Commercial courts introduced to settle business disputes faster

The government has introduced commercial courts aimed at speeding up business dispute settlements, a move officials and investors say would help improve the country’s investment climate.

In this regard, an ordinance was issued by the Ministry of Law, Justice and Parliamentary Affairs on January 1. It came into immediate effect.

Business leaders and legal experts have welcomed the dedicated legal arrangement as a long-overdue reform, especially at a time when weak contract enforcement continues to weaken investor confidence and add pressure to an already stretched civil court system.

The Dhaka Chamber of Commerce and Industry (DCCI) described the ordinance as a landmark step that responds to a long-standing demand from the private sector for faster and more predictable dispute resolution.

“This ordinance marks a decisive step toward overcoming chronic weaknesses in contract enforcement,” said DCCI President Taskeen Ahmed. “We have consistently advocated for the establishment of specialised commercial courts, and this development reflects meaningful progress.”

Contract enforcement in Bangladesh has remained slow for years, a problem that frequently features in global assessments of the business environment. According to World Bank data, the country ranks 189th out of 190 economies in enforcing contracts, placing it among the weakest performers worldwide.

According to World Bank data, pending cases have doubled over the past 15 years, leaving disputes worth an estimated $3.5 billion unresolved. The number of pending cases rose from 4.44 million in September 2024 to 4.65 million by June 2025, highlighting the strain on the judicial system.

Ahmed said the ordinance directly targets the causes of delay through time-bound procedures, stricter case management and limits on adjournments.

He said these weaknesses were not adequately addressed by existing laws such as the Code of Civil Procedure, 1908, the Artha Rin Adalat Act, or the Arbitration Act, 2001.

The chamber urged the government now to focus on implementation, including the creation of well-resourced commercial benches, clear procedural rules, judicial training and effective coordination with arbitration and alternative dispute resolution mechanisms.

“Efficient commercial dispute resolution is vital to improving the investment climate,” Ahmed added. “International experience from countries like India, Singapore, the UK, and Malaysia shows that dedicated commercial courts significantly enhance competitiveness and investor confidence.”

If enforced properly, the DCCI believes the ordinance could strengthen contract enforcement, attract foreign direct investment and support Bangladesh’s transition towards a more export-oriented and private sector-driven economy.

Foreign investors have also welcomed the initiative. Rupali Chowdhury, president of the Foreign Investors’ Chamber of Commerce and Industry (FICCI), said the absence of reliable domestic dispute resolution has long been a concern for international businesses.

“This ordinance, which provides for the establishment of commercial courts and addresses related procedural matters, seems very effective -- particularly for foreign investors,” she said. “I believe this will expedite dispute resolution significantly.”

She said the initiative went beyond a routine legal change and could address uncertainty faced by foreign companies.

“In many cases, especially in disputes involving long-term agreements with the government, foreign investors face delays and uncertainty. Often, we have had to resort to arbitration in Singapore, as domestic options were either not available or not trusted.”

Chowdhury pointed to sectors such as energy, where disputes often arise when contracts signed earlier no longer favour the government, leading to prolonged legal battles.

This uncertainty, she said, has discouraged investment in the past.

“If disputes can now be settled within the country through commercial courts, it will build confidence. We also have several pending tax-related cases. If those can be resolved quickly, that is a big plus,” she added.

Under the ordinance, commercial disputes must be filed within 30 days, while proceedings are expected to be completed within 90 days. Chowdhury said the timelines are encouraging, but it all depends on how well this system is executed.

Ashik Chowdhury, executive chairman of the Bangladesh Investment Development Authority (Bida), said legal complexity and delays have repeatedly been identified as major obstacles for investors.

“Our legal system has consistently been flagged in global rankings, such as the World Bank’s Doing Business Index, as overly complex,” he said. “This has created a challenging environment for investors, especially foreign investors, who often face lengthy delays and legal uncertainties.”

He said the introduction of commercial courts could help reduce uncertainty and create a more business-friendly environment, provided the system is properly set up and resourced.

“This could open the door for creating a more investment-conducive environment for both foreign and local investors,” he added. “Because, unfortunately, we have seen that almost every dispute eventually ends up in court. In many cases, the legal process is used as a tool to slow down or obstruct business operations.”

Nihad Kabir, former president of the Metropolitan Chamber of Commerce and Industry (MCCI), said commercial disputes often take years to resolve in regular civil courts.

“These time-bound proceedings will be a game-changer for commercial litigation in Bangladesh,” said Kabir, who has practised commercial law for 35 years.

She said a quicker resolution could reduce the time required to settle high-value disputes, but noted that outcomes would depend on whether courts receive adequate infrastructure and skilled personnel.

“I hope these will be made available,” she added.

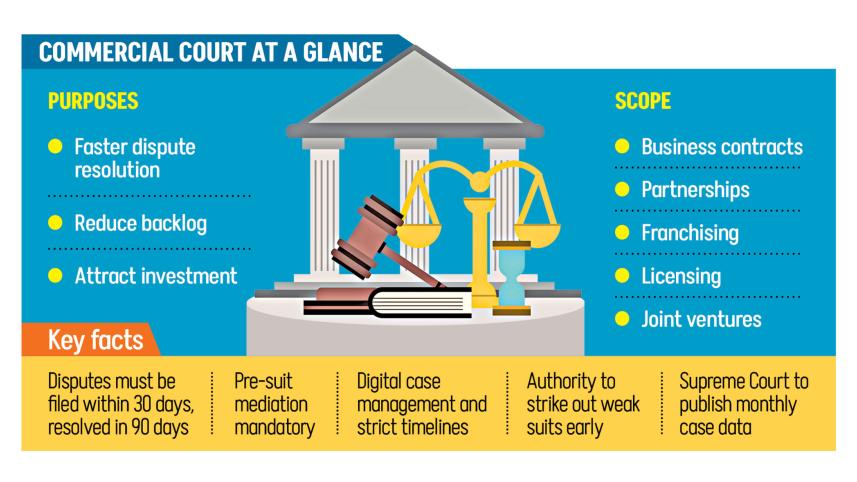

The ordinance requires that commercial disputes arising from business contracts, partnerships, distribution, franchising, licensing and joint ventures be heard exclusively by commercial courts with trained judges and dedicated facilities.

Courts must resolve cases within 30 days of filing. Proceedings may be extended by another 30 days only on justifiable grounds. Written judgments must be delivered within 90 days after hearings conclude.

To reduce formal litigation, the law introduces mandatory pre-suit mediation, requiring parties to attempt settlement through alternative dispute resolution before approaching the court. It also provides for digital case management, strict procedural timelines and the authority to strike out non-maintainable suits at an early stage.

The Supreme Court will publish monthly data on filings, disposals and pending cases in commercial courts and the High Court Division. The information will be made available on the Supreme Court website.

The mediation processes will allow some disputes to be resolved without placing additional strain on the commercial courts, which is appreciable, said Syed Akhtar Mahmood, a former global lead of the World Bank Group’s regulatory reforms and public-private dialogue.

Besides, the Supreme Court will publish case statistics regularly. That will enable us to monitor whether the legislative changes are making a difference on the ground, he added.

Mahmood said, “We often do reforms without putting in place systems to monitor results. This appears to be an exception, and that is good.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments