‘Rules on compulsory diploma discriminatory’

It will be very tough for bankers to pass the exam smoothly if the existing curriculum is retained.

12 February 2023, 03:30 AM

BB injects $330m into market since IMF loan

The Bangladesh Bank has injected $330 million into the country’s foreign exchange market since February 1 when the International Monetary Fund disbursed $476.27 million to Bangladesh as the first installment of a $4.7 billion loan.

10 February 2023, 02:00 AM

BB to offer new tool for cash support to Islamic banks

Bangladesh Bank will introduce another tool to provide liquidity support to cash-strapped Shariah-based banks in order to safeguard their ailing financial health.

5 February 2023, 18:00 PM

IMF releases $476.27 million as first loan instalment for Bangladesh

The International Monetary Fund (IMF) has disbursed $476.27 million to Bangladesh as the first instalments of $4.7 billion loan it approved early this week.

2 February 2023, 13:01 PM

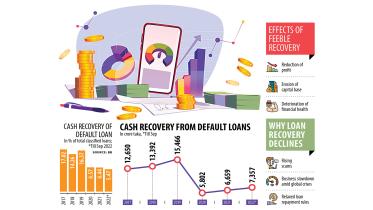

Relaxed rules failed to speed up default loan recovery

The recovery of default loans is still weak in Bangladesh despite offering relaxed repayment policies for three consecutive years to 2022 as delinquent borrowers are not paying back funds on time, hitting banks’ income and cash flow.

1 February 2023, 02:00 AM

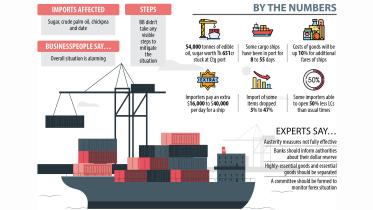

No visible step from BB to ease importers’ woes

The Bangladesh Bank is yet to take any visible measure in line with a commerce ministry directive aimed at asking banks to earmark a portion of their foreign currency holdings to open letters of credit to import essentials ahead of Ramadan.

19 January 2023, 02:00 AM

Pilot kicks off for digital payment with QR code

The Bangladesh Bank will commence a campaign tomorrow to popularise an interoperable QR code across the capital city in a move to bring millions of small businesses such as street vendors and lower-income groups under the digital transaction system.

17 January 2023, 16:13 PM

Feeble monetary policy against challenges

Bangladesh Bank yesterday unveiled a wishy-washy monetary policy for the next six months that will prove to be ineffective in tackling the headwinds passing through the economy.

16 January 2023, 01:00 AM

Monetary policy won’t work if interest rate cap stays

By retaining the interest rate cap on lending and fixed exchange rate, the upcoming monetary policy for the second half of this fiscal year will not play any role in containing inflation, economists said.

15 January 2023, 02:20 AM

Lanka gets 6 more months to repay BB’s $200m

Bangladesh Bank yesterday granted Sri Lanka’s request to be given six more months to repay a $200 million loan due to the prolonging of its economic crisis.

13 January 2023, 03:00 AM

Nagad Finance inches closer to running MFS operation

The Bangladesh Bank yesterday decided in principle to allow Nagad Finance PLC, a proposed non-bank financial institution (NBFI), to run mobile financial services.

13 January 2023, 02:30 AM

Sri Lanka given 6 more months to repay Bangladesh’s $200m loan

Bangladesh Bank today granted Sri Lanka six more months to repay the $200 million loan after the Island nation requested to extend the repayment period due to its prolonged economic crisis.

12 January 2023, 14:18 PM

Desperate, banks ignore own rates for collecting remittance

In a desperate attempt at collecting the greenback to meet immediate requirements, a good number of banks are ignoring directives of two lenders’ organisations to not offer over Tk 107 for each US dollar coming in as remittance.

12 January 2023, 02:30 AM

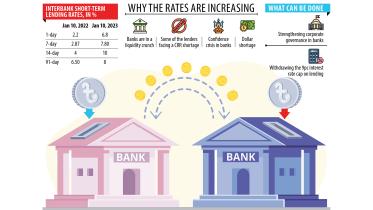

Interbank lending rate goes past 9% cap for liquidity crunch

Cash-strapped banks are borrowing from cash-rich lenders paying more than 9 per cent in interest rate, which is above a cap set by the central bank, as an unprecedented liquidity crunch has hit the banking sector of Bangladesh.

11 January 2023, 02:00 AM

Govt keeps borrowing heavily from BB

The government continues to borrow from Bangladesh Bank on a large scale as commercial banks are now unable to finance the state due to liquidity crunch.

6 January 2023, 01:30 AM

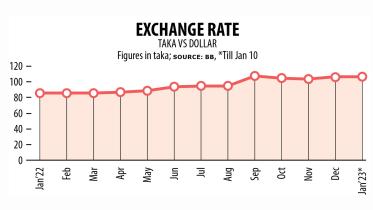

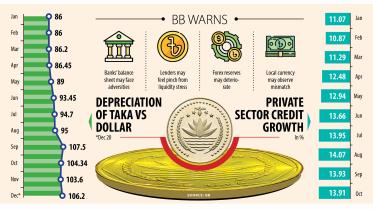

Forex market continues to stay under pressure

Come January there won’t be any volatility in the foreign exchange market -- was the overarching message from the government in the past couple of months. January has arrived, and the situation is dicey as before.

5 January 2023, 01:45 AM

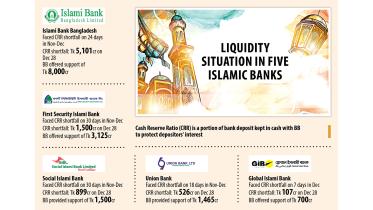

Four more Islamic banks take BB emergency loans

Four more shariah-based banks have been found to have taken emergency funds, which are usually taken during extraordinary circumstances, in an attempt at dressing up their balance sheet for last year.

3 January 2023, 02:00 AM

Islami Bank takes emergency Tk 8,000cr from BB

Islami Bank has started to avail a central bank facility that is only summoned during extraordinary circumstances, as the Shariah-based lender looked to dress up its balance sheet ahead of the year’s end.

2 January 2023, 01:30 AM

BB to dissolve Uttara Finance board for scams

Bangladesh Bank yesterday decided to dissolve the board of directors of the Uttara Finance and Investments over major financial irregularities involving Tk 5,100 crore it had unearthed two years ago.

28 December 2022, 02:00 AM

Only two options left for macroeconomic stability

Bangladesh does not have too many policy options other than reducing consumption of goods and services and making the exchange rate flexible in order to ensure macroeconomic stability, said a central bank report.

22 December 2022, 02:00 AM