In Bangladesh Bank we trust

This ought to be, if it already is not, the motto of stock market players in Bangladesh. Bangladesh Bank (BB) has left no stone unturned to show that it stands ready to put lipstick on everything to drive stock markets higher.

11 February 2020, 18:00 PM

Treasury bills: a double-edged sword

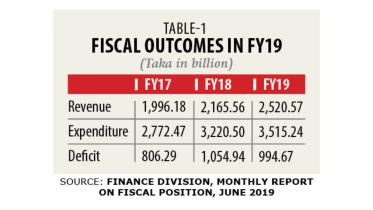

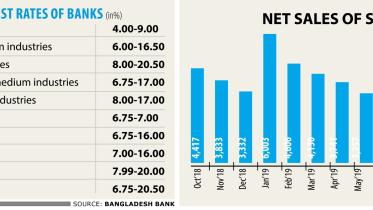

The surge in public borrowing from banks has significantly elevated the risk of further reducing the availability of credit to the private sector through two channels. One channel is through reducing the availability of liquidity for lending to the private sector. The other channel is interest rates.

9 February 2020, 11:16 AM

The 9 per cent cap will hurt the financial inclusion agenda

Banks prefer to work with large national and multinational business groups and the government, which offer less risk and higher returns.

6 February 2020, 18:00 PM

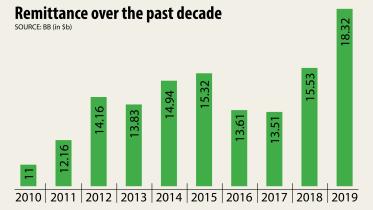

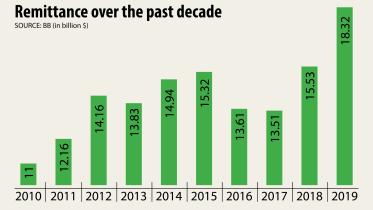

What is riding on remittance?

Thinking about the role of remittance in our economy often makes us think about growth and standard of living.

28 January 2020, 18:00 PM

NEW MONETARY POLICY: Nothing really new except renewal of old worries

The Bangladesh Bank (BB) has adjusted the monetary programme for the current fiscal year. Although the adjustment is limited to just one component, it is a big one.

20 January 2020, 18:00 PM

Alternative facts and contradictory policies

Like dead characters in Hollywood and Bollywood movies, paradoxes seem to reappear in Bangladesh’s economic landscape more often than analysts would like. Here are two new arrivals:

16 January 2020, 18:00 PM

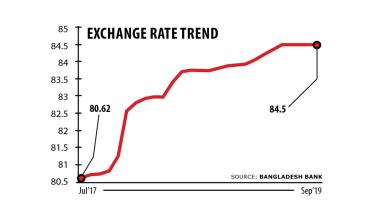

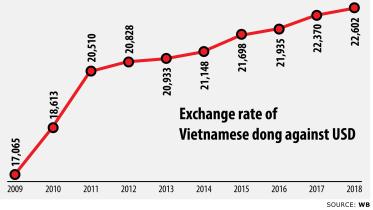

Revisiting the devaluation debate

The debate on taka devaluation is a debate on whether the exchange rate is currently overvalued. How do we know?

13 January 2020, 18:00 PM

The economics of remittance growth

Most economic indicators on the state of the Bangladesh economy during the first half of FY20 are down with one big exception—remittances.

9 January 2020, 18:00 PM

How well founded are the devaluation worries?

In an interview published in this newspaper on January 3, the finance minister stated unequivocally “no currency devaluation”. Is such a sweeping stance compatible with the government’s own economic policy objectives?

5 January 2020, 18:00 PM

Back to square one

It’s deja vu all over again. On June 21, 2018, Bangladesh Association of Bankers (BAB), a platform of private banks’ owners, agreed to cap the interest rate on deposits at 6 percent and the lending rate at 9 percent from July 1, 2018.

1 January 2020, 18:00 PM

Missing the cause for the symptoms

The stock of non-performing loans (NPLs) is increasing in both public and private banks. This is raising the threat to financial stability, impairing financial intermediation and damaging the resilience of the banking sector to shocks, thus increasing systemic risk. NPLs are also associated with higher funding costs and a lower supply of credit. However, the recent hot debate in Bangladesh has centred on whether high NPLs are a cause or a consequence of high lending rates.

12 December 2019, 18:00 PM

Bon voyage, Bangla Bond!

Bangladesh needs to boost private investment from the current 23 percent of GDP to nearly 30 percent to accelerate and sustain growth as it moves up the middle-income path and strives to achieve the Sustainable Development Goals.

11 November 2019, 18:00 PM

Encouraging progress, still long way to go

Bangladesh has made encouraging progress on the World Bank’s Ease of Doing Business (DB) 2020. The rank has improved by 8 places to 168 from 176 a year ago.

24 October 2019, 18:00 PM

A toxic sundae

Bangladesh’s stock markets have been fluctuating sharply in recent years.

6 October 2019, 18:00 PM

What is needed to make the AMC solution work?

The government wants to form a public asset management company (PAMC) to buy distressed loans from banks.

28 September 2019, 18:00 PM

Don’t throw the baby out with the bathwater

Offshore Banking Units (OBUs) of domestic banks have borrowed from banks in the euro zone at 2 percent interest rate to meet their euro liabilities against Usance Payable At Sight (UPAS) issued by them to Bangladeshi importers. Simply stated, the UPAS issuing bank

13 September 2019, 18:00 PM

Is the loan restructuring narrative credible?

The Bangladesh Bank (BB) has caved in to pressure for extending the loan restructuring facility to large borrowers once again, albeit on

2 September 2019, 18:00 PM

What is needed for sustaining high growth in Bangladesh?

We know from growth accounting that GDP growth can be broken into growth in the labour force and growth in labour productivity.

28 August 2019, 18:00 PM

Why go around elbow to get to the nose?

The government announced a 2 percent subsidy on remittances in the FY20 budget and allocated Tk 3,060 crore for this purpose.

19 August 2019, 18:00 PM

No room for complacency

The monetary policy recognises the contextual challenges, particularly banking sector ailments relating to high non-performing loans

31 July 2019, 18:00 PM