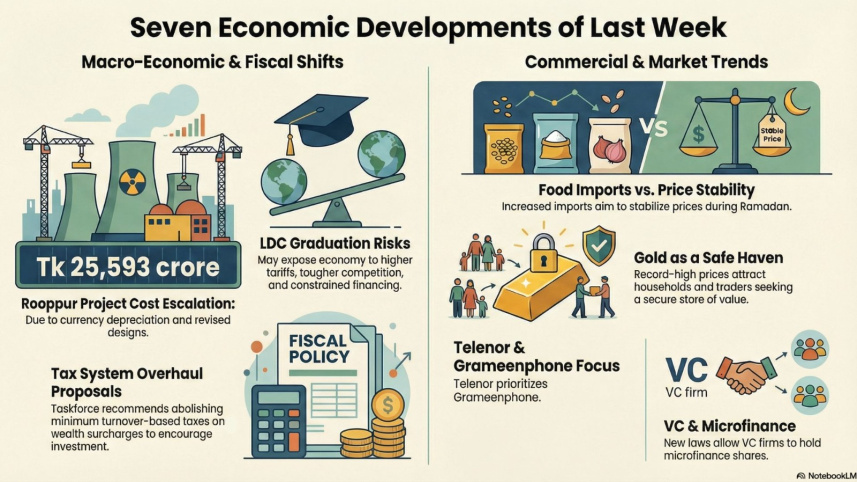

Seven developments that shaped economy last week

Bangladesh’s economy last week revolved around a mix of fiscal reform proposals, investment signals, market behaviour and structural concerns as the country navigates macroeconomic pressures ahead of LDC graduation.

The following is a recap of seven major developments covered by Star Business.

Rooppur power project seeks Tk 25,593cr cost hike (Jan 25)

The Rooppur Nuclear Power Plant project has sought an additional Tk 25,593 crore, citing currency depreciation, revised designs and added infrastructure. If approved, the total project cost will rise to Tk 138,685 crore, with the completion timeline pushed back to 2028.

Higher imports raise hopes of stable food prices in Ramadan (Jan 26)

Imports of key essentials such as lentils, sugar, onions and dates increased significantly in the first half of the fiscal year, raising expectations of stable food prices during Ramadan. Officials said adequate stocks and steady supply chains could help curb seasonal price spikes.

Telenor shrinks Asian footprint, puts GP in spotlight (Jan 27)

Telenor’s exit from Pakistan and Thailand has narrowed its Asian presence to Bangladesh and Malaysia, putting renewed focus on Grameenphone. Analysts said the strategy may signal portfolio consolidation, while raising questions about Telenor’s long-term plans for its largest Asian operation-- Grameenphone.

Glittering gold draws both buyers and sellers (Jan 27)

Record-high gold prices have attracted both investors seeking safe assets and sellers aiming to cash in. Amid subdued confidence in financial instruments and inflationary pressures, gold has emerged as a preferred store of value for households and traders alike.

LDC graduation will expose economy to serious risk (Jan 28)

Economists and business leaders said that Bangladesh could face higher tariffs, tougher competition and constrained financing after LDC graduation. They stressed urgent reforms to boost productivity, diversify exports and strengthen institutions to mitigate long-term economic risks.

Abolish minimum tax, wealth surcharges (Jan 29)

A tax reform taskforce recommended abolishing minimum turnover-based taxes and wealth surcharges, arguing that these measures discourage compliance and investment. The proposals aim to simplify the tax regime, improve fairness and support revenue mobilisation in the run-up to LDC graduation.

Startups, venture capital can hold shares in microfinance banks (Jan 30)

The new Microcredit Bank Ordinance allows startups and venture capital firms to hold shares in microfinance banks, expanding ownership options beyond individuals. Policymakers said the move could attract innovation-driven capital while strengthening governance and financial inclusion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments