Local companies’ outward investment hits $35m

Bangladeshi companies are investing more money abroad than before, even though they are sending out less brand-new capital, suggesting that local firms are becoming more confident about doing business beyond the border.

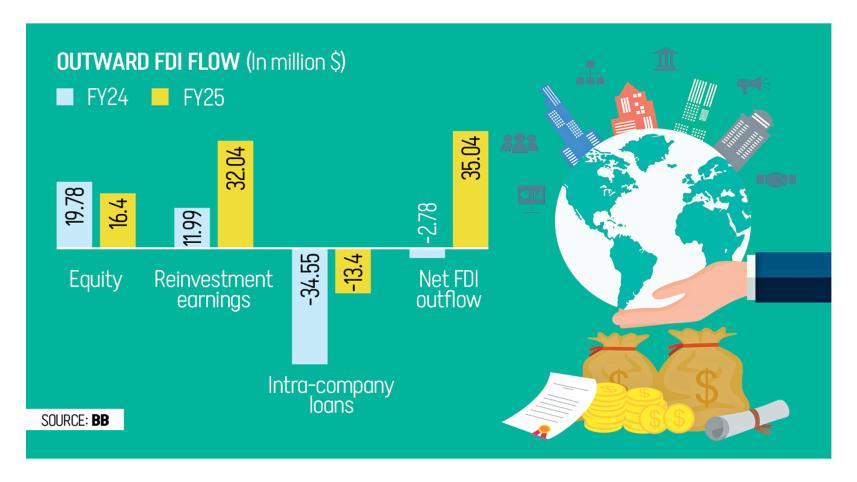

According to the latest data from Bangladesh Bank, the country's outward foreign direct investment (OFDI) reached $35.04 million in fiscal year 2024-25 (FY25) – a major turnaround from the previous year, when more money flowed into Bangladesh than out, resulting in a net inflow of $2.78 million.

This shift has roots in a 2015 amendment to the 1947 Foreign Exchange Regulation Act, which allowed firms to invest overseas under specific conditions, such as if the investment helped increase exports.

Since then, Bangladeshi companies have expanded into more than 18 countries across Asia, Africa, and Europe in search of new customers, broader markets and diversified revenue streams.

Most of the money going out in FY25 came from financial companies, which invested nearly $30 million. Mining and quarrying firms sent out about $3.6 million, and pharmaceutical and chemical companies sent just over $1 million. But not all sectors showed growth. Some industries, including trading and manufacturing, actually pulled money back, meaning they withdrew part of what they had once invested abroad.

The United Arab Emirates was the top destination for Bangladeshi money, receiving almost $17 million. India received just over $16 million. Other destinations included Singapore, Kenya, and Ireland, showing that companies are looking beyond just nearby markets.

By June 2025, the total amount of Bangladeshi money invested abroad over the years – the "OFDI stock" – stood at $351.37 million, up 4.19 percent higher than the year before. This figure includes not just fresh investments but also profits that companies earned abroad and reinvested there.

Investment slowed somewhat in the first half of 2025 compared to the previous six months. Between January and June, the amount sent out was $14.91 million, down from $20.13 million in the previous six months. Even so, it was still higher than the same period the year before.

Interestingly, while the total outward investment rose, the amount of new money companies sent out, called equity capital, actually fell. It dropped to $16.40 million in FY25, down from $19.78 million the year before, indicating many companies may be expanding using profits they've already earned abroad.

Economists say this rise in outward investment shows private companies in Bangladesh are maturing. But they also warn that this trend could create problems if not managed well, especially because Bangladesh carefully controls how money moves in and out of the country.

Selim Raihan, executive director of the research group South Asian Network on Economic Modeling (Sanem), said that companies investing abroad reflect a shift toward a more global mindset.

However, he warned, "While the upward trend is encouraging, it also raises a number of concerns. Increased capital outflows could put pressure on foreign exchange reserves, particularly under a tightly controlled investment regime."

He added that without proper oversight, some money might be misused or fail to benefit the local economy.

Explaining the benefits of OFDI, Raihan said, "It allows firms to bypass the limitations of the local market, tap into new consumer bases, and reduce exposure to domestic volatility. Overseas operations strengthen supply chains and create diversified revenue streams."

Still, companies face big hurdles overseas. Rules can be stricter. Doing business in a foreign country can be expensive. And political or economic instability in those countries can pose risks.

From the business side, executives say outward investment is becoming necessary to stay competitive.

Shawkat Haider, executive director of Beximco Pharmaceuticals, pointed to a past joint venture in Malaysia, where Beximco partnered with a local company and shared technology. "It helped us understand how to collaborate, transfer technology, and establish a presence in a new market."

"Foreign investments reduce tariff barriers, eliminate shipping costs, and simplify regulatory compliance in the export destinations," he said.

He added that top Bangladeshi conglomerates like Beximco and Square Group are now doing business in Kenya, Ethiopia, and Sri Lanka, where they are building facilities and training local workers.

"We set up facilities, transfer knowledge, and enable local teams to run operations. These moves generate employment and elevate Bangladesh's profile in the global generics market," he said.

M Masrur Reaz, chairman and CEO of Policy Exchange of Bangladesh, said facilitating outward investment with proper checks and strategic alignment can help Bangladeshi firms scale globally, tap into global value chains, and build international branding positioning the country as a strong trade and investment partner.

As Bangladesh continues its journey toward graduating from the least developed country status, a coherent outward investment policy may soon become a cornerstone of its economic diplomacy and private sector expansion, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments