Cattle fatteners to get loans from Tk 5,000cr BB fund

The Bangladesh Bank yesterday said cattle fatteners or beef producers would get loan from its Tk 5,000 crore refinance scheme formed for ensuring food security.

22 March 2023, 03:30 AM

Real-time monitoring of imports, national supply for key commodities needed

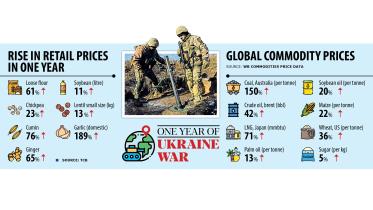

Bangladesh should conduct real-time monitoring of imports and national supply chains for critical commodities to forecast and respond in a timely manner to policy challenges and tackle the impacts of the dragging Russia-Ukraine war, said Johan Swinnen, director-general of the International Food Policy Research Institute (IFPRI).

6 March 2023, 03:30 AM

Economy bleeds while reality only getting harsher for people

Russia’s war in Ukraine might be taking place 5,800 kilometres away from Bangladesh and the country is not involved militarily in the dragging conflict in any way, but its economy and people have been paying heavy prices.

22 February 2023, 02:00 AM

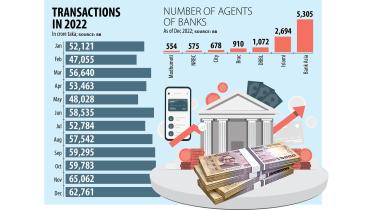

Agent banking transactions climb over 46% in 2022

Transactions through agent banking accounts rose more than 46 per cent to Tk 673,069 crore in 2022 in Bangladesh riding on the increased use of the fast-expanding banking window, official figures showed.

20 February 2023, 03:30 AM

Balance of payments deficit to go thru the roof this fiscal year

Bangladesh’s balance of payments (BoP) deficit would widen massively in the current fiscal year than the central bank had earlier projected owing to escalated imports, lower remittances and export receipts, and higher accumulation of debts.

19 January 2023, 03:00 AM

Internet banking transactions surge in November

Internet banking transactions rose more than 61 per cent year-on-year to Tk 27,426 crore in November in Bangladesh as an increasing number of people are opting for digital technologies to carry out financial transactions, official figures showed.

15 January 2023, 03:30 AM

5,683 firms receive registration from RJSC in Jul-Dec

Some 5,683 companies, societies and partnership firms received registration from the Office of the Registrar of Joint Stock Companies and Firms (RJSC) in the first half of the ongoing financial year.

10 January 2023, 03:30 AM

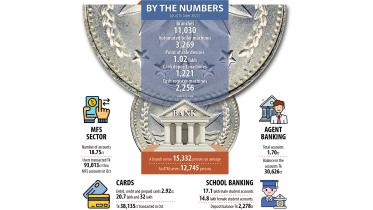

Bank branches go past 11,000 mark for first time

Branches of banks in Bangladesh have gone past the 11,000-mark for the first time despite expanding digitalisation in the financial sector, central bank data showed.

8 January 2023, 03:00 AM

Private sector credit growth rises

Private sector credit growth rose to 13.97 per cent in November to near the central bank’s target for the ongoing financial year owing to cheaper loans, a development that may stoke inflationary pressures.

3 January 2023, 02:15 AM

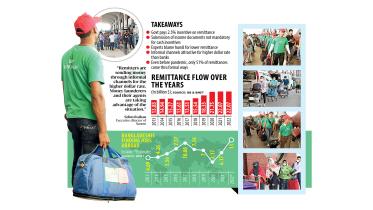

Remittance flat at $22b despite record worker outflow

Bangladesh received $22.07 billion in remittance in 2022, almost unchanged from a year earlier, although a record number of workers went abroad for jobs in the just-concluding year, Bangladesh Bank data showed yesterday.

2 January 2023, 02:00 AM

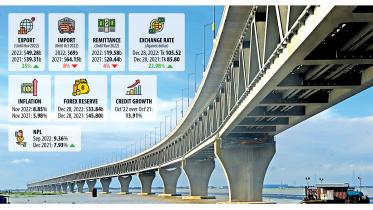

What’s in store for Bangladesh in 2023?

Both the International Monetary Fund and the World Bank have painted a gloomy scenario for the global economy for 2023 as uncertainty persists amid the protracting Russia-Ukraine war, the volatility in the international energy market and higher inflation. The world is expected to head for a recession.

1 January 2023, 02:00 AM

Out of the frying pan into the fire

One could not ask for more from Bangladesh at the outset of 2022 as the country rebounded from the coronavirus pandemic-induced lows and people’s two-year struggle appeared to be over finally and they were raring to return to normalcy.

30 December 2022, 02:00 AM

Remittance outflow crosses $100m -- thru legal channel

Outward remittances from Bangladesh through legal channels crossed the $100-million mark for the first time in 2021 as more foreigners are working in the fast-growing economy, data from a global organisation showed.

26 December 2022, 02:30 AM

Dhaka, Ctg home to most agent banking activities

Although agent banking is spreading at a faster clip in Bangladesh, accelerating financial inclusion, a majority of activities are concentrated in Dhaka and Chattogram divisions, central bank data showed.

21 December 2022, 03:30 AM

Bright prospects for Bangladesh despite short-term challenges

Bangladesh is going through some short-term challenges like the rest of the world largely for the external factors but the medium-term prospects for the country remain bright, said Standard Chartered Bank Group Chairman José Viñals.

18 December 2022, 02:30 AM

BB to return to biannual monetary policy

The central bank is set to return to its semiannual monetary policy stance after three years as per a suggestion of the International Monetary Fund (IMF) but local economists say the move would not bring about any change amid the lending rate cap and multiple exchange rates.

12 December 2022, 02:30 AM

LIVE UPDATE: ‘Make dollar exchange rate free for Bangladesh’

The exchange rate of dollar needs to be freed to make the garment business profitable at this crisis time, said a top leader of Bangladesh Garment Manufacturers and Exporters Association (BGMEA) today.

7 November 2022, 07:38 AM

LIVE UPDATE: ‘Complacency responsible for falling forex reserve’

"Complacency has brought us to the current forex reserve situation,” said Salehuddin Ahmed, former governor of the Bangladesh Bank.

7 November 2022, 07:00 AM

LIVE UPDATE: Come up with strategy now to stop depletion of forex reserves: Ahsan H Mansur

The government should come up with a clear strategy to stop fast depletion of the foreign currency reserves in a bid to save the country from a major crisis, said a noted economist today.

7 November 2022, 06:22 AM

Premier Bank to grow further on new trends

The Premier Bank Limited celebrates its 23rd anniversary today. Set up in 1999, it is one of the strongest banks in Bangladesh today with the lowest non-performing loan ratio. Its deposit base and loans have expanded in the last two decades. Recently, M Reazul Karim, managing director of Premier Bank, spoke about the bank’s journey, digital banking and new challenges and opportunities for banks, during an interview with The Daily Star.

26 October 2022, 03:10 AM