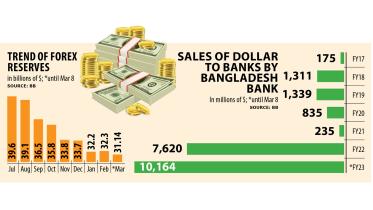

Forex reserves fall below $31 billion

It hit $30.92b on April 30, down from $44.01b on same day a year ago

2 May 2023, 12:25 PM

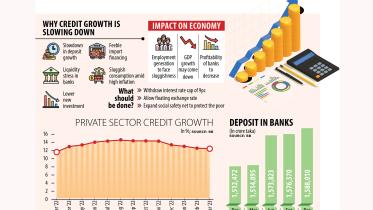

Demand for loans falls to 12-month low

Private sector credit growth in Bangladesh slipped to a 12-month low of 12.03 per cent in March, a development that may hurt GDP growth and job creation.

1 May 2023, 02:00 AM

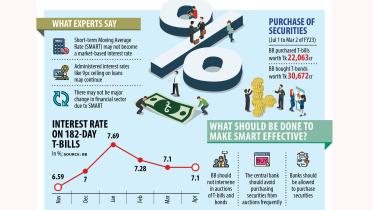

Will BB’s lending rate-setting formula yield expected results?

The Bangladesh Bank has decided to implement a market-based interest rate from July, moving away from the 9 per cent interest rate cap on loans, an initiative that may help the central bank uses its policy rates effectively in its fight against higher inflation.

30 April 2023, 02:00 AM

Forex reserves keep falling amid dollar selling spree

The central bank has kept injecting a hefty volume of US dollars into the market to help banks clear import bills, eroding the Bangladesh’s foreign exchange reserves.

28 April 2023, 02:00 AM

BB sets goal for 75% retail transactions digitally by 2027

The central bank has set a goal so that at least 75 per cent of retail transactions are settled through digital technologies by 2027, a move that may give Bangladesh’s digital transformation a massive fillip and turn the cash-based economy into cashless.

11 April 2023, 02:00 AM

Financial account deficit widens

The deficit in Bangladesh’s financial account widened substantially in the first eight months of the ongoing fiscal year, in an indication that the current stress in the foreign exchange regime will continue in the coming months.

6 April 2023, 03:30 AM

City Bank: a phoenix in Bangladesh’s banking sector

Many banks in Bangladesh struggled to ensure expected profit in the last couple of years owing to the business slowdown, but The City Bank Ltd managed remarkable returns on the back of corporate governance and diversified products.

28 March 2023, 03:00 AM

Uncertainties abroad may affect growth momentum at home: BB

The Bangladesh Bank yesterday said the ongoing global uncertainties may have an adverse impact on the country’s growth momentum and the inflationary situation.

28 March 2023, 02:30 AM

Lessons for Bangladesh from US bank collapse

Silicon Valley Bank (SVB), the 16th largest lender in the United States, has not reportedly faced any scam or lack of corporate governance. Still, it could not avoid the collapse.

14 March 2023, 02:00 AM

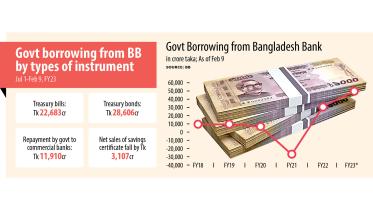

Govt borrowing from BB may fuel inflation

The government has continued borrowing from Bangladesh Bank as commercial banks have been unable to come up with much-needed funds owing to a liquidity crunch.

12 March 2023, 02:30 AM

Forex reserves slip to six-year low

Bangladesh’s foreign currency reserves have slipped to a six-year low of $31.15 billion after the central bank cleared import bills to the tune of $1.05 billion with a number of Asian countries, official figures showed.

10 March 2023, 05:55 AM

Central bank’s USD investment plunges

Bangladesh Bank’s foreign exchange reserves invested in US dollars declined 34 per cent year-on-year to $23.63 billion in February as the country is heavily dependent on the American greenback to settle payments for global trade.

28 February 2023, 02:00 AM

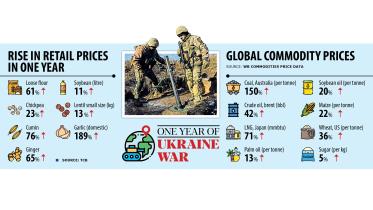

One Year Of Ukraine War: Undoing of Bangladesh economy

In the end, it was a war that began some 5,800 kilometres away a year ago that laid bare the longstanding weaknesses of the Bangladesh economy.

24 February 2023, 01:00 AM

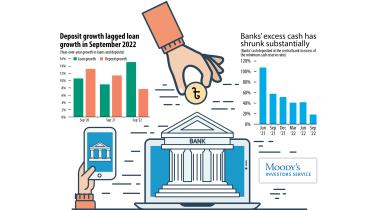

Spike in funding costs to hurt banks’ profitability

Weak banks in Bangladesh with small holdings of government securities, which are used to mobilise funds either from the central bank or peers, may become more vulnerable in the days to come, Moody’s Investors Service warned yesterday.

23 February 2023, 02:00 AM

Economy bleeds while reality only getting harsher for people

Russia’s war in Ukraine might be taking place 5,800 kilometres away from Bangladesh and the country is not involved militarily in the dragging conflict in any way, but its economy and people have been paying heavy prices.

22 February 2023, 02:00 AM

Eight banks face provision shortfall of Tk 19,048cr

Eight banks in Bangladesh faced a collective provisioning shortfall of Tk 19,048 crore in 2022, creating a risk for their depositors.

21 February 2023, 02:00 AM

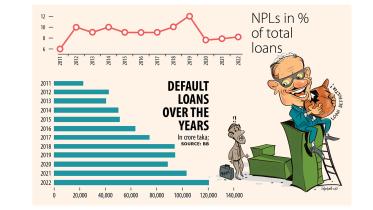

Relaxed rules can’t tame default loans

Default loans in Bangladesh’s banking sector jumped 17 per cent year-on-year to Tk 120,656 crore last year owing to a lack of corporate governance and the ongoing business slowdown.

20 February 2023, 02:00 AM

Default loans rises nearly 17%

Habitual defaulters' reluctance to repay the funds fuelled the amount to reach Tk 120,656 crore

19 February 2023, 11:29 AM

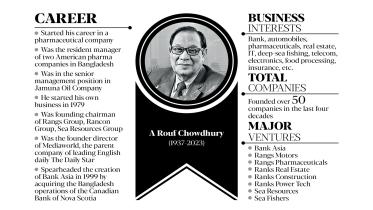

A Rouf Chowdhury: a dreamer and a trailblazer

Bangladesh’s banking sector has long been going through a difficult time as a majority of banks are plagued by challenges stemming from a lack of corporate governance. But Bank Asia Ltd stands out thanks to its unwavering focus on following rules strictly under the leadership of a strong board of directors led by A Rouf Chowdhury.

19 February 2023, 02:00 AM

Govt’s higher borrowing from BB stokes inflation risk

The government has kept borrowing from the Bangladesh Bank as commercial banks can’t come up with much-needed funds owing to the liquidity crunch.

15 February 2023, 02:00 AM