Tech, recycling drive plastic sector growth

The country’s plastic industry, long overshadowed by garments, is steadily expanding as manufacturers adopt new technologies, increase recycling, and diversify exports beyond traditional markets.

Speaking to The Daily Star recently, Shamim Ahmed, president of the Bangladesh Plastic Goods Manufacturers and Exporters Association (BPGMEA), said access to technology and skills development has driven the sector’s progress over the past two decades.

“As policymakers push for broader industrial growth and export diversification, the International Plastics Fair (IPF) has become a vital platform connecting local producers, especially small and medium enterprises (SMEs), with global machinery, materials, and production processes,” he added.

Ahmed highlighted that many SME entrepreneurs cannot afford to attend international fairs. “IPF allows them to see these technologies in Bangladesh,” he said.

The ongoing 18th fair features about 700 foreign booths and nearly 170 local exhibitors, with participants from 16 countries, including China, Vietnam, Italy, the US, South Korea, and India. “India’s participation is lower this year, but China and South Korea have a strong presence,” Ahmed said.

Unlike consumer-focused trade fairs, IPF centres on machinery, equipment, raw materials, and production technology rather than finished goods. “Foreign exhibitors cannot sell finished consumer products. The focus is on technology and production knowledge,” he said.

Exposure to diverse technologies and production systems helps local manufacturers improve efficiency and product quality. “Walking through the fair, you see different machines, materials, and processes. It shows where the global industry is heading,” Ahmed said.

Fairs like IPF also promote business connections, with many machines sold and deals signed during the event, he added.

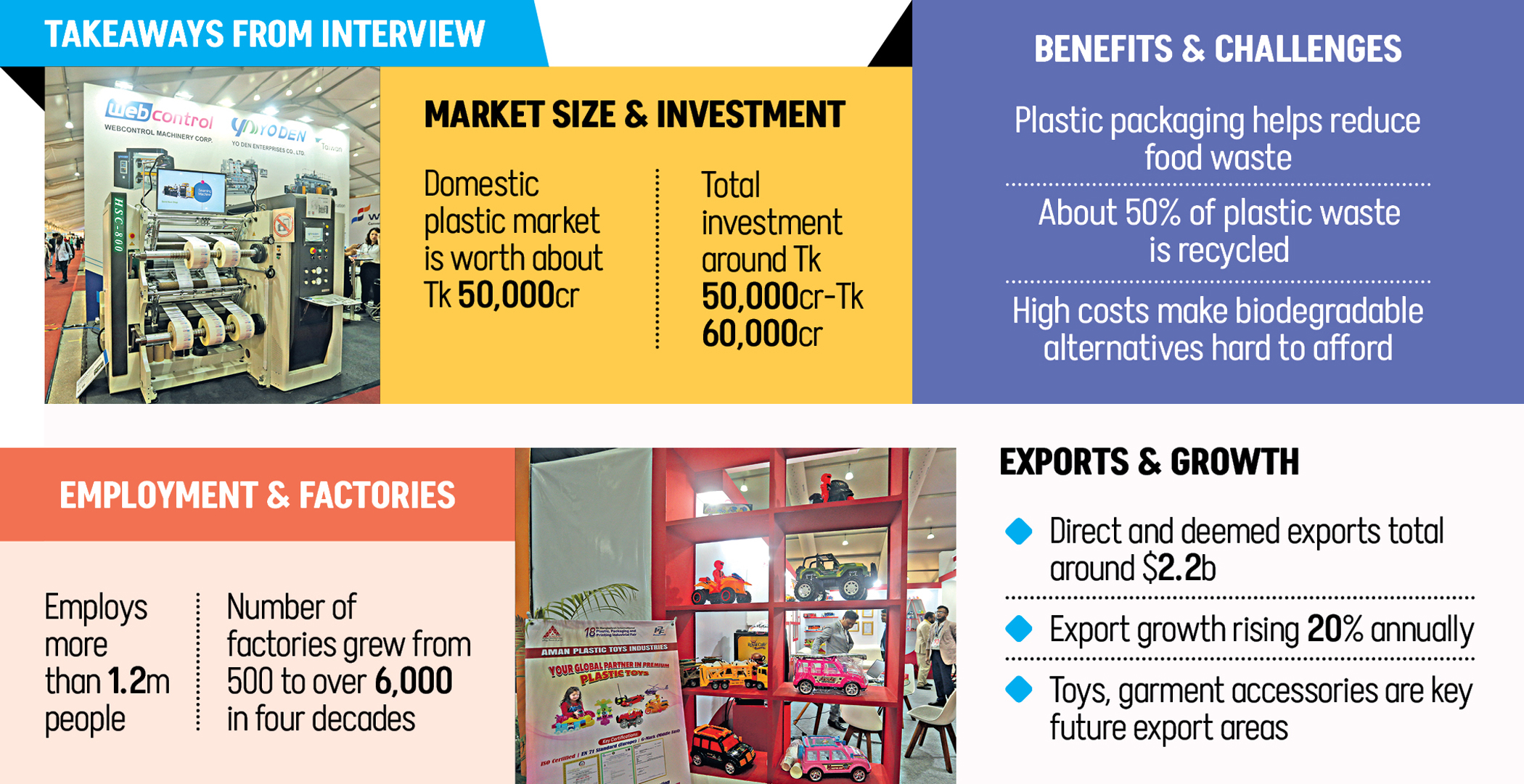

The plastic sector is now a vital part of the industrial economy. “The domestic plastic market is worth about Tk 50,000 crore a year,” said Ahmed, estimating total investment at Tk 50,000 to Tk 60,000 crore.

Employment figures vary, but the industry remains a major source of jobs. “A World Bank study put employment at around 1.2 million, but the actual number is likely higher,” he added.

“When I joined the industry four decades ago, there were only 400 to 500 factories. Now there are over 6,000, both small and large, across Bangladesh,” Ahmed said.

RECYCLING EXPANDS

Recycling has grown rapidly in Bangladesh and “may one day become as large as the main plastic manufacturing industry,” Ahmed said.

He added that plastic can be reused multiple times without losing its properties, and recycling has spread beyond major cities into rural areas, often through small-scale operations processing PET bottles, polythene films, and packaging waste.

Ahmed estimated that around 50 percent of plastic waste in Bangladesh is now recycled, reducing pressure on the environment. However, he stressed weaknesses in handling plastic at the end of its life.

“Waste is often collected and dumped in different places without proper processing,” he said, stressing the need for a structured system that focuses on recovering resources through recycling rather than repeated dumping.

Ahmed said that affordability is a major barrier to alternatives like bio-based and biodegradable packaging. “Consumers in high-income countries can afford it, but the same model does not work in Bangladesh,” he added.

Pointing out that a sandwich packet in the UK can cost more than a sandwich in Bangladesh, he added that middle-income Asian countries still rely heavily on plastic packaging.

Plastic packaging also reduces food loss and extends shelf life. “Globally, about 40 percent of plastic production is for packaging,” he said, citing puffed rice as an example. While packaging in agriculture, fisheries, and fresh produce is limited, its use is expected to grow with industrialisation and rising incomes.

EXPORTS ON THE RISE

Direct and deemed plastic exports stand at around $2.2 billion. “Exports grow about 20 percent a year, while domestic consumption grows 10-12 percent,” Ahmed said.

He added that plastics contribute more to exports than official figures suggest, as many items are recorded under other sectors. “Plastic accessories used in garments earn foreign currency but are counted under garment exports,” he said, identifying toys, packaging products, garment accessories, household items, and bags and sacks as areas with strong export potential.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments