Default loans hit 34%, highest in 25 years

- Defaults surge to 34.6 percent of credit

- Bad loans jump Tk 3,88,573 crore

- Irregularities, weak oversight fuel crisis

- State banks hold 44.6 percent defaults

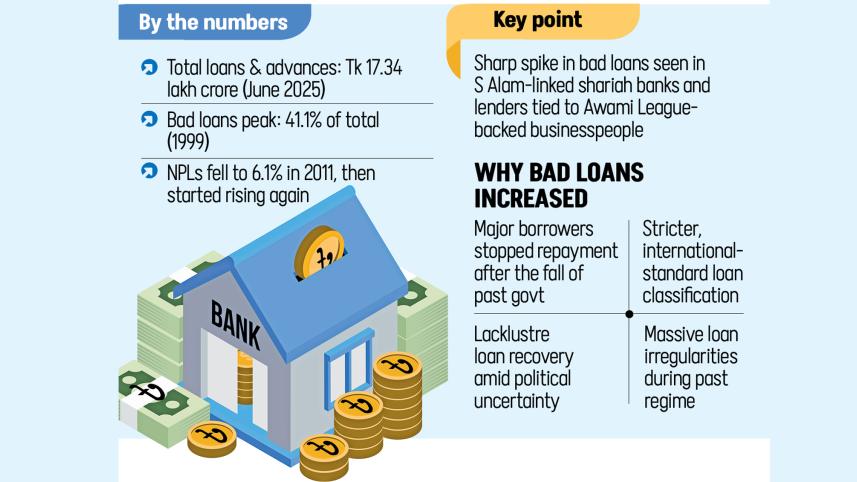

Defaulted loans in the country's banking sector reached 34.6 percent of all disbursed credit till June this year, the highest level since 2000, exposing the fragile state of the banking system and renewing concerns about financial governance.

The non-performing loan (NPL) ratio stood at 24.6 percent in March this year. A year earlier in June, it was only 12.2 percent, according to a quarterly report by the Bangladesh Bank (BB).

At the end of June this year, total loans and advances amounted to Tk 17,34,200 crore. Of this, Tk 5,99,964 crore had turned sour.

Although the central bank did not mention the bad loan amount directly, its quarterly estimates show that defaulted loans made up 34.6 percent of all disbursed credit.

Bad loans stood at Tk 2,11,391 crore in June last year. This means defaults rose by Tk 3,88,573 crore within twelve months.

BB officials said distressed assets, a term that covers bad loans, written off loans, rescheduled loans, and loans locked in money loan court, could cross Tk 10,00,000 crore.

According to them, the sharp rise in bad loans points to widespread irregularities, scams, and weak oversight throughout the 16-year Awami League regime.

In 1999, bad loans in the banking sector stood at a record 41.1 percent, the highest on record. Since then, the ratio began to decline and fell to 6.1 percent in 2011. After that, the NPL ratio started rising again.

Several shariah-based banks linked to S Alam Group, a business conglomerate long surrounded by controversy, have seen sharp increases in defaulted loans, according to BB officials.

They also said politically connected businesses with ties to the previous ruling party influenced lending decisions in a number of banks.

Big borrowers, such as S Alam Group and Beximco Group, defaulted on a large scale after the fall of the Awami League government in August last year. This contributed to an unprecedented jump in defaults across the sector.

"Nearly 35 percent of loans are now classified as non-performing, a level that has far-reaching effects," said Toufic Ahmad Choudhury, former director general of the Bangladesh Institute of Bank Management (BIBM).

He said that when defaulted loans rise, banks earn less as they have to set aside larger provisions. This leads to the erosion of their capital base.

"As a result, foreign investors think twice, and international banks raise transaction charges," Choudhury said.

"The country must come out of this situation. Exemplary punishment should be ensured for loan defaulters."

He also said the higher figure partly reflects the central bank's decision to classify loans in line with international standards.

State-owned banks held about Tk 1,52,755 crore in bad loans in June, or 44.6 percent of their total credit, shows the BB report.

Private commercial banks had around

Tk 4,25,660 crore in NPLs, equal to 32.9 percent of their portfolios. Specialised banks reported Tk 19,305 crore in bad debts, or 39 percent of their lending.

Foreign commercial banks fared better, with Tk 2,952 crore in defaults, equal to 6.1 percent of their loans, according to the BB report.

Bad loans also rose sharply in half a dozen Islamic banks, including Islami Bank Bangladesh, due to massive loan irregularities during the previous regime.

Md Omar Faruk Khan, managing director and CEO of Islami Bank Bangladesh, said that the bank is stepping up efforts for loan recovery through legal channels.

"Besides, we are signing agreements with international legal firms to recover foreign assets. Our main target now is recovery," he told The Daily Star.

The commercial lender is focusing on cash recovery, Khan said, while rescheduling loans for industries that have been genuinely affected.

"Our target is to bring down non-performing loans from 50 percent to 35 percent," he said.

The CEO added that loan recovery is proving difficult as business activities slow ahead of the national elections slated for February next year.

The Banking Regulation and Policy Department (BRPD) of the central bank usually compiles classified loan data. However, it has not produced the figures for the June quarter.

Instead, the Statistics Department of BB gathered information directly from banks and prepared the report, which may lead to differences between the two sets of data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments