Steelmakers’ earnings soar on higher sales

Profits of listed steel manufacturers have soared thanks to higher volumes of sales made after the economy opened up in full swing.

The producers claimed the higher profits did not result from higher rod prices, explaining that they had raised rod prices to make partial adjustments to an increase in price of raw materials.

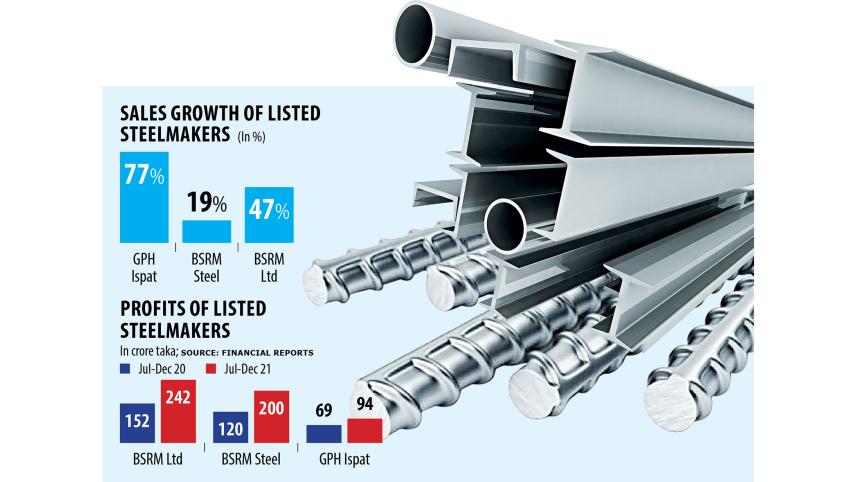

Among the five listed steelmakers, the BSRM, BSRM Steel and GPH Ispat have disclosed their financial reports. Of the remainders, SS Steel mainly deals with stainless steel while RSRM Steel has not disclosed its information yet.

The first three companies logged a staggering profit growth of more than 53 per cent on an average year-on-year in the first half of the current financial year of 2021-22.

Their average sales-induced revenue growth was more than 47 per cent in the six months.

The sales revenue climbed due to higher demand from government projects and private sector construction, said Tapan Sengupta, deputy managing director of the BSRM.

Many construction activities were brought to a halt during the early period of the pandemic and those resumed simultaneously, so the demand rose, he said.

Asked whether the higher prices of rods resulted in the stunning profit growth, Sengupta responded that they had been forced to raise the prices as prices of raw materials had soared.

Prices of scrap more than doubled to stand at $560 to $580 per tonne at present from $250 to $275 in the pre-pandemic period, he said, adding that the price of the finished goods was not raised at the same extent.

The price of the 60-grade rod and 40-grade rod went up by around 32 per cent and 31 per cent respectively in the last one year, according to the state-run Trading Corporation of Bangladesh.

"Due to the supply chain disruption during the pandemic and sudden demand from all the buyers, the raw material prices rose," said Sengupta.

Along with the raw material prices, logistics costs also soared, he said citing an example of freight charges.

In cases where the freight charge was $30 to $35 in the pre-pandemic period, the cost had gone up to $110 to $120 at present, he said. "Container charges also more than doubled, so our costs soared," he said.

"We could raise the price of finished goods partly," he added.

Raw material costs ate up 90 per cent of the BSRM's revenue in the recent half yearly, which was 84 per cent in the same period of the previous financial year, shows financial reports of the BSRM.

Abu Bakar Siddique, company secretary of GPH Ispat, said their higher sales and profits were a result of starting production in new projects.

Its new Tk 2,390-crore plant began production in late 2020 using state-of-the-art technology, which is an expansion of GHP Ispat's existing operations.

The unit has an annual capacity to produce 840,000 tonnes of mild steel (MS) billets and 640,000 tonnes of MS rod and medium section products, such as support beams and flat bars.

"Now, our capacity has risen and range of products diversified. If the raw material prices had not soared, our profits would be much higher," he said.

As the income level of the people rose and many people are sending remittance to the rural areas, demand for rods is soaring, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments