Impose tax on gifts, bequests: taskforce

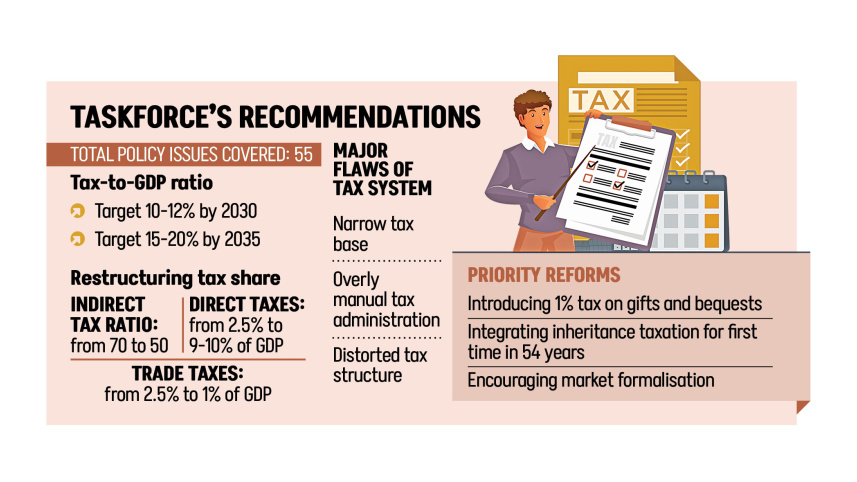

A national tax reform taskforce has recommended introducing a 1 percent levy on gifts and bequests as part of efforts to modernise Bangladesh’s tax system and raise the tax-to-GDP ratio.

Bequests refer to assets or property passed on to another person without payment, either during the owner’s lifetime or after death.

Under the taskforce’s proposal, the tax would apply to transfers of both tangible and intangible property, including inheritance following a person’s death.

Assets would be assessed at their fair market value at the time of ownership changes, including when land or property is formally transferred to heirs through mutation in official records.

Currently, transfers of money and movable or immovable property among parents, spouses, children, and siblings are exempt from tax.

Zaidi Sattar, chairperson of the taskforce and chairman of Policy Research Institute, yesterday unveiled the suggestions at a press briefing in Dhaka. The 11-member panel, formed in October 2025, handed over its report titled “Tax Policy for Development: A Reform Agenda for Restructuring the Tax System” to Chief Adviser Muhammad Yunus on Tuesday.

In the report, the panel suggested reducing the trade taxes from the current 2.50 percent to 1 percent of the GDP (gross domestic product).

It also recommends reducing the share of trade taxes in total revenue from around 28 percent currently to 15 percent by 2030 and to about 7.5 percent by 2035.

The panel’s report includes a set of key policy recommendations aimed at restructuring Bangladesh’s tax system to cover direct and indirect taxes, which could help to enhance the tax-to-GDP ratio and support the country’s overall economic development.

It said ensuring long-term economic prosperity and meeting the country’s growing development needs will require a comprehensive and structural overhaul of Bangladesh’s tax system, rather than fragmented or purely administrative reforms.

Bangladesh’s existing tax system is unnecessarily complex and inefficient, characterised by a narrow tax base, excessive reliance on manual processes in tax administration, and heavy dependence on indirect taxes, said the report.

It notes that without a coherent and well-structured tax policy framework, sustainable and credible revenue mobilisation cannot be achieved through administrative measures alone. “As a result, piecemeal reforms will fail to deliver the desired outcomes.”

The report has identified a total of 55 priority policy issues across three major tax areas – direct taxes, value-added tax (VAT), and trade taxes.

Of these, 32 relate to direct taxes, 10 to VAT, and 13 to trade taxes. It sets targets to raise the tax-to-GDP ratio to 10-12 percent by 2030 and to 15-20 percent by 2035.

One of the key objectives of the reform agenda is to restore balance in the tax structure by reducing reliance on indirect taxes and significantly increasing the share of direct taxes.

To this end, the report proposes gradually shifting the current indirect-to-direct tax ratio from 70:30 to 50:50. It estimates that revenue from direct taxes could rise from about 2.5 percent of GDP at present to 9-10 percent by 2035.

It argues that once the tax-to-GDP ratio reaches 15-20 percent, substantial revenue can still be generated from trade taxes even at these lower rates.

The report warns that weak tax policy forces tax administration to rely on discretionary decisions rather than rules. This gives rise to practices such as aggressive audits, arbitrary assessments, and excessive withholding taxes, which undermine the credibility of the tax system and discourage voluntary compliance in the long run.

Digital transformation, automation, artificial intelligence–based risk analysis, and risk-based audits are identified as core pillars of the overall reform strategy.

On trade taxes, the report recommends a gradual shift away from reliance on tariffs and para-tariffs towards domestic taxes such as VAT, personal income tax, corporate income tax, and property tax.

It notes that the current tariff structure is excessively complex, creates barriers to trade and imports, and introduces an anti-export bias that hinders export diversification.

The report calls for modernisation and rationalisation of the tariff structure, discontinuing the use of supplementary duties and VAT for protectionist purposes, and ensuring that domestic sales do not become more profitable than exports.

It also urges that longstanding valuation problems be addressed on a priority basis, as high tariffs encourage under-invoicing and tax evasion.

The report also recommends fundamental reform of the withholding tax system, suggesting that withholding taxes be gradually withdrawn in all areas except salaries, interest, dividends, and capital gains on listed shares.

It further calls for a review of the minimum tax on gross receipts.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments