Drug sales growth slip to single digits amid high costs, inflation

Sales growth of prescribed medicines has slowed to single digits, ending the double-digit expansion the pharmaceutical market enjoyed for years before the pandemic, as rising production costs and currency depreciation collide with prolonged inflation.

Low-income households are cutting back on medicines they consider non-essential, while an increasing number of pharmaceutical companies have stopped producing several drugs after higher input costs eroded profit margins.

Drugmakers say they have been unable to raise prices to offset those costs because any adjustment requires strict regulatory approval, and is also a subject of political sensitivity.

Although the authorities allowed limited price increases in 2023, most applications submitted last year were rejected. The sharp depreciation of the taka has compounded the pressure, pushing up the cost of imported raw materials.

PATIENTS, FIRMS BOTH CUT BACK

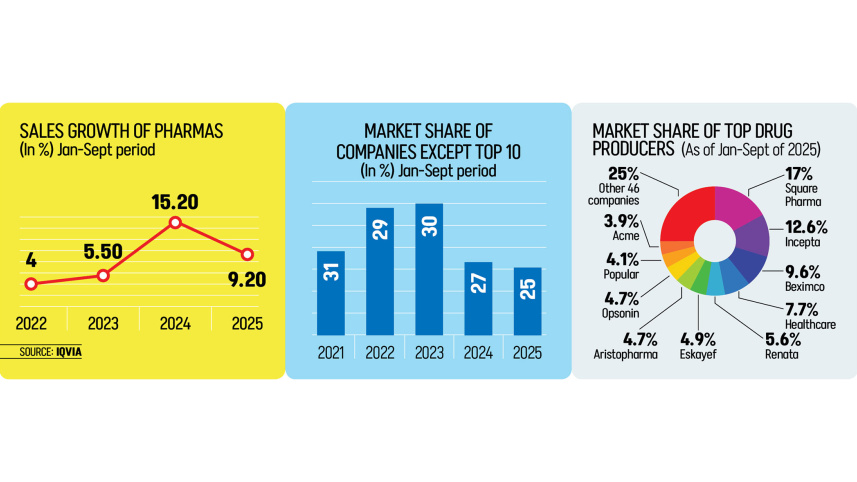

According to IQVIA, which tracks prescription data from pharmacies, covering 93 percent of outpatient activity, sales of prescribed medicines rose 9 percent to Tk 37,500 crore in the first nine months of 2025.

In the same period a year earlier, sales grew by 15 percent, roughly in line with the average annual growth rate before the pandemic.

For patients, the slowdown has meant selective consumption rather than abandoning treatment altogether.

Medicines for chronic conditions such as diabetes, hypertension and high cholesterol continue to be prioritised. Spending on supportive or adjunct drugs has declined, however, as inflation has hovered above 8 percent for more than three years, squeezing household budgets.

Hosne Ara Begum, an elderly patient in Chattogram, said she now limits her purchases to what she considers essential. “I take my cholesterol medicine regularly, but other medicines like boosters and gastric drugs I often skip.”

She said, “The cost of medicines is a burden for my son, who supports six family members. With prices rising everywhere, we had no option but to cut back.”

Manufacturers say the demand slowdown has coincided with a sharp rise in operating costs. The weaker taka has driven up spending on imported active pharmaceutical ingredients and other raw materials, while higher interest rates, energy prices and wages have further narrowed margins.

“The dollar rate has gone up, interest rates have increased, energy prices are higher, wages have risen, and many other costs have grown,” said Zakir Hossain, secretary general of the Bangladesh Association of Pharmaceutical Industries (Bapi) and managing director of Delta Pharma Ltd.

He said the impact was falling most heavily on “small companies, and many of them are being squeezed day by day”.

Large pharmaceutical firms have generally continued producing some loss-making medicines, often to retain market presence or meet what they see as social responsibilities.

Smaller companies, with limited cash reserves and narrower product portfolios, have found such productions harder to sustain, and have halted production of numerous drugs.

Blaming government policy for the crisis, Hossain said, “I don’t know why the government is killing a successful industry.”

Describing pharmaceuticals as an import-substituting sector, he warned that restricting price increases could harm local production.

“If local companies stop production, many medicines will have to be imported at much higher prices. Currently, the sector meets 98 percent of local demand and imports raw materials worth around $1 billion annually. If medicines had to be imported instead, the country would need to spend $7-$11 billion.”

SMALL ONES SUFFER MOST

The impact of the slowdown has been uneven across the market.

IQVIA data covering 56 companies show that the top 10 producers now account for 75 percent of prescription drug sales, up from 69 percent in 2021. The remaining 46 companies share the rest.

Sales among the largest firms, many of which also export abroad, have remained comparatively resilient, with the top 10 companies not seeing any drop in sales.

Square Pharmaceuticals, the market leader, recorded an 8.8 percent rise in sales to Tk 6,428 crore in January-September 2025, although this was well below its 15.8 percent growth rate a year earlier, holding about 17 percent of the market.

Among other top players, Arishtopharma posted 21 percent growth, followed by Popular Pharmaceuticals at 19 percent and Renata PLC at 16 percent.

Among smaller firms, however, around 80 percent reported a decline in sales over the same period, IQVIA data show.

Syed S Kaiser Kabir, chief executive officer and managing director of Renata, said smaller companies are particularly vulnerable during periods of cost pressure because they depend heavily on bank borrowing.

“Large companies usually have enough cash, so higher interest rates don’t affect them much,” he said. “Small companies rely on overdrafts, which hurts their bottom line.”

He claimed that government restrictions on medicine price increases have worsened the situation, forcing 30-40 small firms to stop production.

Renata itself has discontinued over 100 loss-making prescription medicines, though many of those products continue to be manufactured by other firms.

However, he noted that smaller companies often lack the scale to make similar adjustments and have instead exited production altogether.

Kabir warns that if price adjustment is not allowed, many people in the sector will lose their jobs. “At present, drug prices in Bangladesh are lower than in the global market, so the government should allow price adjustments.”

Rashed Hasan, managing director and chief executive officer of UCB Asset Management, which conducts research across sectors including pharmaceuticals, said prolonged inflation has reduced demand for prescribed medicines beyond essential treatments, with larger firms better positioned to absorb the impact.

“Most essential drugs are produced by top companies, so their sales are less affected. Their brand value, strong distribution networks, pricing strategies, and higher profit margins keep them ahead of smaller companies,” he explained.

Regulators say they have sought to balance affordability with industry sustainability.

Md Akter Hossain, spokesperson for the Directorate General of Drug Administration, said medicine prices have remained unchanged for about a year following consultations with senior government officials.

“This stability would not have been possible without the cooperation of pharmaceutical companies,” he said. “But I am unsure how much longer we can sustain it.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments