Junk stocks beat blue chips as rumours abound

Low-performing stocks have kept dominating over blue-chip and sound shares in an unpromising sign that the stock market in Bangladesh is driven more by speculation instead of the health and performance of companies.

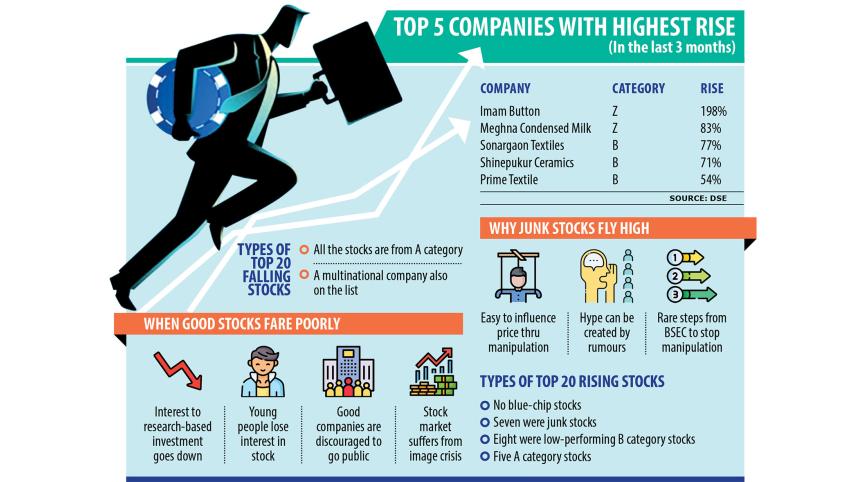

It will become evident if anyone takes time to look into the 20 stocks that recorded the highest increase in the last three months to July 21: seven junk stocks topped the gainers' list along with eight low-performing companies. No shares of the DSE-30 Index, which consists of blue-chip firms, could make it to the list.

Most multinational stocks and a number of renowned local conglomerates declined during the period in keeping with the bearish trend of the market, which is reeling under the global and local economic crises.

Analysts say the tendency is not a good sign for the market because it discourages investors, including the institutional ones, who make investment decisions based on analysis.

In another flip side, good companies will lose interest to go public, they added.

In the last three months, some junk stocks, which have failed to provide any dividends for years, were sold like hot cakes whereas the benchmark index of the Dhaka Stock Exchange (DSE) plunged 7 per cent, or 480 points, data from the exchange showed.

For example, Imam Button, a junk stock that has not paid any dividend to shareholders after 2010, rocketed 198 per cent to Tk 137 from Tk 46, posting the highest pace of growth among the 20 companies.

The second highest growth was recorded by Meghna Condensed Milk although the company has had no history of giving dividends since its listing in 2001. The stock climbed 83 per cent to Tk 37.5.

Such a mismatch, however, is not rare in the premier bourse of the country. In fact, it has been a common scenario in the last several years.

"As a result, many people have already lost confidence in good stocks as low-performing securities are rising more," said Faruq Ahmed Siddiqi, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC).

He said manipulators are targeting the low-performing or low paid-up capital-based companies and some people are chasing them, sending the prices of the securities to dizzying heights.

The surge in the low-performing stocks is giving a message that the exchanges have become a manipulation-based market, according to Siddiqi.

"However, there are many well-performers that have been making a good profit for years and have growth potential."

The soaring prices of low-performing companies have also cemented the belief among a section of investors that the stock market is a place for making an abnormal profit.

A big firm placed a large amount of funds with an asset management company three years ago. Now it is trying to take it back because of the lower yield of the stocks it was invested in compared to speculative stocks, said a top official of the asset management firm.

"A negative mindset has grown even among corporates that the stock market is a gambling board and produces a higher return. So, they have no interest in investing in good stocks. This attitude is an alarming sign for the market," the asset manager said.

Sharif Anwar Hossain, a former president of the DSE Brokers Association, said the investors who invest in good stocks are not active in the market because the securities have not risen to a large extent for several months.

"On the other hand, some low paid-up capital-based companies are rising even in a bearish market. So, people are considering the market risky and manipulation-based," he said, adding that the young generation is not coming to the market as well.

"If the manipulation does not come to an end, good stocks will not rise."

Hossain urged the surveillance team of the DSE and the BSEC to act proactively to stop manipulation.

"Many investors are unwilling to invest in good stocks since rumour-driven securities are producing more capital gains," said Mir Ariful Islam, managing director of Sandhani Asset Management.

He says the rise of junk and low-performing stocks has been a common trend for many years. Now, many institutional investors are betting on them.

"This is not a good indication for the market."

Islam urged investors to keep faith in sound companies since they make profits sustainably.

"The regulator should see why the low-performing stocks are rising," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments