Roadmap for banking reforms: Implementation is key

Although the roadmap drawn up to reform the banking industry of Bangladesh may seem attractive on the surface, there are questions regarding its efficacy in ensuring good governance in the scam-hit sector.

18 February 2024, 00:13 AM

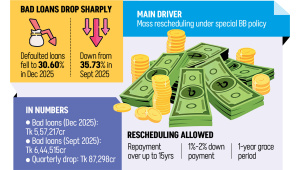

Defaulted loans soar 20.7pc in 2023

The banking sector’s defaulted loans soared 20.7 percent to Tk 145,633 crore in 2023 as both governance and accountability continue to get looser.

12 February 2024, 18:00 PM

Bad loan ratio rises to 9% in 2023

The default loan ratio in the banking sector of Bangladesh rose to 9 percent in 2023 from 8.16 percent a year ago

12 February 2024, 11:23 AM

Studying Abroad: Students struggle to open profiles for dollar crisis

For over a year now, thousands of Bangladeshi students wanting to study abroad have encountered obstacles while trying to open bank profiles essential for paying their fees or other expenses like housing and transportation

9 February 2024, 18:00 PM

Nine banks asked to tighten forex vigilance at Dhaka airport

The Bangladesh Bank yesterday instructed nine banks, including four state-run lenders, to transfer officials who have been in charge of their foreign exchange booths at the Hazrat Shahjalal International Airport for more than one year.

9 February 2024, 01:12 AM

Investors flock to risk-free treasury bills for higher returns

Government treasury bills, popularly known as T-bills, have become a lucrative tool to park funds for investors and savers driven by a record spike in yields in recent months.

4 February 2024, 01:41 AM

Islami Bank borrows Tk 1,000cr from Sonali breaching rules

Cash-strapped Islami Bank borrowed Tk 1,000 crore from the state-run Sonali Bank offering interest, in violation of the Bangladesh Bank guidelines for Shariah-based banking.

30 January 2024, 18:00 PM

BB’s funds to banks complicate efforts to curb inflation

The Bangladesh Bank is injecting fresh funds into the economy despite adopting a contractionary monetary policy, a contradictory move that may make it harder to tame stubborn inflation.

30 January 2024, 00:28 AM

Funds get costlier as liquidity crisis drags on

Both the government and banks are facing a tight liquidity situation, which has pushed up the yield of treasury bills and bonds and the lending rate in the banking sector

28 January 2024, 00:27 AM

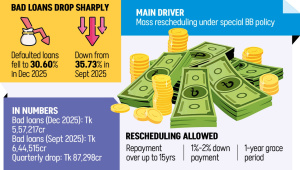

Bangladesh plans more licences for digital banks in push to go cashless

BB plans to offer more permissions for digital banks in order to pave the way for full-fledged financial services based on a 100 percent branchless banking system

25 January 2024, 01:00 AM

BB makes money costlier to tame inflation

The Bangladesh Bank yesterday announced an array of measures to bolster its fight against stubbornly high inflation, a major headache for the new government.

17 January 2024, 18:00 PM

How the crawling peg for currency will work

The central bank has rolled out a plan to introduce an interim crawling peg system for the taka to regulate abrupt fluctuations of its value, paving the way towards a fully flexible regime in the future.

17 January 2024, 12:34 PM

BB to adopt crawling peg to curb exchange rate volatility

The peg system would be linked to a carefully selected basket of currencies and operate within a predefined exchange rate corridor

17 January 2024, 09:51 AM

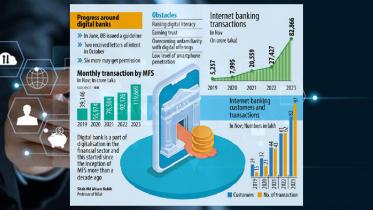

Private sector credit growth target lowered to 10% from 11%

Bangladesh Bank also raised the benchmark policy rate by 25 basis points to 8 percent

17 January 2024, 09:33 AM

Policy rate hike looms again as previous attempts yield little success

To tame inflation, BB is likely to increase the policy rate further

17 January 2024, 01:15 AM

BB to adopt crawling peg. Can it end exchange rate volatility?

BB's adoption of crawling peg as per IMF prescription will possibly rule out a market-driven exchange rate, as suggested

14 January 2024, 00:30 AM

Inflation stays stubborn despite rate hikes. Can it be tamed?

Even rate hikes cant tame a raging inflation, so what is the solution ?

10 January 2024, 01:13 AM

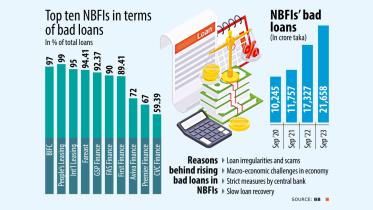

Non-bank loans turning sour hit record

Widespread irregularities and scams are reasons that defaulted loans at NBFIs account for 30 percent of disbursed loans

9 January 2024, 01:15 AM

Liquidity crunch widens fault lines in banking system

An intensifying liquidity crisis is making a majority of Bangladeshi banks turn to call money market and central bank

5 January 2024, 01:30 AM

Export, remittance earnings limp along

Export and remittance sectors suffered disappointments in 2023, looking desperately for solutions this year

3 January 2024, 00:10 AM