Depositors bear the brunt of loan scams

Careful where you put your money, hoping for steady returns. Let alone interest, depending on the institution, you might even face difficulties in getting the original money back. Even banks that appear financially healthy can fail to deliver promises.

What should be a routine financial transaction has become a source of anxiety for Bangladeshis. The country has long witnessed financial fraud through Ponzi schemes and multi-level marketing companies such as Destiny and Jubok, which had no regulatory oversight.

However, banks and non-bank financial institutions (NBFIs) do have a regulator and are required to follow rules and regulations set by that authority – the Bangladesh Bank (BB).

The regulator supervises 61 banks and 35 NBFIs. Any institution seeking to accept deposits or extend loans must obtain a licence from the central bank.

Established in 1971, the BB was tasked with fostering financial stability, promoting transparent governance, and supporting sustainable economic growth.

Yet the recurring difficulties faced by depositors, including long waits, crowded branches and fragmented repayments, raise questions about the effectiveness of regulatory enforcement.

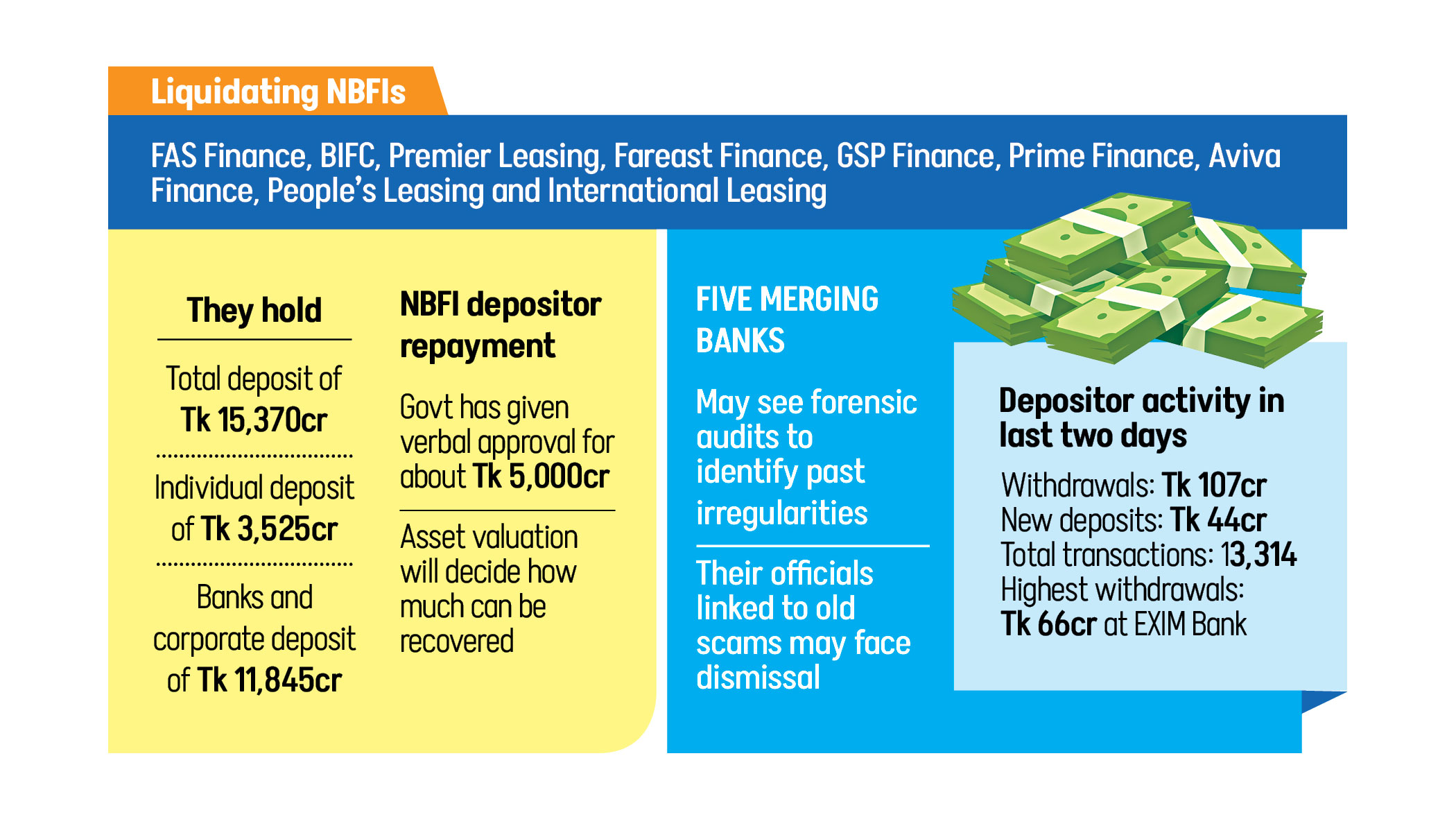

Following widespread irregularities and loan scams under the previous government, the interim administration implemented a merger initiative to consolidate five shariah-based banks. The lenders are - First Security Islami Bank, Social Islami Bank, Union Bank, Global Islami Bank, and EXIM Bank.

The resulting institution, Sammilito Islami Bank PLC, received Tk 20,000 crore in paid-up capital from the government.

Under the merger plan, depositors of the affected banks began receiving repayments in phases from the start of the new year. However, depositors were never supposed to receive their hard-earned money in such fragmented instalments.

Depositors chose these banks believing they were financially sound, only to discover through forensic audits that the institutions were in poor condition.

This raises the question: who bears responsibility for the deception suffered by depositors?

The finance adviser has said that actions will be taken against these auditors who portrayed these banks as being in good health despite their poor condition. But timelines and implementation of those actions remain unclear.

In light of losses incurred by the merging banks, the BB, on January 14, instructed the five lenders that deposit balances be recalculated based on their position as of December 28, 2025.

The regulator also announced that depositors will not receive any profit for 2024 and 2025.

BB Governor Ahsan H Mansur yesterday at a press briefing emphasised that the decision aligns with shariah principles, under which no profit is distributed in the event of losses.

“However, depositors will receive their full principal amount,” he said.

Depositors with savings above Tk 200,000 are expected to wait at least 24 months for full repayment.

While the central bank governor is correct in principle, the question remains whether the banking regulator and the government are doing enough to take action against loan scammers and the culprits who drained these banks and non-bank financial institutions of funds.

Those who embezzled money from these banks and laundered funds abroad are still living luxurious lives, while ordinary depositors are bearing the consequences.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments