Avg smartphone prices could rise by 6.9% in 2026

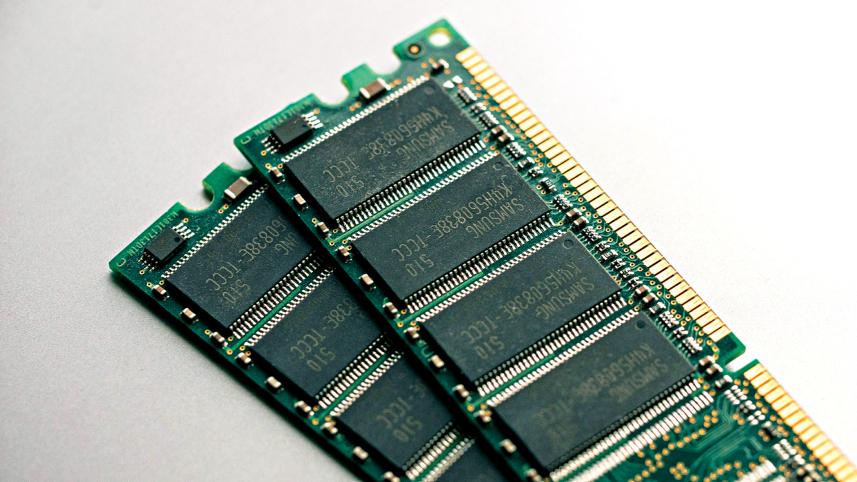

The global technology industry is bracing for a sustained rise in random-access memory (RAM) prices through 2026, a shift expected to ripple across consumer electronics markets, particularly desktops and smartphones. After a period of relative stability following the volatility of the pandemic years, memory prices are climbing again as demand from artificial intelligence (AI) infrastructure and data centres begins to outstrip supply.

Major chipmakers including Samsung Electronics, Micron and SK hynix have redirected large portions of their production capacity towards high-bandwidth memory (HBM), a specialised form of RAM used in AI accelerators and data centres. This strategic pivot has tightened supplies of conventional dynamic RAM (DRAM), which remains essential for personal computers and mobile devices, pushing prices to levels not seen in recent years.

In Bangladesh, the impact of the global memory squeeze is already visible. Retailers and distributors in Dhaka report sharp increases in the cost of RAM modules and memory-dependent hardware over recent months. Prices for standard laptop and desktop RAM have risen by more than 200%, according to local sellers. A 16GB DDR5 6000MHz RAM module that sold for around Tk 7,800 in October 2025 was priced at approximately Tk 28,500 by December, this reporter found.

Rising prices have begun to alter consumer behaviour. Many buyers are now turning to the second-hand market, while others are exploring technical workarounds such as using laptop RAM in desktop systems with adapters.

Nasim Rahman Zeem, a computer science graduate, said the scale of recent price hikes was difficult to justify. “RAM prices are expected to rise,” he said. “But global manufacturers have not yet fully shifted production. The sharp increase in Bangladesh over the past few months does not seem entirely justified.”

Market analysts say the effects of the price hike will be felt most sharply in the smartphone sector, which is highly sensitive to global supply-chain trends. Counterpoint Research forecasts that average smartphone selling prices could rise by nearly 6.9% in 2026, as manufacturers either pass on higher component costs to consumers or scale back device specifications to protect margins. The firm also expects global smartphone shipments to fall by 2.1% that year, citing higher memory costs as a key factor.

Budget smartphones are likely to be hit hardest. These devices typically operate on thin profit margins and rely on lower-cost memory configurations, leaving manufacturers with limited room to absorb price increases.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments