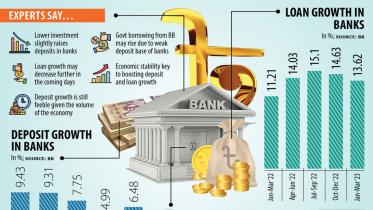

Deposit growth rises, loan growth falls

The deposit growth in the banking sector of Bangladesh rose in the first quarter of 2023 from a quarter ago as businesses prefer to park funds with lenders instead of making investments amid the ongoing economic slowdown and uncertainty.

14 June 2023, 02:10 AM

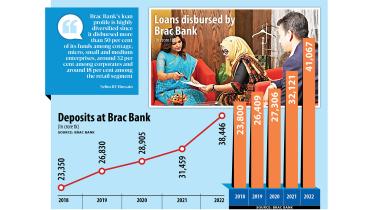

Brac Bank plans to double business by 2025

Brac Bank Ltd has planned to double its business by 2025 with a view to catering banking services to people from all walks of life, said its managing director, Selim RF Hussain.

10 June 2023, 18:00 PM

Private sector’s foreign loan repayment to drop 42% in 2023

The Bangladesh Bank has projected that loan repayments against mid- and long-term foreign credits secured by the private sector might fall by 42.6 per cent in 2023, but the development might not bring about major relief for an economy reeling under the forex crisis.

8 June 2023, 01:30 AM

Islamic banks’ loan surges 9 times their deposits in a year

Investments made by full-fledged Islamic banks in Bangladesh surged nearly nine times their deposits in a span of a year, raising questions as private sector credit growth has slowed in the entire banking sector, official figures showed.

6 June 2023, 01:50 AM

Extended contractionary monetary policy might be needed: BB

The stubbornly high inflation has raised concerns that inflation expectations would become unanchored, meaning inflation will get much worse, which may necessitate an extended period of contractionary monetary policy, said Bangladesh Bank.

5 June 2023, 02:15 AM

Digital bank to bring positive change

The government’s move to set up a digital bank and develop a machine learning and artificial intelligence-based credit rating system will bring a positive change in the banking sector, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank Limited (MTB).

3 June 2023, 18:00 PM

Higher borrowing may fan inflation

The government will depend heavily on borrowing from Bangladesh Bank to manage its budget deficit in the next fiscal year amid the tax authority’s continuous failure to generate adequate revenues, a reliance that may stoke inflationary pressures and worsen the current economic volatility.

1 June 2023, 18:00 PM

Stress on forex reserves to ease soon: Kamal

Finance Minister AHM Mustafa Kamal today in his budget speech hoped that the ongoing stress in the foreign exchange reserves would improve in a short period of time.

1 June 2023, 12:51 PM

Digital bank to be set up for financial inclusion

Finance Minister AHM Mustafa Kamal today in his budget speech said that a digital bank would be set up within the next fiscal year to broaden and accelerate financial inclusion efforts.

1 June 2023, 11:28 AM

Moody’s Credit Rating: Bangladesh downgraded

The US-based global credit rating agency Moody’s Investors Service yesterday downgraded Bangladesh’s sovereign rating by one notch to B1 from Ba3.

30 May 2023, 18:00 PM

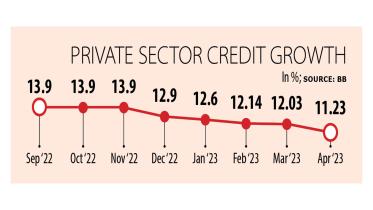

Credit growth slips to 14-month low

Private sector credit growth in Bangladesh dropped to a 14-month low of 11.23 per cent in April owing to weak credit demand amid the current business slowdown, official figures showed.

30 May 2023, 02:00 AM

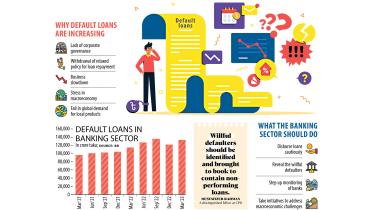

Tk 10,964cr loans turn sour in 3 months

Banks in Bangladesh witnessed an accumulation of default loans by Tk 10,964 crore in the first three months of 2023, highlighting the worsening financial health of the banking sector, official figures showed.

29 May 2023, 02:00 AM

Default loans rise 9% in three months

It increased by Tk 10,954 crore to hit Tk 131,621 crore in March

28 May 2023, 10:18 AM

Govt keeps borrowing big amounts from BB

The government has kept borrowing a hefty amount of funds from the Bangladesh Bank as commercial banks are unable to meet the financing requirement of the state because of the liquidity crunch.

18 May 2023, 02:30 AM

Can falling imports alone ease stress in the economy?

Bangladesh’s trade gap and current account deficit have narrowed significantly in recent months but the positive developments might not prove enough to bring back stability to the economy.

16 May 2023, 02:00 AM

BB’s dollar sales this FY go past $12b

The US dollar sold by the central bank has surpassed the $12-billion mark in the ongoing fiscal year as it has had to pump the American greenbacks into the market in order to clear import bills.

14 May 2023, 03:00 AM

Financial account deficit goes past $2b

The deficit in Bangladesh’s financial account widened further in the first nine months of the ongoing fiscal year, an indication that the current instability in the foreign exchange market will continue in the coming months.

11 May 2023, 02:30 AM

Reinvestment of earnings pushed FDI up in 2022

Foreign direct investment (FDI) in the country increased 20 per cent year-on-year to $3.48 billion in 2022 for a surge in reinvestment of earnings by foreign companies.

5 May 2023, 03:00 AM

Taka keeps falling, forex reserves slip below $31b

The taka has lost its value further against the US dollar after the Bangladesh Bank sold the greenback at Tk 104.5 as the foreign exchange reserves keep falling.

3 May 2023, 02:30 AM

Economic pressure deepens as export, remittance dip

Exports and remittances, two major sources of foreign currencies for Bangladesh, plunged in April, a bad omen for the economy as it deals with multiple challenges, including a dollar crisis, an elevated level of import costs and falling reserves.

3 May 2023, 02:00 AM