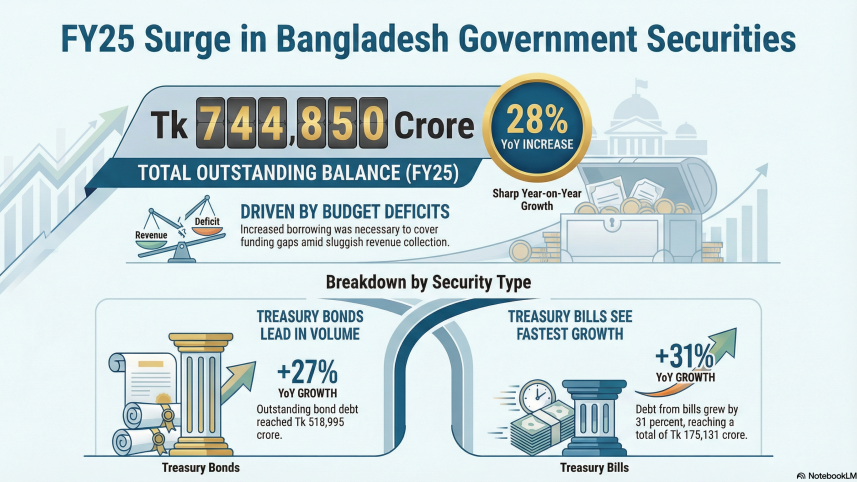

Govt debt jumps 28% to Tk 7.45 lakh crore in FY25

The outstanding balance of government debt through the issuance of different securities, mainly treasury bills and bonds, increased further in fiscal year 2024–25, as authorities borrowed more to cover budget deficits amid sluggish revenue collection.

At the end of FY25, the total outstanding balance of government securities rose 28 percent year-on-year to Tk 744,850 crore.

Of the amount, outstanding debt from treasury bonds was Tk 518,995 crore, which increased 27 percent year-on-year.

At the same time, outstanding debt through treasury bills grew 31 percent to Tk 175,131 crore, according to a Bangladesh Bank report on government securities published on Thursday.

Including other securities, such as Shariah-based sukuk bonds, the total outstanding amount of government debt rose to Tk 768,850 crore—12.92 percent of Bangladesh’s gross domestic product (GDP)—at the end of June 2025.

The Bangladesh Bank (BB) said the increase in debt from the banking sector was significant, driven by policy measures to reduce non-tradable securities such as savings certificates, as well as higher financing needs related to budget implementation.

The BB said the banking sector was the leading investor, accounting for 68.87 percent of total outstanding securities, followed by 12.03 percent held by long-term investors such as insurance companies, trust funds, and provident funds.

Individual investors held 1.14 percent of the total outstanding amount.

The BB said that in FY25, the average yields of treasury bills and treasury bonds increased during the first half, followed by a marginal moderation during the second half of the fiscal year.

The report said the net issuance of treasury bonds and bills by the government surged in FY25.

During FY25, the net issuance of treasury bonds was Tk 110,762 crore, which was 165.30 percent higher than that of the previous fiscal year. The net issuance of treasury bills grew more than four times during the period.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments