Glittering gold draws both buyers and sellers

Dilruba Akter, a private jobholder in Dhaka, had been closely tracking the ups and downs of gold prices for several months. On January 22, when the price of the precious metal reached a historic high of Tk 2.52 lakh per bhori, she decided the moment was right to invest.

She spent a portion of her savings to buy one bhori of gold jewellery from a shop at Bashundhara City Shopping Complex in the capital. She told The Daily Star that she plans to sell the jewellery later, once prices rise further, to make a profit.

With that amount, it is possible to earn a good return within a short period, she said, adding that the risk is relatively low as she believes prices are unlikely to fall sharply.

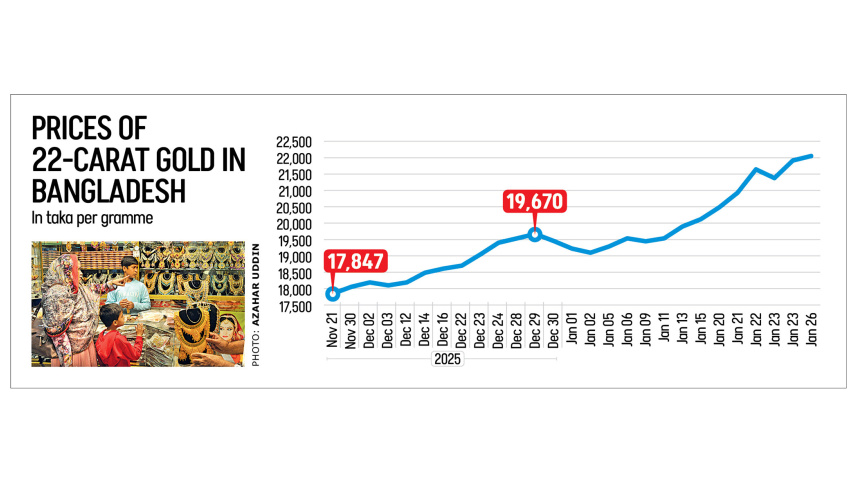

The latest trend shows that she was right on the money. Domestic gold price broke its previous record and reached Tk 2.62 lakh per bhori.

Akter is not alone in her investment choice as gold’s rise appears seemingly unstoppable. Against the backdrop of the highly anticipated national election and persistent stress in the banking sector, more people are turning to gold as a safe-haven investment.

THE GREAT GOLD RUSH

An official at Venus Jewellers’ Bashundhara City branch said a growing number of customers are buying gold with the expectation that prices will continue to rise.

The domestic gold price surged in line with the rising cost of pure gold in the market, according to the Bangladesh Jewellers Association (Bajus), which sets the metal’s price in Bangladesh.

According to a Reuters report, spot gold reached $5,089.78 per ounce on Monday, after earlier touching an all-time high of $5,110.50. The metal soared 64 percent in 2025, its biggest annual gain since 1979, driven by safe-haven demand, US monetary policy easing, robust central bank purchases, including China’s fourteenth straight month of buying in December, and record inflows into exchange-traded funds.

Bajus President Enamul Haque Khan, also the owner of Diamond and Divas, said the gold market in Bangladesh has remained buoyant for years, with prices climbing steadily.

This, he said, has prompted many to view gold as an alternative investment.

Gold first crossed Tk 50,000 per bhori in January 2018. By July 2023, the price had surpassed Tk 100,000. It rose to Tk 150,000 in February 2025 and crossed Tk 200,000 later that year.

Liton Paul, manager of JCX Gold and Diamond at Bashundhara City Shopping Complex, said interest in gold investment picked up noticeably after prices crossed Tk 2 lakh per bhori.

Around 30 percent of his customers now buy gold primarily as an investment, he estimated.

Gold’s liquidity is a key attraction, according to Paul, as it can be sold quickly in times of need and often yields a reasonable return.

Many of the new buyers are private sector employees or business owners, while female students are also increasingly purchasing smaller items priced between Tk 20,000 and Tk 40,000.

WHEN ALL FAILS, IN GOLD PEOPLE TRUST

Paul noted that confidence in other investment avenues like banks has weakened, which has pushed some customers towards gold.

The banking sector is going through a turbulent period. By the end of 2025, default loans had reached record levels, depositor confidence had eroded, and reforms remained constrained by old power structures.

Five weak banks -- First Security Islami, Social Islami, Union, Global Islami and EXIM -- are being merged into a new state-run institution, Sammilito Islami Bank PLC. This led to discontent growing among the depositors of these banks, as many account holders were unable to access their funds for months on end.

On January 18, the Bangladesh Bank decided not to pay profit on deposits for 2024 and 2025, a move it partially reversed a day later following protests.

At the same time, the central bank has been moving to shut down nine troubled non-bank financial institutions, where depositors have also endured liquidity shortages.

The capital market, another traditional investment option, has remained sluggish for some time now.

As these formal financial institutions fell out of favour, investors naturally turned to gold.

OTHER SIDE OF THE COIN

The rush into gold has another side -- its near-instant liquidity, which made it a fallback for those in financial distress.

Shahidul Islam, a stock market investor, said his earnings from the capital market have declined recently. He was in dire need of money and recently opted to sell a gold item for Tk 60,000 at a jewellery shop in Mirpur after running out of alternatives.

“Since the price per bhori crossed Tk 2 lakh, even a small gold item fetches a good price,” said Abdul Khalek, manager of New Haven Jewelers at New Market in Dhaka.

But no matter the rise, for gold, the selling price is always lower than the buying price, thanks to an asymmetric value-added tax (VAT) deduction system.

“Buyers must pay the prevailing market price along with a 5 percent VAT when purchasing gold, while selling gold for cash results in a deduction of up to 17 percent,” explained Dewan Aminul Islam Shahin, chairman of Bajus’ Standing Committee on Pricing and Price Monitoring.

However, he said exchanging old gold for new products is more favourable, with a lower deduction of around 10 percent based on current market rates.

He stated that gold bars and coins are more profitable for investment purposes compared to ornaments, as their value is calculated purely on gold content.

Jewellery, while less efficient as an investment, offers additional utility because it can be worn and later sold or passed down to future generations, he said.

“Overall, gold investment should be approached with a long-term perspective, as its stability and enduring value continue to make it a reliable store of wealth,” said Shahin.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments