Bangladesh Bank looked away as tycoons borrowed at will from 2 banks

On edge -- is what best describes the sensation surrounding the banking sector. But the Bangladesh Bank higher-ups were warned as early as October 2021 that such a situation might transpire. Yet, no definitive action was taken then.

18 December 2022, 01:00 AM

Five Islami banks put on tight leash

Bangladesh Bank has instructed five shariah-based banks to send a daily log of sanctioned credit of Tk 10 crore and above as it looks to restore calm and order at the lenders that have recently faced withdrawal pressure.

16 December 2022, 01:00 AM

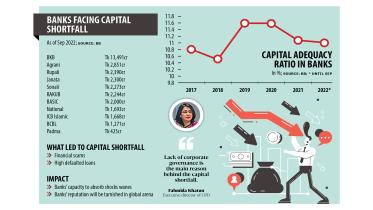

11 banks suffer capital shortfall

Eleven banks in Bangladesh collectively faced a capital shortfall of Tk 32,606 crore in September, which highlighted their fragile health caused by years of irregularities.

13 December 2022, 02:00 AM

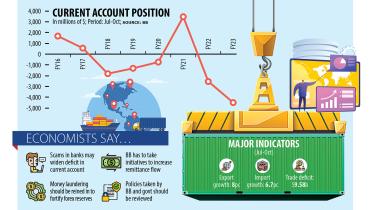

Current account deficit widens further

Bangladesh’s current account deficit widened further in October as imports continued to surge compared to the combined receipts from exports and remittances.

7 December 2022, 02:00 AM

With observer’s departure, Islami Bank’s health worsened

Despite being among the best-run and the most profitable bank in Bangladesh in the past decade, Islami Bank had an observer in its board the entire time.

30 November 2022, 18:00 PM

Private credit growth drops further

Private sector credit growth in Bangladesh dropped in October as banks slowed loan disbursement amid a liquidity crunch.

30 November 2022, 03:30 AM

TK 7,246CR loans to 9 firms: BB probing ‘breach of rules’ at Islami Bank

Bangladesh Bank has begun an investigation into Islami Bank Bangladesh Ltd for disbursing Tk 7,246 crore in loans to nine companies this year grossly violating banking rules.

29 November 2022, 01:20 AM

Forex volatility: BB injects $6b into market so far this fiscal year

The amount of US dollar injected into the market so far by Bangladesh Bank has surpassed $6 billion in the current fiscal year, creating further pressure on the country’s foreign exchange reserves that are now depleting fast.

24 November 2022, 02:30 AM

HC bars cheque bounce case against defaulters

No bank or non-bank financial institution can lodge any cheque dishonour case to recover defaulted loans from now onwards, as per a High Court verdict yesterday.

23 November 2022, 18:00 PM

Pressure on economy: Next three months are critical

For the Bangladesh economy, the next three months are expected to be delicate as the measures the government has taken so far to steady the ship amid the global economic tempest start to play out.

18 November 2022, 02:00 AM

Depositors’ money completely protected

The Association of Bankers, Bangladesh (ABB), a platform of managing directors of banks in Bangladesh, yesterday said depositors’ money in banks were completely protected as lenders were now enjoying a hefty amount of excess liquidity.

17 November 2022, 03:00 AM

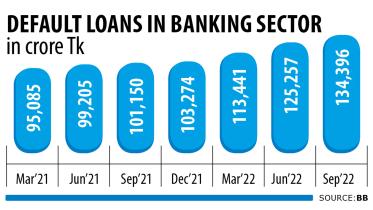

Soured loans soar to new highs

Banks’ defaulted loans hit Tk 134,396 crore at the end of the third quarter of this year -- yet another high as a lack of governance continues to wring the sector.

14 November 2022, 02:00 AM

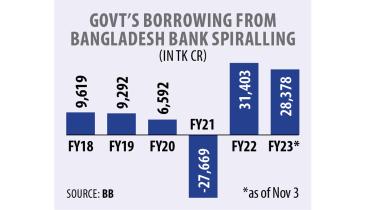

Govt borrowing from Bangladesh Bank stokes inflation fears

In a time of elevated inflation, the government has started to borrow heavily from the Bangladesh Bank to meet the budget deficit, in a move that is set to push up the consumer price level further.

11 November 2022, 02:00 AM

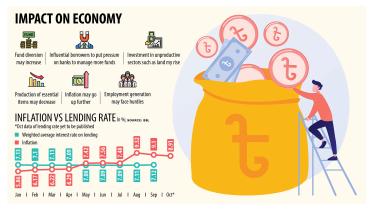

Economy paying the price of cheap funds

The current lending rate, which equals the inflation rate, has brought about major challenges for the economy as a negative interest rate has prompted many large clients to borrow hugely despite subdued demand, giving them the leeway to divert funds to the unproductive sector.

9 November 2022, 02:10 AM

Savers on the receiving end again

The Bangladesh Bank has decided to withdraw the interest rate floor on retail term deposits which had been set by banks equivalent to the average inflation rate of the immediate past three months, said bankers.

6 November 2022, 02:20 AM

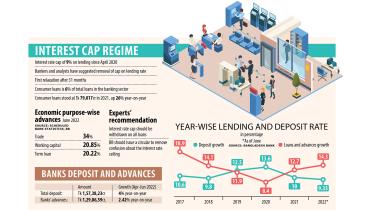

BB eases cap on lending interest after 31 months

The Bangladesh Bank has decided to raise the interest rate on consumer loans to 12 per cent from 9 per cent after economists have long called for the withdrawal of the cap on all loans to contain inflation.

6 November 2022, 02:10 AM

State lenders asked to improve health as IMF raises concerns

The Bangladesh Bank yesterday asked four state-owned commercial banks to improve their financial health by containing defaulted loans and broadening capital base after the International Monetary Fund (IMF) expressed concerns about their weak conditions.

4 November 2022, 02:20 AM

Current account balance: Sinks further in red

Bangladesh’s current account balance sank further in the red in September, heaving the pressure on the exchange rate that is trading at record lows against the US dollar.

3 November 2022, 02:00 AM

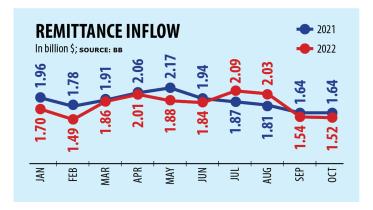

Remittance keeps falling as hundi gains upper hand

Despite a surge in the outflow of migrant workers, remittances to Bangladesh declined 7.4 per cent year-on-year to $1.52 billion in October, an unpromising development that may deepen the volatility in the economy.

2 November 2022, 02:10 AM

Credit growth slows

Private sector credit growth fell by more than two percentage points in September as banks slowed loan disbursement amid liquidity crunch, snapping a seven-month upward trend.

28 October 2022, 02:10 AM