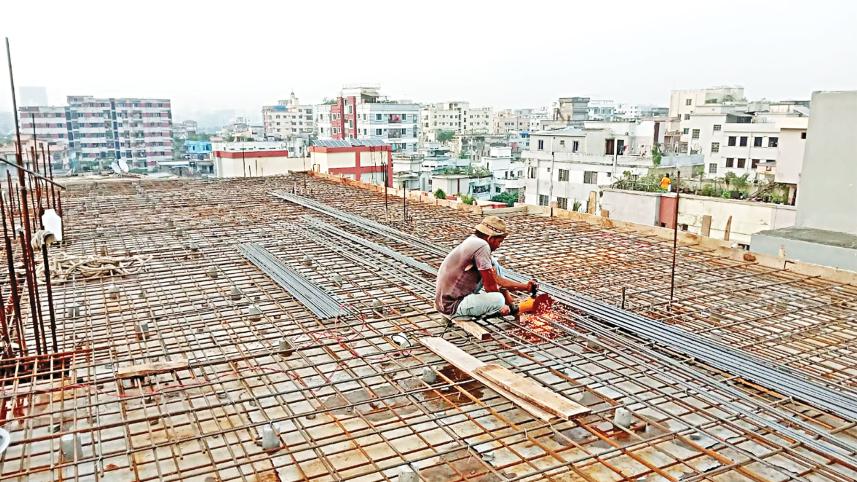

Construction slump likely to persist in 2026

Bangladesh's construction sector is expected to remain under strain in 2026, extending a downturn that took hold over the past year amid weak public spending, subdued private investment and prolonged policy uncertainty, according to industry leaders and analysts.

After a turbulent year marked by sluggish project approvals, falling demand for construction materials and constrained development spending by the government, the slowdown has rippled through real estate, infrastructure and manufacturing-linked industries.

"The construction sector may continue to suffer in 2026, much like last year, due to persistent financial challenges," said Mir Nasir Hossain, managing director of Mir Akhter Hossain Ltd, one of the prominent construction companies in the country.

"The main issue is financial mobility," he said. "Unless interest rates on bank loans are reduced, doing business will remain extremely difficult. The new loan classification rule – under which loans are classified as non-performing after just three months – has added further pressure."

He also pointed to broader industry issues, such as disruptions in gas supply, which have impacted operations. "We do have customers, but these kinds of complications continue to make things tough."

Regarding public sector projects, Hossain said their participation in government tenders has become uncertain due to unclear fund availability.

"We are currently working on foreign-funded projects, where processes are more structured. But even there, payment delays are causing cash flow problems," he added.

The real estate sector, the most vital driver of construction activity, also ended the past year on a weak footing, with industry players expecting the downturn to carry into 2026.

"Overall business across the market has declined by at least 20 to 25 percent compared to last year," said M Hoque Faisal, director of sales and marketing at Tropical Homes Limited.

He attributed the contraction largely to prolonged uncertainty surrounding planning regulations, particularly the Detailed Area Plan (DAP) and floor area ratio (FAR) rules.

"Due to indecision on these issues, fewer land signings have taken place, and approvals for new projects have significantly decreased," he added. "As a result, developers have been cautious, and new areas have not opened up for development."

Political uncertainty ahead of national elections has further dampened sentiment. Buyers and investors, Faisal noted, have largely adopted a wait-and-see approach, delaying purchase decisions amid questions about the future policy direction.

The slowdown in construction and real estate has fed directly into weaker demand for building materials.

With few new projects being launched by either private developers or the government, demand for key inputs such as steel rods and cement has dropped sharply.

"From my perspective, the construction materials sector may have seen an even sharper decline, possibly around 30 percent," said Faisal.

Project approvals have also fallen well below historical norms. According to Faisal, in a typical year, the real estate sector records between 1,000 and 1,500 new project approvals. "This year, approvals are likely to be limited to 300 to 500, a third of what we'd normally expect."

Economists warn that the prolonged weakness in construction is already weighing on broader economic performance.

"The construction sector has remained sluggish for over a year, with a noticeable adverse impact on GDP growth and employment," said M Masrur Reaz, chairman and chief executive officer of Policy Exchange of Bangladesh.

High inflation, he said, has eroded purchasing power and constrained spending on capital-intensive activities, while a slowdown in private sector credit growth has curtailed investment.

Public spending has offered limited support, he also noted.

The Annual Development Programme (ADP) implementation fell to its lowest level in at least 15 years in the first five months of the ongoing fiscal year, as the interim government has taken a cautious approach to expenditure.

"All of these factors combined have led to a significant slowdown in the construction sector over the past year," Reaz said.

Downstream industries are also feeling the effects.

The ceramic sector, which is heavily dependent on construction and real estate demand, is unlikely to see a rebound before political and economic stability improves, said Irfan Uddin, general secretary of the Bangladesh Ceramic Manufacturers and Exporters Association.

"The ceramic industry depends heavily on real estate and development, and the lack of momentum in these areas continues to have a serious impact," he said.

Demand for tiles, sanitaryware and tableware has declined sharply and may remain weak well into 2026 if construction activity fails to pick up, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments