Ailing stock market pulls down NBFIs’ profit

Most of the non-bank financial institutions in Bangladesh delivered lower profits in the first half of 2022 due to the shrinkage of income from the ailing stock market.

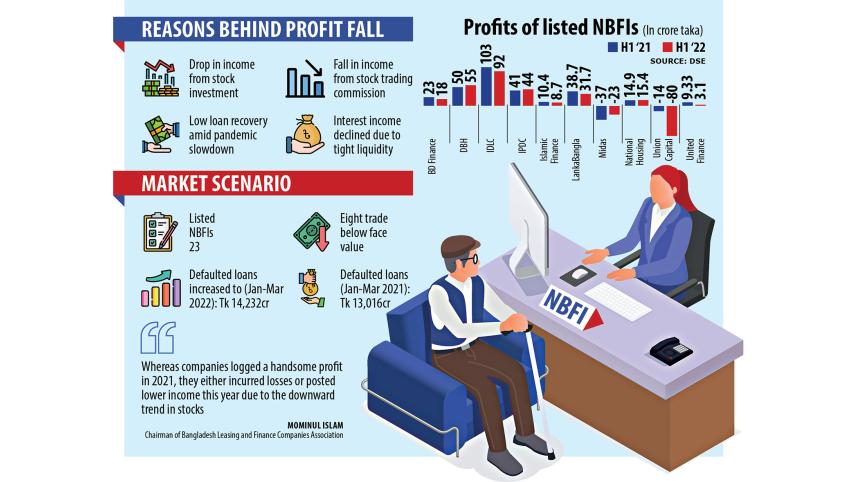

Of the 23 NBFIs listed on the Dhaka Stock Exchange, 10 have published their financial reports for the six-month period and eleven have not made their earnings data public for several quarters since their health is in a precarious situation.

Among the 10, five companies reported lower profits in January-June and two suffered higher losses.

The earnings for the rest three went up slightly.

"The main reason for the profit erosion is lower income from the share market investment," said Mominul Islam, chairman of the Bangladesh Leasing and Finance Companies Association, a platform of NBFIs.

"Whereas companies logged a handsome profit in 2021, they either incurred losses or posted lower income this year due to the downward trend in the stock market."

The DSEX, the benchmark index of the premier bourse in Bangladesh, tumbled 6.96 per cent in the first half of this year, data from the DSE showed. The index had surged 9.46 per cent during the same period last year.

Turnover, another important indicator of the market, was also lower this year, hurting the incomes from commissions and brokerage incomes of NBFIs, said Islam, also the managing director of IPDC Finance.

Profits of IPDC Finance rose 7 per cent year-on-year to Tk 44 crore in January-June. DBH and National Housing witnessed profits of Tk 55 crore and Tk 15.4 crore respectively.

On the other hand, the profits of United Finance fell 66.7 per cent to Tk 3.1 crore.

Islamic Finance and Investment logged 16 per cent lower profits of Tk 8.7 crore and LankaBangla Finance took home Tk 31.7 crore, a decrease of 18 per cent, financial reports showed.

The profits of BD Finance went down by 23 per cent to Tk 18 crore while IDLC's profits declined 10.6 per cent to Tk 92 crore.

The main business of the NBFIs was also hit due to the narrowing of the gap between the interest rate on deposits and the lending rate, Islam said.

"The liquidity in the financial sector tightened in 2022 compared to the previous year."

The central bank maintained a moratorium facility throughout 2020 to help borrowers keep their head above the water amid lockdowns related to the coronavirus pandemic.

Under the facility, borrowers were allowed to avoid slipping into the default zone even if they failed to repay loans. The relaxed policy continued last year as well.

The facility kept non-performing loans of NBFIs at a reduced level, allowing them to set aside a lower amount for provisioning.

Since the payment holiday was lifted, bad loans are rising again in the NBFI sector.

The default loans of NBFIs surged by Tk 1,216 crore, or 9.34 per cent, to Tk 14,232 crore in the January–March quarter of 2022 compared to a quarter ago, Bangladesh Bank data showed. Default loans were up 37.45 per cent year-on-year.

At the end of March, bad loans amounted to 20.63 per cent of the total credits disbursed by institutions.

"Profits for most NBFIs shrank mainly due to the impact of the pandemic and the fall in income from the stock market," said M Jamal Uddin, managing director of IDLC Finance.

"The stock market maintained a downward trend in the first half of 2022, so the income from the capital market investment was lower. Besides, leasing companies had to keep provision on the unrealised loss of the investments. So, profits fell."

At a time when Bangladesh's economy was rebounding from the impacts of the pandemic, the Russia-Ukraine war hit the global economy and Bangladesh has not been immune from the crisis.

Fuel prices have risen, inflation surged to a record high, and businesses have been hit, Jamal said. "As a result, collections slowed."

NBFIs have had to compete with banks as well.

Since banks' lending rate has been below 9 per cent since April 2020, NBFIs have had to cut the lending rate to remain in the business.

"But our deposit rate is high," said Jamal. He is, however, optimistic about the coming months, saying the performance would be better on the back of higher growth of loans and deposits.

Private sector credit growth in Bangladesh accelerated to a four-year high of 13.66 per cent last fiscal year.

"A higher lending from a Bangladesh Bank's refinance scheme will also help NBFIs in the coming days," he added.

The BB unveiled a refinance scheme of Tk 25,000 crore for cottage, micro, small and medium enterprises last month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments