Jute sector losing edge due to high costs, old technology

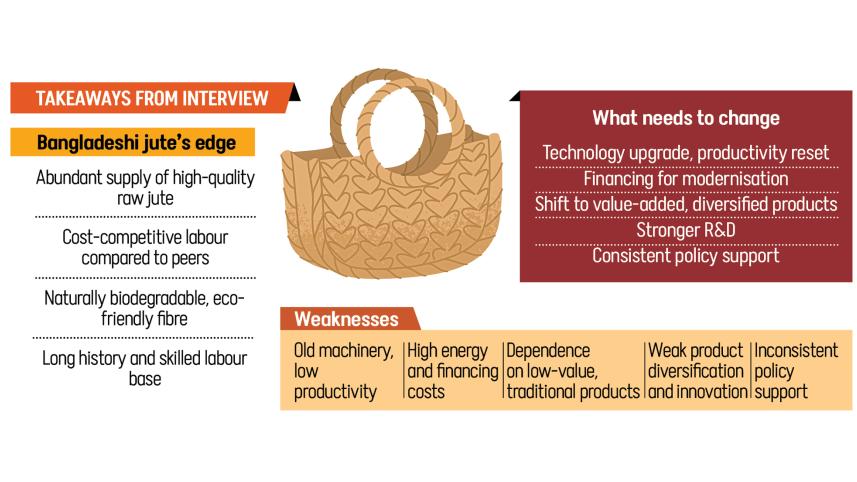

Bangladesh's jute industry is losing global competitiveness as outdated machinery, low productivity and high energy costs keep production expensive, while rival countries have modernised and achieved better cost efficiency, said Bangladesh Jute Spinners Association (BJSA) Chairman Tapash Pramanik.

Speaking to The Daily Star in a recent interview, he said the sector remains heavily dependent on traditional products such as yarn, hessian and sacks, even as global demand has shifted towards diversified, value-added and blended eco-friendly goods.

"Bangladesh has lagged in research and development, design development and the commercialisation of new jute-based products," he noted.

Jute used to be one of the most prominent products of this region. Its high economic value and importance as a cash crop once earned it the moniker of the "golden fibre". But over the decades, it has lost its glory.

"The sector is largely treated as a legacy industry to be protected, not as a modern agro-industrial value chain to be rebuilt," Pramanik said.

Noting that the sector has environmental advantages, he said it has nevertheless failed to regain its former prominence due to structural, policy-driven and market-oriented challenges, while most government initiatives have been fragmented rather than transformative.

He pointed out the stark difference in policy support for the readymade garments (RMG) industry, the current crown jewel of Bangladesh's export economy, and the jute industry.

He pointed out that RMG benefited from predictable incentives, modern machinery, high productivity, export-focused strategies, access to low-cost finance and continuous R&D, enabling rapid global integration and higher margins.

In contrast, he said the jute sector remained dependent on bulk, low-value products, suffered from outdated technology, financial constraints, weak institutional support and limited innovation, leaving it stagnant in exports and unable to capture emerging global opportunities.

Policy failures played the most decisive role in holding back the sector, according to the BJSA chairman. "Weak and inconsistent policies discouraged long-term investment in modernisation and reinforced both technological stagnation and managerial inefficiency."

He also identified limited financial incentives and poor enforcement of laws, such as mandatory jute packaging, which undermined market confidence and demand.

State dominance without meaningful reform also allowed inefficient public sector mills to continue operating without accountability, he added.

At present, according to Pramanik, the most serious concern for the sector is high production costs, driven by obsolete machinery, low labour productivity, high energy prices and expensive financing. "These factors make jute products less competitive than synthetic alternatives and other natural fibres."

Limited access to affordable finance has further restricted modernisation, as mills struggle to secure low-interest, long-term loans.

Technological stagnation remains widespread, resulting in low efficiency, high wastage and inconsistent quality, he added.

Weak product diversification is another major challenge.

Despite growing global demand for diversified and lifestyle-oriented jute products, exports remain dominated by traditional, low-value items.

"Inconsistent policy support and weak enforcement create uncertainty for investors and exporters," Pramanik said.

Quality control issues, logistics bottlenecks, and the absence of strong global branding and effective trade diplomacy continue to erode Bangladesh's position in the international jute market, he added.

To overcome these challenges, Pramanik said the sector requires a coordinated approach in which the government acts as an enabler while private enterprises function as market drivers.

The government, he said, should provide stable, long-term policy support by recognising jute as a strategic export sector and strictly enforcing existing jute laws to stabilise domestic and export demand.

It should also offer affordable financing through low-interest working capital facilities and technology upgradation funds, while reforming sector institutions to improve accountability and ensure industry-oriented research and development (R&D).

Support for product diversification, quality certification and international branding, backed by active trade diplomacy, is equally essential, he also said.

Private enterprises, on the other hand, should prioritise modernising production, improving efficiency and shifting away from low-value commodity exports.

He added that effective public–private coordination through a joint sector platform is necessary to align policy, finance and market strategies for sustainable transformation.

For more than a decade, export earnings from jute and jute goods have stagnated between $900 million and $1 billion.

Breaking this deadlock, Pramanik said, will require deep structural reforms rather than short-term incentives.

The sector must move from volume-based, low-margin exports to value-based, diversified products with higher unit returns, he said.

A sector-wide technology and productivity reset is a must, including the creation of a dedicated jute technology upgradation fund and the phased replacement of obsolete machinery, said Pramanik, also the managing director of Teamex Jute Mills Ltd.

Financial reforms are also needed to treat jute as a priority export industry, offering single-digit interest loans and export-linked credit facilities.

Strengthening applied R&D, certification, and product innovation will help capture premium markets, he added.

"Proactive trade diplomacy and global branding of 'Bangladeshi Jute' as a sustainable product are necessary to expand markets and improve pricing power," Pramanik said.

Climate change poses an additional risk by affecting jute yields, fibre quality and cultivable areas.

Addressing this will require climate-resilient jute varieties, improved agronomic practices, diversified cultivation zones and crop insurance, Pramanik said.

Looking ahead, Pramanik said the industry should adopt an export-led strategy, engage directly with global buyers, ensure compliance, professionalise management and invest in innovation and R&D.

Key opportunities include eco-friendly packaging, partnerships with global brands for certified jute bags and wraps, lifestyle and home décor products such as rugs, mats and furniture, and technical textiles including geotextiles and automotive composites.

Agricultural and environmental applications, such as erosion control mats, also offer potential demand from NGOs and government projects, he said.

Bangladesh's strengths in the global jute market include abundant high-quality raw jute, an established production base, low-cost labour and a strong sustainability image.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments