subrata Ranjan Das, executive director of ACI Motors, the official distributor of Yamaha motorcycles, said Japanese brands have benefited from a clear shift in buyer behaviour.

He estimated overall market growth at 16-17 percent year-on-year.

“Though Yamaha’s calendar year sales trail slightly, we’ve led the market over the past six months,” Das said.

Das said performance, fuel efficiency and durability have become decisive factors for buyers, particularly as price differences with Indian models have narrowed.

“Japanese motorcycles offer better long-term value,” he said, adding that 82 percent of Yamaha buyers are existing motorcycle users, and 55 percent upgraded from Indian brands.

Yamaha’s strength in the 150cc segment has also supported its position, he said, driven by consistent demand and recent product launches.

However, Das flagged fuel quality as a growing concern, warning that substandard fuel has caused corrosion and mechanical damage in motorcycles.

He said the company and the Motorcycle Manufacturers Association had shared laboratory findings with authorities, calling for tighter regulation. “We’ve conducted multiple lab tests and shared results with energy officials.”

Honda executives offered a similar assessment. Shah Muhammad Ashequr Rahman, chief marketing officer of Bangladesh Honda Private Limited, said improving macroeconomic stability had supported demand but stressed that brand trust and after-sales service were key to Honda’s gains.

“A relatively stable exchange rate, better foreign currency reserves, easing inflationary pressures, and the rising purchasing power of the broader population have all contributed to this improvement,” he added.

Against this backdrop, Honda expanded its service network and introduced new models to strengthen customer loyalty.

“We responded to evolving customer needs by introducing new models, expanding our after-sales service network, and deepening our relationship with customers,” he said.

Meanwhile, TVS recorded a steep decline of 70 percent, selling just 3,590 units in the second half, compared to 11,947 in the same period last year. In total, its sales dropped 80 percent in 2025.

Biplob Kumar Roy, chief executive of TVS Auto Bangladesh, said the company’s sales dropped to just over 10,000 units in 2025, from a typical annual volume of around 60,000.

Roy attributed the slump to the company’s failure to introduce new or upgraded models, distancing the decline from broader market trends.

“It’s not the market, it’s us,” he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments