Weaker taka hits listed multinationals’ profits

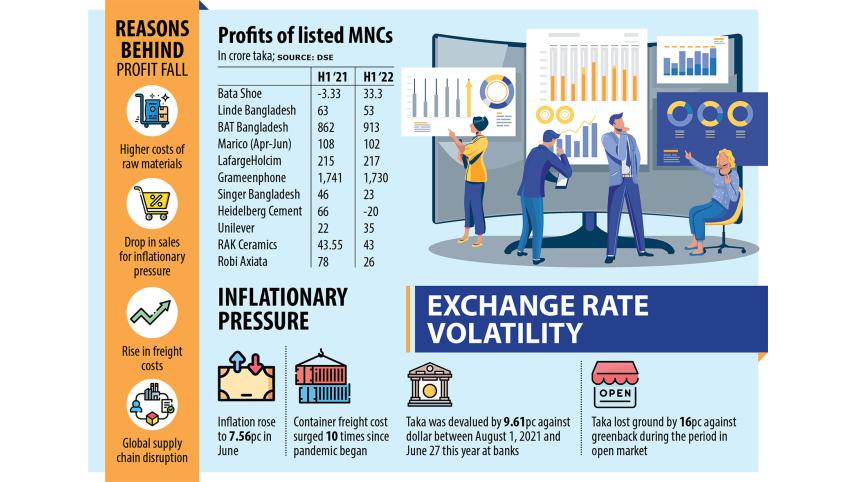

Profits of most multinational companies listed in Bangladesh dropped in the first half of 2022 due to the depreciation of the local currency and higher consumer prices.

Because of the weaker taka, the cost of imported raw materials for the foreign companies operating in the country has gone up, while rising inflation has hurt sales.

Among the 13 listed MNCs, 11 have published their half-yearly earnings results. Of them, seven posted year-on-year lower profits in the January to June period.

From telecommunication and fast-moving consumer goods companies to ceramics and cement manufacturers, all were impacted by the weakening of the local currency against the American greenback.

A record surge in imports needed to feed the economy rebounding from the coronavirus pandemic, moderate exports and a decline in remittance flow have caused the country's foreign currency reserves to deplete at a faster rate in recent months, making the US dollar dearer.

On the interbank foreign exchange market, the dollar traded at Tk 92.95 on June 27 this year, a 9.61 per cent increase from Tk 84.8 on August 1 last year, data from the Bangladesh Bank showed.

The exchange rate in the open market, however, surged by 16 per cent for importers reaching up to Tk 99 per US dollar.

Among the listed MNCs, HeidelbergCement Bangladesh plunged into losses.

It lost Tk 20 crore in the first half of 2022 whereas it logged a profit of Tk 66 crore during the identical period a year ago.

The local operation of the German company incurred losses mainly for an increase in the cost of raw materials, an increase in freight costs, and the depreciation of the local currency, said HeidelbergCement Bangladesh.

The cement maker's sales dropped to Tk 930 crore in January-June against Tk 960 crore a year prior.

Singer Bangladesh witnessed a 50 per cent plunge in profit to Tk 23 crore in the first half of the year.

The electronics and home appliance company blamed the dragging impacts of the Covid-19 pandemic, higher prices of essential commodities, accelerating inflation, the depreciation of the taka, and the recent floods for the decline in profit.

Inflation in Bangladesh rocketed to a nine-year high of 7.56 per cent in June, deepening the higher cost of living crisis the lower-income and middle-class people are facing as a consequence of the Russia-Ukraine war and the supply chain chaos.

This had an adverse bearing on the macroeconomic performance of the country as well as the company's operations and financial position, said Singer Bangladesh.

The import costs of raw materials increased but the prices of products could not be adjusted fully. As a result, profits declined, it said.

Container freight costs have jumped nearly 10 times to $10,000-$15,000 from $1,000-$1,500 since the pandemic began.

The persisting higher cost of production compelled the MNCs to raise the prices of their products in June, so they hope to generate higher profits in the coming months.

"All companies have already adjusted the prices in line with the surge in the costs of raw materials. The impact of the price increases will be evident in the coming months," said a top official of a multinational company.

RAK Ceramics reported a 1 per cent decrease in profit despite a 16 per cent increase in sales.

The profit fell due to the significant volatility in the foreign currency market and the disruptions to the global supply chain, the company said.

Grameenphone and Robi-Axiata, the two largest mobile operators, reported lower profits in the first half as well.

Profits of Grameenphone, majority owned by Norway's Telenor, fell to Tk 1,730 crore in January-June from Tk 1,741 crore during the same period in 2021.

Robi's profits dropped to Tk 26 crore from Tk 78 crore in the previous year.

Bata Shoe, however, reported an astounding 900 per cent increase in profit.

The EPS increase was driven by the growth in sales volume and amount, especially during Eid festivals, said the company in a filing on the Dhaka Stock Exchange yesterday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments