Moody’s downgrades Bangladesh banking rating to ‘very weak’

Moody’s has downgraded Bangladesh’s banking sector to “very weak” from “weak”, citing worsening client confidence, limited transparency and inadequate financial safeguards over the past year.

20 November 2024, 18:00 PM

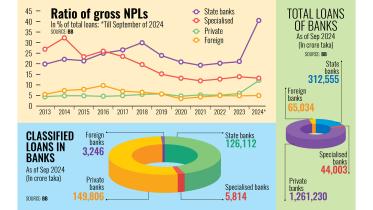

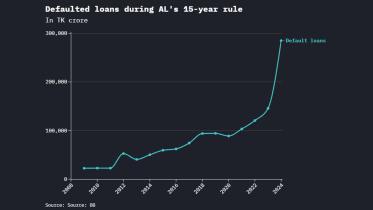

Bad loans hit alarming record

Awami League-affiliated businesses had already put the country’s banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party’s ouster.

17 November 2024, 18:40 PM

Credit card spending rose 14% in September

Credit card transactions within Bangladesh in September rose 14.42 percent to Tk 2,668 crore compared to that in August.

14 November 2024, 18:00 PM

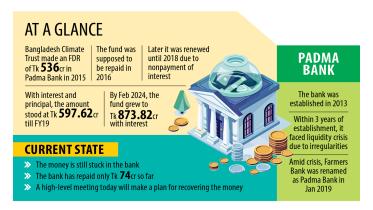

Govt to devise plan to retrieve Tk 873cr climate fund from Padma Bank

The interim government is going to formulate a specific roadmap to recover funds of the Bangladesh Climate Change Trust (BCCT), amounting to Tk 873.82 crore, that have been held up in Padma Bank since 2016.

6 November 2024, 18:00 PM

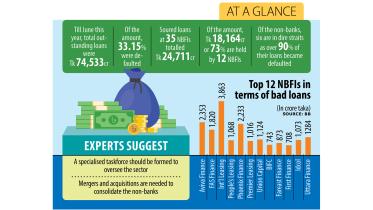

A third of NBFIs hold over 73% of bad loans

Twelve non-bank financial institutions (NBFIs) out of a total 35 are holding nearly 73.5 percent of the sector’s bad loans, according to Bangladesh Bank data, reflecting a precarious situation at those entities.

5 November 2024, 18:00 PM

IMF team due in Dec to review fourth tranche of $4.7b loan

The International Monetary Fund (IMF) is sending a team within the first week of December to review whether Bangladesh qualifies for the fourth tranche of a $4.7 billion loan programme.

27 October 2024, 18:00 PM

Trust distinguishes MTB from other banks

In the competitive local banking landscape, Mutual Trust Bank PLC (MTB) differentiates itself by offering trust to its customers, says Syed Mahbubur Rahman, managing director and chief executive officer (CEO) of the bank.

23 October 2024, 18:00 PM

Bangladesh Bank expands inflation battle with rate hike

The central bank raised the key policy rate by 50 basis points to 10 percent yesterday, making borrowing costlier for the 11th consecutive time to tame inflation as spiralling prices remain a headache for the interim government.

22 October 2024, 18:00 PM

Cash outside banks keeps rising

The volume of cash outside the banking sector of Bangladesh has been increasing since the start of the year due to persistent inflation, the loss of consumer confidence in the sector due to the presence of ailing lenders, and the prevailing situation following the recent political changeover.

16 October 2024, 18:00 PM

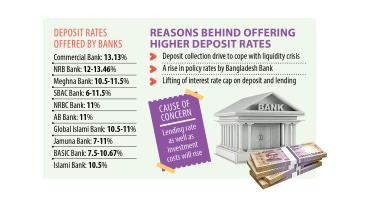

Amid liquidity crunch, banks offer high rates to lure depositors

Amid a persistent liquidity crunch, some lenders are desperately trying to increase their deposit base by offering higher interest rates to attract customers.

14 October 2024, 18:00 PM

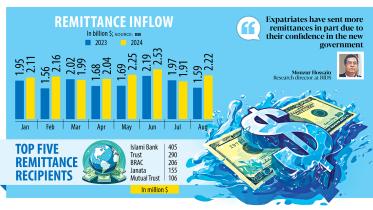

Inward remittance through MFS hits 5-year high in August

Bangladesh’s migrant workers sent home Tk 1,101.8 crore in remittances through mobile financial service (MFS) providers in August, marking the highest monthly receipts through digital channels in the past five years.

12 October 2024, 18:00 PM

Card transactions hit 27-month low in August

Transactions through debit, credit and prepaid cards dipped to a 27-month low in August this year, owing to a lack of cash in ATM booths amidst security concerns and people curtailing spending for political uncertainties..Overall transactions through the cards in August amounted to Tk 33,9

10 October 2024, 18:23 PM

Yunus’ economic gambit paying off

Two months ago, as Professor Muhammad Yunus waded into Bangladesh’s unprecedented political turmoil, he inherited economic chaos by default.

7 October 2024, 18:00 PM

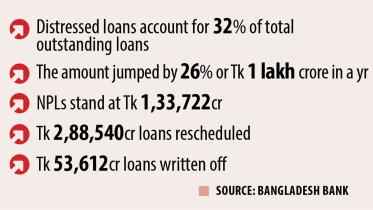

Distressed loans soar to a record Tk 4.75 lakh cr

Distressed loans at banks totalled over Tk 4.75 lakh crore at the end of 2023 – a revelation that makes for a sobering read of the actual health of this vital sector of the economy.

30 September 2024, 01:00 AM

Minimum 2% shareholding for board membership a reason behind banking sector ills

Referring to the legal provision requiring a 2 percent shareholding in a commercial bank to become a director, Abdul Mannan, chairman of First Security Islami Bank (FSIB), said this has driven away seasoned banking leadership from boardrooms and allowed infamous individuals like S Alam into banking leadership roles.

28 September 2024, 18:00 PM

Beximco seeks extension of loan tenure by 10 years

Beximco has sought support from the government to extend the repayment period of its liabilities to Janata Bank over the next 10 years, including a two-year moratorium.

22 September 2024, 18:05 PM

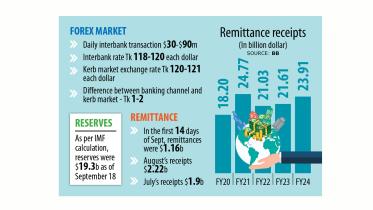

Forex market on the mend as remittances rebound

After a prolonged period of crisis, the foreign exchange market in Bangladesh, especially the interbank forex market, is showing signs of recovery, driven by a rebound in remittance receipts and key policy interventions by the central bank.

21 September 2024, 18:00 PM

Salman loses grip on IFIC Bank

The Bangladesh Bank yesterday constituted a new board of directors at IFIC Bank after dissolving the previous board, effectively bringing an end to Salman F Rahman’s grip on the private commercial bank.

4 September 2024, 18:00 PM

Islamic bank deposits grow despite irregularities

The country’s Islamic banking sector registered growth in deposits in June although several Shariah-based lenders are facing widespread scams and irregularities.

3 September 2024, 18:00 PM

Remittances jumped 39% in August

Remittances sent by Bangladeshis living abroad soared nearly 39 percent year-on-year to $2.2 billion in August, which is likely to ease pressure on the foreign exchange reserves to some extent.

1 September 2024, 18:00 PM