Rumours buck up junk stocks

Junk shares are being traded like hot cakes on the stock exchanges of Bangladesh as rumours are mostly sending such securities to lofty heights rather than performances.

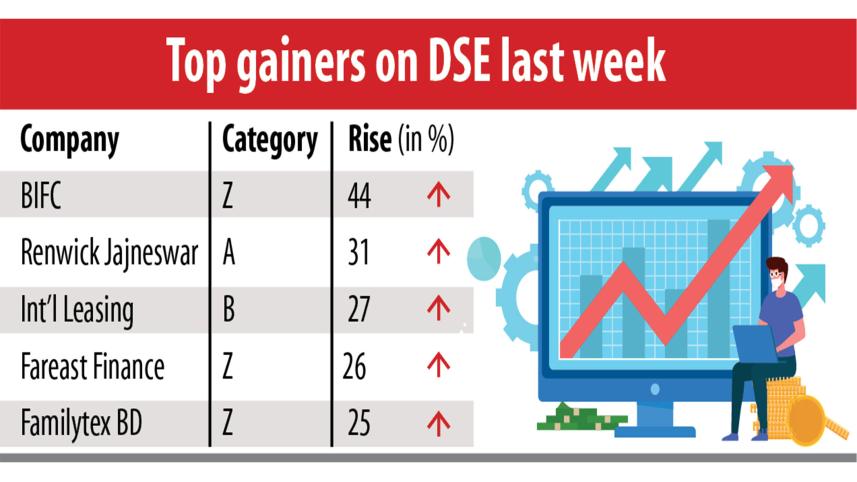

Bangladesh Industrial Finance Company topped the gainers' list last week, rising 44 per cent in a span of four days.

Two other junk stocks -- Fareast Finance & Investment and Familytex (BD) -- were also in the list, rising 26 per cent and 25 per cent, respectively.

People are investing in these stocks based on a pack mentality believing that they will rise, said Shekh Mohammad Rashedul Hasan, CEO of UCB Asset Management Company.

"Investors need to realise the true worth of the companies' asset quality," he said.

The junk stocks nosedived below their face value due to their substandard performance. As the government is taking steps to bring them back to operation, some investors have become speculative, he said.

If these shares rise slightly, then it not a big worry. But some stocks jumped by five or six times. "This is a matter of concern," said Hasan.

"The big issue is that people are not investing in good stocks by taking the fundamentals into consideration."

Good stocks have not moved much higher in the last six months, although the key index and turnover rose significantly.

Recently, the Bangladesh Securities and Exchange Commission (BSEC) has taken steps to restructure the boards of some companies whose stocks have become junk, including Fareast Finance & Investment and Familytex.

As the BSEC move is aimed at bringing companies with performances not up to the mark back to the profitable zone, investors are putting their money into these stocks, said a top merchant banker.

"But with this, they are taking a huge risk because the restructuring of the boards does not guarantee profits for the companies," he said, adding that some people were using the opportunity to spread rumours and get people to buy the stocks.

Investors have to go a long way, so they need to be cautious, the merchant banker said.

Many stocks with good records are still at a lucrative level. So, people should not take risks. Instead, they should invest in good stocks, he said.

"Stocks with a good record are not providing a good return, so I prefer to invest in such a stock that will jump higher within a short time. I know this involves risks," said Salauddin Rana, a stock investor who entered the market in 2019.

Social media is a major source of speculative information on junk stocks, Rana acknowledged.

The BSEC is strict about penalising the people who spread rumours, and many social media pages were taken down, said a top official of the regulator.

"But what can be done if investors take high risks and pay heed to rumours?" he said, adding that investors needed to be cautious to safeguard their investments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments