BB autonomy deadlocked as interim govt nears end

says issue is about control, not policy substance

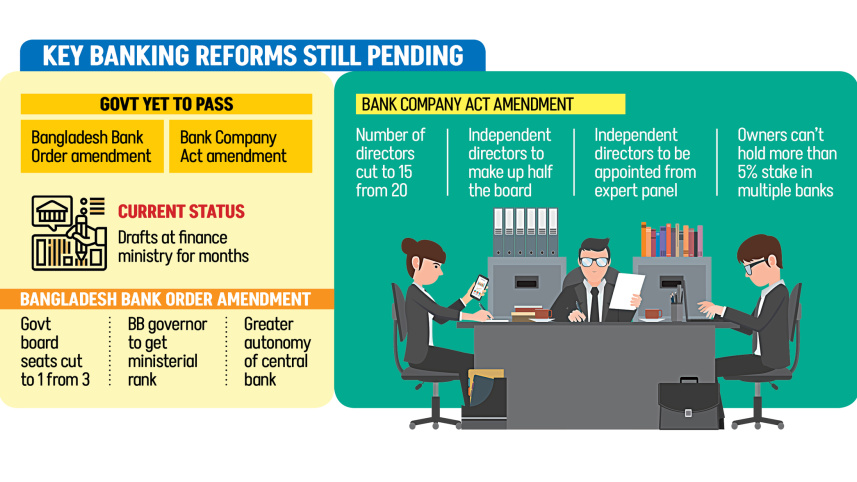

With around two weeks left in office, the interim government has yet to pass two important banking reform laws that the central bank says are crucial for strengthening its oversight of the financial sector.

The laws are related to the autonomy of the Bangladesh Bank (BB) and the ownership and governance of banks.

Those laws topped the reform agenda that the interim government had pledged following the July uprising in 2024. Besides, the International Monetary Fund (IMF) has long advocated greater autonomy for the BB. Under its $5.5 billion loan programme, the Fund provided technical support in drafting the amendments.

Now both of the drafts are pending with the finance ministry, though the BB submitted them months ago and repeatedly urged their passage before the national election on February 12.

So far, the interim government has enacted only two banking-related laws. Those are the Bank Resolution Ordinance and the Deposit Insurance Ordinance.

Central bank officials say the remaining drafts, including amendments to the Bangladesh Bank Order 1972 and the Bank Company Act, have not progressed.

In a press release yesterday following its Article IV consultations, the IMF said the government reiterated its commitment to legal, institutional and operational reforms but noted that key policy decisions would be taken by the next government.

The IMF said that delays in banking and fiscal reforms would weaken growth, raise inflation, and increase macro-financial risks.

At a public programme last week, BB Governor Ahsan H Mansur expressed concern over the delays, saying passing the laws after the election would be difficult.

Finance Adviser Salehuddin Ahmed attended the event. Mansur reminded the government that the central bank considers the reforms unfinished business.

“We will try,” said Ahmed in response. “However, the time is short, so we are not sure how much can be accomplished,” he said.

Central bank officials said the revised draft amendment to the Bangladesh Bank Order has been with the finance ministry for around four months. The amendment is prepared to increase the autonomy of the banking regulator.

The original draft proposed removing bureaucrats from the BB board, where three government officials currently sit. Following objections from the finance ministry, the proposal was revised to allow one bureaucrat instead of three.

It also seeks to grant the BB governor the rank of a minister and require the governor to take the oath before the chief justice. Despite these revisions, the amendment has not been approved.

The second pending reform is the proposed amendment to the Bank Company Act. The BB board approved the draft in October last year and submitted it to the finance ministry.

It has 45 proposed changes, including reducing the maximum number of directors on bank boards from 20 to 15 and increasing the number of independent directors to at least half of the board, up from the current three.

The draft also recommends that independent directors be appointed from a vetted pool of candidates shortlisted by an expert panel.

Another proposal would limit ownership concentration by preventing any individual, family or institution from holding more than 5 percent stakes in multiple banks.

BB says the amendments aim to improve governance standards and strengthen oversight of both private and state-owned banks.

However, private bank owners have expressed opposition to the proposals. The Bangladesh Association of Banks (BAB) formally communicated its objections to the finance ministry, especially regarding the proposed ownership limits.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said the delay is difficult to explain given how the drafts were prepared.

“This is not a new file,” he said.

According to Hussain, the drafts were developed after extensive discussions, including coordination committee meetings involving the finance ministry, BB and other stakeholders. The reforms were outlined in IMF mission reports and incorporated into the government’s Letter of Economic and Financial Policies, signed by both the finance minister and the BB governor.

“After that process, the role of the finance ministry is straightforward,” he said. “It should review the draft, clear it, or clearly explain why it cannot be cleared.”

Leaving the file idle for months, he said, raises questions.

Hussain said the delay shows resistance linked to authority rather than technical disagreements. “One key element of the reform is reducing the representation of the finance ministry on the Bangladesh Bank board. From that perspective, the issue is control,” he said.

He added that the central bank’s independence should not be defined narrowly. “It is not only about fiscal dominance. It also involves bureaucratic dominance and influence from business lobbies.”

According to the economist, passing the reform laws now would clarify where institutions and political actors stand, rather than deferring responsibility to the next government.

For comments, The Daily Star approached Finance Adviser Salehuddin Ahmed, BB Governor Ahsan H Mansur and Financial Institutions Division Secretary Nazma Mobarek. Despite phone calls and text messages, they did not respond.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments