High costs limit exporters’ gain from taka’s fall

The business sector in Bangladesh has been going through severe challenges for the past four years, which, for many, have been the toughest period in decades, with the coronavirus pandemic being the dominant factor in the early part before the Russia-Ukraine war broke out. Today, we are running the third report of a series to present how various sectors fared in the face of the two unprecedented shocks.

Though the depreciation of the local currency against the greenback could have massively benefitted exporters, increase in production costs ate away at the profits.

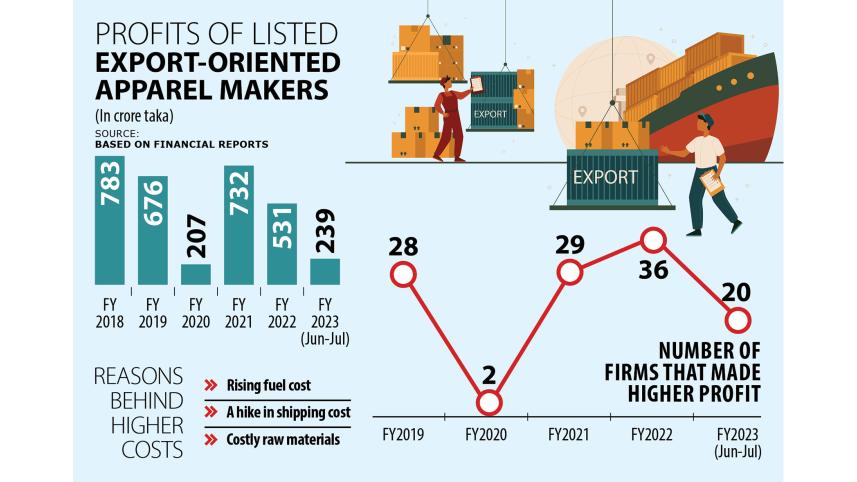

Financial reports of export-based listed apparel makers show that most of these companies' profits have been on the decline over the past year.

Among the 54 listed export-based apparel makers, 26 logged lower profits year-on-year in financial year 2018-19 whereas 52 companies saw a fall in their income in the pandemic-hit financial year of 2019-20.

Utility charges, wages and raw material prices rose at the same time for which many exporters' profit margins did not get a boost

They bounced back in 2020-21, with 29 companies raking in higher profits. In 2021-22 the number of companies whose profits increased was 36.

In the first half of 2022-23, the number of companies who made higher profits dropped to 20.

The government depreciated the currency in an export-friendly manner so they were the beneficiaries, said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

However, utility charges, wages and raw material prices rose at the same time for which many exporters' profit margins did not get a boost.

Had the currency not been depreciated, many companies would have incurred losses and even been forced to shut down their factories, he said.

So, the depreciation saved the day by raising their competitiveness in the global market, Hassan added.

Last year, the taka was depreciated by 23.5 per cent, shows Bangladesh Bank data.

Energy, labour and raw materials are major ingredients for manufacturers, said Anwar-Ul Alam Chowdhury, president of the Bangladesh Chamber of Industries.

Energy costs rose in Bangladesh and it is now even higher than that in many other countries including neighbouring India, he said.

The government hiked the prices of diesel, kerosene, petrol and octane by up to 51 per cent last August.

Earlier in November 2021, the government had hiked the price of diesel by 23 per cent.

Bangladesh Energy Regulatory Commission raised the price of electricity at the wholesale level by 19.92 per cent in November 2022.

If energy prices rise at this extent, it raises production costs, he said, adding that transportation costs also soared when the fuel price rose.

So, the depreciation benefits are eaten away by the production costs, he added.

The combined profit of export-based apparel makers dropped 42 per cent year-on-year during the July-December period of 2022-23.

In general, the depreciation of the local currency enhanced the competitiveness of the exporter, said Prof Mustafizur Rahman, a distinguished fellow of Centre for Policy Dialogue.

But for exporters whose raw materials need to be imported and domestic value addition is low, the benefit was comparatively low, he said.

As the fuel price and shipping costs increased, so did the production costs. If the currency had not been depreciated, their competitiveness could have dropped, he said.

Sector that do not need to import raw materials benefitted like jute and leather industries, he added.

MA Razzaque, research director of Policy Research Institute, echoed Rahman.

He said the depreciation helped to absorb the situation induced for the Russia-Ukraine war.

"In the absence of depreciation, exporters' capability could fall," he said. It is true that the exporters are not getting the maximum benefit for the presence of multiple exchange rates, he said.

The Western countries are witnessing high inflationary pressure, so they are containing their demand which could have an impact on exports of Bangladesh, said Razzaque.

However, Bangladesh's export earnings were good mainly because orders are shifting from China, he said, adding that Bangladesh has already create an image as a reliable supplier.

So, they bounced back from the pandemic shocks fast and are getting orders from the global market, he added.

In the July-December period of the current fiscal year, earnings from merchandise exports stood at $27.32 billion, which was 0.44 per cent higher than the periodic target of $27.19 billion, according to data from the Export Promotion Bureau.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments