Stocks manipulation

The involvement of listed and non-listed companies in the manipulation of stocks is growing, an ominous sign for a market already facing a confidence crisis.

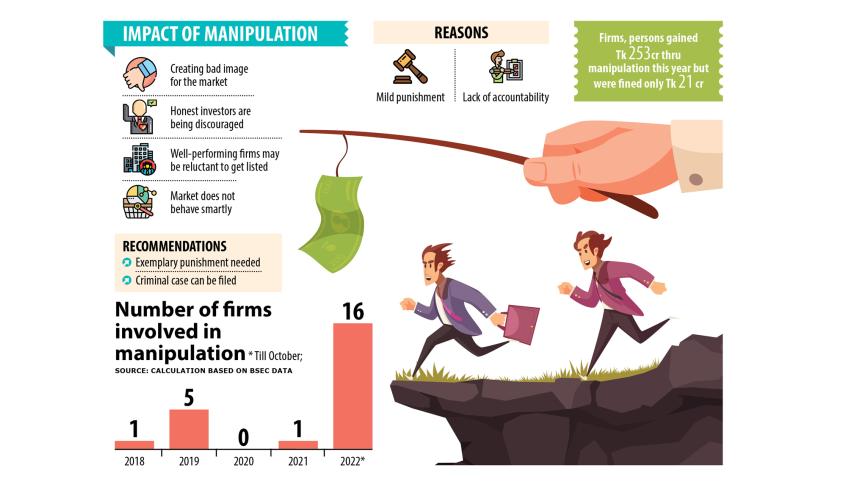

In the 10 months to October this year, the Bangladesh Securities and Exchange Commission (BSEC) found that 16 firms were involved in stock price manipulation. In contrast, the number was seven in the previous four years thanks to the regulator's enhanced surveillance to punish non-compliers.

Manipulation is an intentional effort to deceive investors by artificially affecting the supply or demand for a stock and driving its price up or down. Those who orchestrate the artificial price movements then gain from them at the expense of other investors.

But institutional investors getting involved in such irregularities are not common since they usually invest in the stock market based on research and analysis.

While many are doing so here in Bangladesh, a section of institutional investors is getting involved in the hiking of share prices to make quick bucks, according to a probe of the BSEC.

Take the case of Fortune Shoes.

The BSEC found that a series of transactions were executed to push up the price of Fortune Shoes. NRB Commercial Bank, Sonali Paper & Board Mills, Prosoil Foundation Consultant, Techbay International, and Uttara Bank Securities were involved.

A series of transactions, also known as serial trading, is the selling and buying of shares from the same beneficiary owners' accounts or related accounts in a bid to inflate a stock price or drive it down. It is banned as per securities rules.

Fortune Shoes share rose 61 per cent within 18 trading days since March 29, the period the BSEC took into account for the probe.

The manipulators gained more than Tk 30 crore from their illegal trading although the BSEC fined them only Tk 1.5 crore.

In 2022, the BSEC unearthed manipulation involving many stocks where the wrongdoers gained Tk 253 crore but were only fined Tk 21 crore.

According to the regulator, CandleStone Investments Partner, Genex Infosys, DIT Cooperative, Monarch Holdings, SKS Foundation, Lava Electrodes, SBL Capital Management, Paramount Insurance, NBL Securities, and Southeast Bank Capital were involved in manipulating of some stocks.

"Some companies are getting involved in the stock manipulation and this is not a good sign at all," said Richard D' Rozario, president of the DSE Brokers Association of Bangladesh.

"Actually, some institutional and individual investors are looking for the stocks that are being manipulated amid the weak performance of sound companies for a long time. But it is not expected that firms would rush towards manipulation-based stocks."

He pointed out that some institutional investors are heavily involved in stock business. Some are even making more money from the market than their core business is bringing.

"Sometimes, a series of transactions may happen due to a knowledge gap among investors," said Md Sayadur Rahman, president of the Bangladesh Merchant Bankers Association.

"Whatever it is, manipulation is always bad for the market. The good thing is the BSEC is now detecting it."

In 2021, the BSEC fined Uniroyal Securities, a brokerage firm, Tk 2 crore for its involvement in manipulation. No institutional investor was found to be involved in such a trading behaviour in the previous year.

In 2019, the regulator found that Bangladesh Commerce Bank, Padma Glass, Getco Telecommunication, Mondol Fabrics, and Alif Textiles were involved in manipulation.

When contacted on Tuesday over the phone, Golam Awlia, managing director of NBR Commercial Bank, told The Daily Star that he would talk about the issue later. However, he did not receive the phone despite multiple attempts.

Mohammad Jahidul Abedin, chief financial officer of Paramount Group, said they had bought the shares of National Feed Mills considering the company's potential around one year before the investigation was conducted.

"During the probe period, we sold the shares as the price was higher," he said.

He admitted that some mistakes took place during the trading period and they were unintentional. "We are now alert so that such mistakes do not repeat."

About the involvement of Southeast Bank Capital Services in manipulation, M Kamal Hossain, managing director of Southeast Bank, said as per his knowledge, the issue is under investigation, so he declined to comment.

When he was informed that the investigation was over, Hossain said he did not know anything about it.

WHAT EXPERTS AND REGULATORS SAY

AB Mirza Azizul Islam, a former finance adviser to the caretaker government, said: "The involvement of firms in stock manipulation is not a good sign for the market as it will discourage good investors."

"As per rules, the BSEC should hand the highest punishment to manipulators to root out the irregularities. If possible, criminal cases should be filed."

The involvement of institutional investors in manipulation will dent investors' confidence, according to Mohammed Helal Uddin, a professor of the economics department at the University of Dhaka.

"As manipulation can't be detected all the time, they keep taking place as the people responsible think that they would not face any punishment. If it is detected, the level of punishment is lower than the gains made from the illegal practices."

"As a result, manipulators don't correct themselves and they feel more encouraged."

Mohammad Rezaul Karim, a spokesperson of the BSEC, said the regulator is focusing on ensuring accountability.

"If anyone breaks rules, it is being detected and the wrongdoers are being punished. Hopefully, the incidence of illegal practice will go down."

He added that some high-net-worth individuals and firms claimed that they carried out serial trading unintentionally.

"So, we are raising awareness among them."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments