Strong words must be matched by firm action

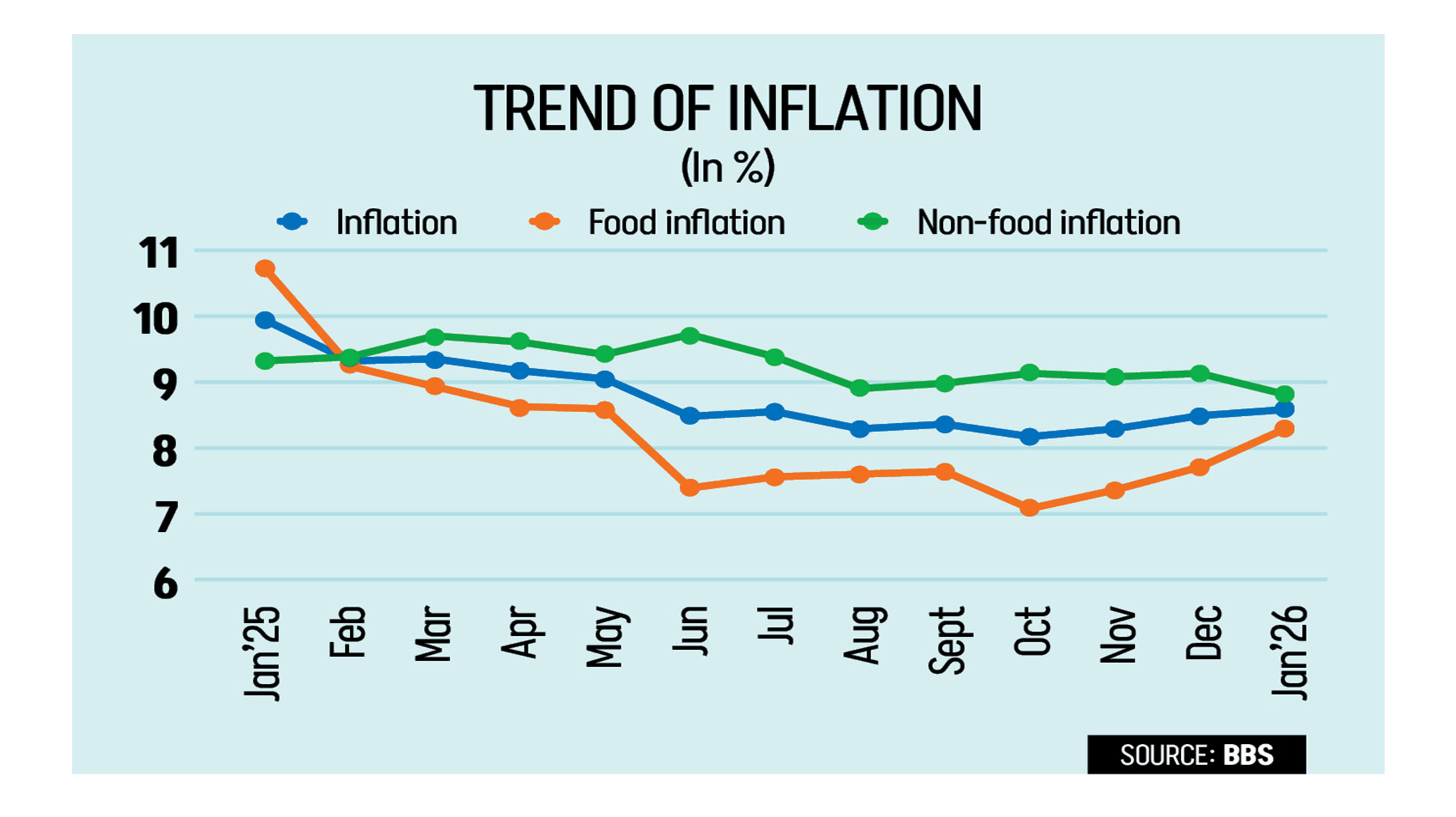

The new government faces a gauntlet of critical economic tests, beginning with the immediate goal of taming rampant food inflation during the Ramadan period. With overall inflation elevated at 8.58 percent in January—and food inflation accelerating to 8.29 percent—the political honeymoon for the new administration may be exceptionally brief. In most countries, public faith in the government’s economic management rises and falls with food prices.

Besides, the new government inherited an economy tethered to external lifelines and suffering from deep structural decay. Since entering an IMF rescue programme in early 2023 following a severe balance-of-payments crisis, Bangladesh has staggered from one review to the next. When an IMF mission arrives in Dhaka next month, it will bring with it the cold calculus of fiscal discipline and monetary tightening. Stabilising the foreign exchange reserves has offered a semblance of stability, but in the meantime, investment has stalled, imports have shrunk, and credit growth in the banking sector has plummeted to historic lows. Should the government succeed in reigniting growth, the demand for foreign currency will swiftly return, putting pressure on the reserve buffer.

If the external picture is precarious, the domestic fiscal ledger is dismal. Total public debt has surged by roughly 60 percent over the past three years, reaching Tk 21.5 lakh crore by September 2025. The state’s growing reliance on the banking sector to finance its deficit has a side-effect: it absorbs liquidity through treasury bonds and crowds out the private enterprise needed to drive recovery. Worse still, a colossal fiscal burden looms on the horizon due to the Pay Commission’s proposal to raise civil service salaries. Implementing the raise would require a recurrent amount of Tk 1 lakh crore on top of the Tk 1.31 lakh crore spent on salaries and pensions for government employees a year.

The administration’s energy must be directed towards revenue mobilisation. Bangladesh remains chronically under-taxed. The value-added tax (VAT) system is plagued by open-secret leakages. Modernising VAT collection and combating evasion require political courage, but they are the only sustainable alternatives to endless borrowing. Long-promised structural reforms, including granting genuine autonomy to the central bank and overhauling the National Board of Revenue, are urgently required. Finally, there is the ticking clock of global trade. Although the government’s request for a three-year delay to the planned exit from Least Developed Country (LDC) status may be a pragmatic step, a delay is not a strategy. It merely buys time that must be used to diversify exports and improve competitiveness.

For Prime Minister Tarique Rahman’s government, the temptation to build early popularity through subsidies, salary hikes, and delayed reforms will be immense. But yielding to it would be a wrong step. The authorities must use their first months in office to communicate hard truths, enforce fiscal discipline, and dismantle the cronyism choking the banking sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments