Impose tax on gifts, bequests: taskforce

30 January 2026, 00:00 AM

Economy

Explainer / How to cancel TIN

22 January 2026, 19:32 PM

Business

Import-stage income tax credits to be auto-reflected in e-returns

18 January 2026, 22:11 PM

Business

NBR launches online system for direct VAT refunds

7 January 2026, 07:14 AM

Business

NBR split may complete before Feb 12 election: finance adviser

6 January 2026, 13:09 PM

Business

NBR surpasses VAT registration target in December

3 January 2026, 10:25 AM

Business

Utilisation permission issuance made automated today

1 January 2026, 11:43 AM

Business

A year of reform and resistance in the tax sector

30 December 2025, 16:02 PM

Business

NBR opens holiday help desk for election aspirants to file tax returns

25 December 2025, 10:33 AM

Business

Proof of return submission: when and why it's necessary

16 December 2025, 13:39 PM

Business

Panel formed to make tax expenditure policy

The National Board of Revenue (NBR) yesterday formed a nine-member committee to make a policy framework for tax expenditure.

19 December 2024, 18:57 PM

Tax cuts yield limited impact on rising commodity prices: NBR chairman

Egg, sugar prices became cheaper to some extent, not other commodities, he says

9 December 2024, 14:27 PM

NBR grants 15-year tax exemption for new renewable plants

With the objective of facilitating clean energy generation, the National Board of Revenue (NBR) has granted a 15-year tax benefit for investments to establish renewable energy-based power facilities..The revenue authority issued a circular in this regard on November 27, saying it would exe

3 December 2024, 18:36 PM

Electronic filings of tax returns double in Jul-Nov

The number of electronic filings of tax returns more than doubled to over 5 lakh since July this year, thanks to the steps taken by the National Board of Revenue (NBR). .Individual taxpayers filed 2.17 lakh returns between July 1 and November 24 of this fiscal year, according to the NBR.<

25 November 2024, 18:23 PM

Special arrangements in Nov to help file tax returns

Instead of holding an income tax fair, the National Board of Revenue (NBR) says it will have dedicated officials and special arrangements at field-level offices to extend tax services and facilitate return submissions throughout November.

3 November 2024, 18:31 PM

e-filing of tax returns crosses 50,000 in less than a month

The NBR relaunched the e-filing portal on Sep 9

3 October 2024, 12:53 PM

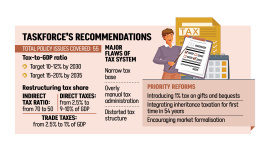

NBR forms taskforce to reform income tax law

Tax Commissioner Ikhtiar Uddin is heading the seven-member task force

3 October 2024, 12:03 PM

NBR asks officials to come to office on time

The National Board of Revenue (NBR) has asked the officials of its income tax wing to be at office ahead of the 9:00am reporting time.

9 September 2024, 18:30 PM

Finance adviser urges NBR to reconsider duty structure

Finance and Commerce Adviser Salehuddin Ahmed yesterday asked the National Board of Revenue (NBR) officials to reconsider the duty structure of imported essential commodities in a bid to tackle persistent inflation..The adviser said essential commodities, namely edible oil, sugar, potato a

27 August 2024, 18:00 PM

Waive port charges incurred amid recent unrest

The Bangladesh Shipping Agents’ Association (BSAA) has urged the government to waive all port charges incurred for delays in container handling amid the weeklong unrest, internet outage and stringent curfew that began on July 18..The BSAA, the country’s sole trade body for shipping agents,

1 August 2024, 18:00 PM

Kaus Mia: a role model in a nation where tax noncompliance is rife

The late successful businessman had been one of the highest taxpayers in Bangladesh since 2010-11

25 June 2024, 16:14 PM

NBR plans self-assessment of tax liabilities for all firms

The National Board of Revenue (NBR) is likely to introduce self-assessment for companies from 2024-25 to allow them to determine their own tax liabilities and cut reliance on taxmen.

20 May 2024, 18:30 PM

Investors in hi-tech parks, EZs may lose tax benefits

Investors in the economic zones and hi-tech parks in Bangladesh may see an end to the zero-duty benefit on imports of capital machinery, components and construction materials next fiscal year.

15 May 2024, 18:30 PM

Alternatives to cash incentives planned for exports

The government plans a new export promotion fund as an alternative to direct cash incentives for export-oriented sectors to help the country face challenges resulting from its graduation to a developing nation in 2026.

15 May 2024, 18:00 PM

FBCCI's plea for tariff protection devoid of reality

On April 4, the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) urged the government to pay attention to ensuring reasonable protection from customs tariffs for the sake of employment and promoting domestic industries, services and small and medium enterprises.

7 April 2024, 01:00 AM

Tax on provident funds' income: One country, dual policy

A provision in the Income Tax Act 2023 created the discrimination

26 March 2024, 15:40 PM

NBR grants tax benefits to 3 sectors

The government has provided tax benefits to three sectors, namely leather, asset management, and research, to boost competitiveness and foreign currency earnings.

16 March 2024, 18:00 PM

Massive reforms needed in tax laws: experts

Massive reforms are required in tax and VAT laws to mobilise domestic resources and achieve the government’s target to become a developed country by 2041, according to experts.

7 March 2024, 18:00 PM

BCI demands 5-year tax holiday for small businesses

The Bangladesh Chamber of Industries (BCI) yesterday demanded a five-year tax holiday for cottage, micro and small and medium enterprises (CMSMEs) beginning from fiscal year 2024-25 in order to foster their growth.

28 February 2024, 18:00 PM

Insurers seek tax, VAT breaks in next budget

The Bangladesh Insurance Association (BIA), a platform for insurance companies, has proposed withdrawal of the VAT applicable to policyholders in order to help the health insurance sector expand.

6 February 2024, 18:30 PM