State-run fuel suppliers’ earnings drop in Q1

Earnings of state-run fuel supplying companies dropped in the July-September period due to a sharp fall in income from bank deposits and in fuel sales amid the Covid-19 outbreak.

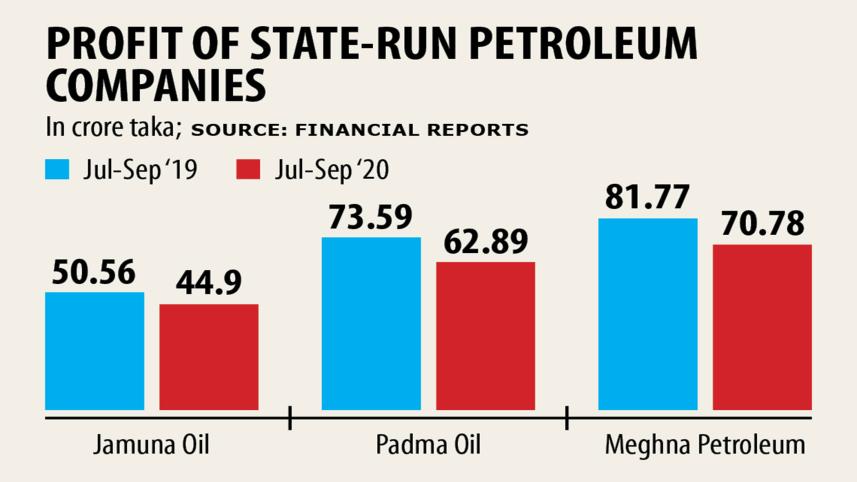

Padma Oil's earnings fell 14.5 per cent year-on-year to Tk 62.89 crore in the first quarter of fiscal 2020-21.

Meghna Petroleum's earnings plummeted 13.4 per cent to Tk 70.78 crore and that of Jamuna Oil 12.5 per cent to Tk 44.9 crore.

All three companies used to have a handsome amount as bank deposit and the interest incomes are their main source of earnings.

As of the first quarter of FY21, Meghna had Tk 1,189.35 crore as fixed deposits and Padma Tk 140.35 crore while Jamuna had Tk 1,445 crore as short-term investment in fixed deposit as of June 30 in 2019.

"Of the drop in earnings, around 20 per cent was caused by the pandemic induced slow economy while the major blow came from the falling interest income from April," said Md Masudul Islam, company secretary of Jamuna Oil.

Scheduled banks pulled down the interest rate for deposits to single digits following an order of the banking regulator to provide 6 per cent interest on deposits and 9 per cent on lending since April 1.

The net interest income of Meghna is 15 per cent higher than what the company earns from petroleum sales, according to company officials.

Meghna's earnings from interest dropped 19.2 per cent year-on-year to Tk 66.14 crore in the first quarter of 2020-21 and the trend was the same for Padma and Jamuna.

Banks offer higher deposit rates to state-owned oil companies as they keep their funds in banks for a long period, said a top official of a listed oil supplier preferring anonymity.

State banks currently offer the fuel suppliers over 6 per cent interest on deposits while the private banks 7 per cent, which is much lower from what the companies used to get earlier, the official said.

"It is a bit weird to find the central bank to create pressure on the banks to lower the rate further when we are trying to make best use of our funds, make more profits and disburse higher dividends."

The impact would be clear in the next quarter, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments