Insurance sector rebounds strongly

The insurance industry rebounded strongly in 2021 after getting hit by the coronavirus pandemic thanks to the contraction of excessive commission to agents and digitisation of services.

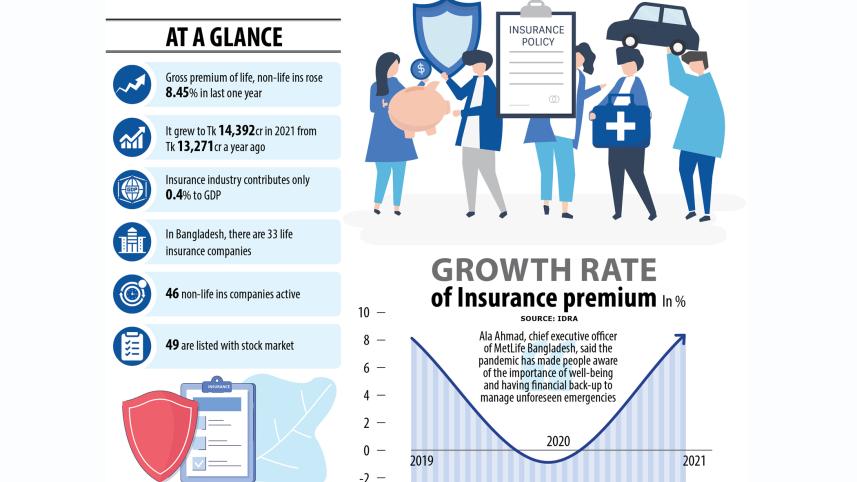

Total gross premium of life and non-life insurance grew 8.45 per cent year-on-year to Tk 14,392 crore in 2021, according to the Insurance Development and Regulatory Authority (IDRA).

However, premium fell 0.89 per cent to Tk 13,271 crore in 2020 due to pandemic. One company's data was excluded due to a lack of data and most of the data for the year 2021 was unaudited.

The unaudited data of 2021 may differ from the audited data and one insurer in 2021 (non-life) has been excluded as data is not available. For 2020, two insurance companies data are unaudited (life insurers), says the IDRA.

"Our regulatory authority IDRA has taken several steps to develop this sector. As before, there was a matter of commission. It was a matter of giving and taking. It is now totally under control," said Zharna Parul, company secretary of the Paramount Insurance Company Limited.

She said the IDRA has come down to the field strong enough to control the matter. The IDRA is also supervising and that's why the portfolio has grown.

In 2012, the IDRA issued a circular barring insurance companies from paying more than 15 per cent of the premium as commission to their agents.

However, most insurers disregarded the directive, prompting the regulator to issue a notice in late 2019, instructing them to comply for the sake of the sector's welfare.

Subsequently, in a meeting with the Bangladesh Insurance Association in 2019, insurance companies collectively agreed to follow the order in a bid to keep the sector alive.

Many companies offered as high as 60 per cent of the premium as commission to secure business, which hurt profits of the insurers, according to industry insiders.

Ala Ahmad, chief executive officer of MetLife Bangladesh, said the pandemic has made people aware of the importance of well-being and having financial back up to manage unforeseen emergencies.

He said financial associates say that now more people are interested to consider insurance for financial protection.

Ahmad said this increased interest in insurance coupled with access and ease of premium payment through online channels has helped drive the upward trend of premium collection.

In 2019, life and non-life insurance total gross premium is Tk 13, 389 crore. On the other hand, it decreased in 2020 to come in at Tk 13, 271 crore.

In addition, it grew in 2021 and turned into Tk 14, 392 crore.

When Covid-19 was there, the situation was one of a kind.

"Again, when the Covid-19 situation improved, there was another kind. Apart from this, a kind of trade that was going on in the commission earlier is closed," said Sheikh Kabir Hossain, president of the Bangladesh Insurance Association (BIA).

He said due to some other reasons, the gross premium growth of the insurance industry in 2020 was highly negative.

The IDRA has made some laws and some issues digitised. Due to which the situation has changed. Things will get better ahead, Hossain added.

According to the business standard and insurance information institute, in 2020 the insurance industry contributes only 0.4 per cent to Bangladesh's growing gross domestic product (GDP).

There are 33 life insurance and 46 non-life insurance companies active in the country. Of them, 49 are listed with the stock market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments