Govt move to reserve 10 MHz for Teletalk raises concerns

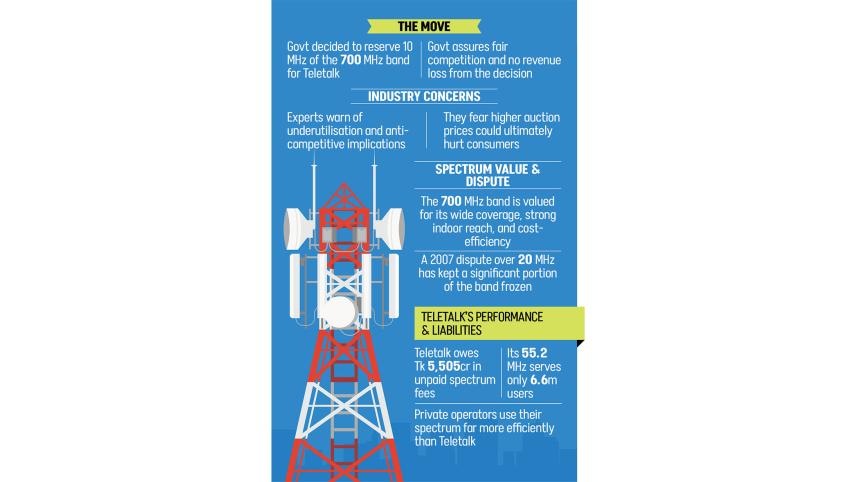

The government has decided to reserve 10 MHz of the valuable 700 MHz band exclusively for state-owned Teletalk once a pending court case is resolved, raising concerns among industry experts about underutilisation and anti-competitive effects.

The 700 MHz band is prized worldwide for its long coverage, strong indoor signal, and low rollout cost, making it ideal for rural and urban networks and fast 5G deployment. In Bangladesh, 45 MHz of this band is currently designated for mobile use, but 20 MHz remains frozen due to a long-running legal dispute.

The reserved portion for Teletalk will come from the 20 MHz of spectrum currently tied up in the legal dispute.

"After the ongoing case regarding 20 MHz of the 700 MHz band is resolved, 10 MHz of that spectrum will be reserved for allocation in favour of Teletalk Bangladesh Limited," according to documents from the Posts and Telecommunications Division.

The dispute began in 2007, when the Bangladesh Telecommunication Regulatory Commission (BTRC) allocated 12 MHz of the band to Always on Network Bangladesh Ltd, a broadband provider, before the band was officially recognised for mobile services.

The regulator later declared the allocation a mistake and offered replacement spectrum in the 5 GHz band. The company challenged this in the High Court, which ruled in its favour. The case is now before the Appellate Division, keeping 20 MHz off-limits since spectrum is allocated in blocks.

Industry insiders say the move favours the state-owned operator and could hurt fair competition. They argue that Teletalk's small subscriber base and limited network may cause underuse of a key band for next-generation connectivity.

According to the BTRC, Teletalk still owes Tk 5,505 crore in spectrum fees.

Experts warn that allocating spectrum without competitive bidding could distort the market, reduce government revenue, and push up costs for consumers as private operators pay more for less bandwidth.

Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue, said, "Spectrum allocation must follow transparent bidding. Reserving a portion for a particular operator is viewed as anti-competitive, as it drives up the price of the remaining spectrum."

"Although allocating a smaller portion of the spectrum may increase competition and boost government revenue in the short term through higher auction prices, operators are likely to pass the costs onto consumers, creating long-term financial pressure for users," he added.

Moazzem also noted that Teletalk's lower tariffs have not led to significant subscriber growth, and much of its existing spectrum remains underutilised. "Reserving 10 MHz from the valuable 700 MHz band for Teletalk, therefore, risks wasting scarce national resources," he said.

The current spectrum distribution shows a clear imbalance. Bangladesh's four operators — Grameenphone, Robi, Banglalink, and Teletalk — together hold 386.6 MHz across various bands.

Teletalk has 55.2 MHz but serves only about 6.6 million subscribers, using 8.31 MHz per million users. In comparison, Grameenphone uses 1.47 MHz, Robi 2.10 MHz, and Banglalink 2.16 MHz per million users. Experts say this indicates Teletalk's spectrum generates much less traffic per MHz.

Teletalk's low revenue limits its investment, leaving many bands underused. Its 2300 MHz spectrum, for example, is still largely undeployed due to a limited network rollout. Unlike private operators, Teletalk lacks the commercial flexibility and financial strength to scale quickly.

Kaan Terzioğlu, group chief executive officer at VEON, a multinational telecom company, said, "Spectrum is a natural resource that only creates value when it is put to use. It should be deployed with proper investments. Parking spectrum just to overcharge operators who urgently need it is wrong.

"Some spectrum will go unused by operators who do not need it, while high spectrum prices will delay technology rollout for those who do. It's a lose-lose situation."

Telecom policy expert Abu Nazam M Tanveer Hossain said that Bangladesh has already lost opportunities due to mismanagement of the 700 MHz band.

"Against that backdrop, withholding further spectrum as 'reserved' for the state-owned operator, which already holds substantial underutilised spectrum in other bands, is difficult to justify on grounds of fairness or efficient policy," he said.

He warned the move could raise auction prices for private operators and discourage investment. "At a time when we are trying to boost foreign investment in the telecom industry, this decision could be detrimental," he added.

WHAT GOVT SAYS

Faiz Ahmad Taiyeb, special assistant to the chief adviser for the Ministry of Posts, Telecommunications and Information Technology, said the government has unanimously decided that no spectrum will be reserved for Teletalk in the first auction of the 700 MHz band.

"After this initial auction, when the remaining 20 MHz is released, there may be a possibility of reserving a portion for Teletalk, depending on market competition," he said.

He added, "It is important to note that every operator must get a share of the 700 MHz band. Technically, if operators do not receive at least 10 MHz each, they cannot ensure adequate 4G and 5G coverage. No operator will be deprived in this process."

Since Teletalk is state-owned, it cannot participate in the auction due to budget constraints. To ensure it is not left out, the idea of reserving some spectrum for Teletalk in a future auction has been discussed. "However, we have made it clear that the government will not adopt any mechanism that could cause revenue loss," he said.

"Both the BTRC and the ministry remain mindful of maintaining market competition while ensuring that each operator receives at least 10 MHz of spectrum," Taiyeb added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments