Treasury bond yields climb to 15-year high

The interest rate of treasury bonds recently jumped to a 15-year high of 12.75 percent, indicating that government borrowing will become costlier in the months ahead.

30 May 2024, 01:00 AM

BB bypasses own rules in appointing IFIC Bank adviser

The Bangladesh Bank has bypassed its own rules by approving the appointment of Mohammad Shah Alam Sarwar as the strategic adviser of IFIC Bank PLC.

29 May 2024, 03:32 AM

Think beyond traditional markets to drive export growth

Bangladesh should consider emerging markets that are growing at a healthy clip and offer growth opportunities to drive up exports instead of keep relying on traditional destinations, said Frederic Neumann, HSBC’s Chief Asia Economist and co-head of Global Research Asia.

26 May 2024, 18:04 PM

Banks sell dollar at more than Tk 118 as pressure mounts

The chief executives of at least three private commercial banks told The Daily Star that the BB had verbally allowed them to quote Tk 1 more than the exchange rate to collect US dollars amid the ongoing forex crunch.

23 May 2024, 00:49 AM

ICB Islamic Bank struggling to pay back depositors

ICB Islamic Bank, which took shape from the ruins of Oriental Bank in 2008, is now failing to repay the depositors’ money due to severe liquidity crisis, indicating a vulnerable situation of the lender.

18 May 2024, 18:00 PM

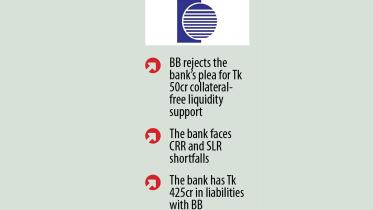

No let-up in reserves slide

Bangladesh’s foreign exchange reserves have been falling since September 2021 despite a series of government initiatives to reverse the trend.

16 May 2024, 18:00 PM

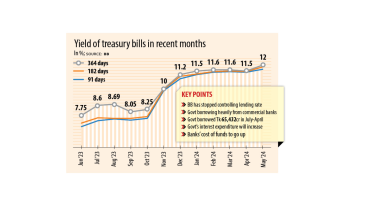

Yield on treasury bills climbs to a record 12% as govt borrowing intensifies

Currently, the government is borrowing heavily from commercial banks using the tool as the central bank has suspended injecting fresh money into the economy to avoid fuelling inflation, which has stayed above 9 percent for the past 20 months.

15 May 2024, 01:52 AM

Pressure mounts as currency outflow intensifies

The deficit in the financial account stood at $9.25 billion in July-March of the current fiscal year, Bangladesh Bank data showed. It was $2.92 billion in the first nine months of the previous fiscal year and $8.46 billion in July-February of 2023-24.

14 May 2024, 00:59 AM

Banks go slow in raising interest rates even after BB cedes control

The interest rates on consumer loans, forced loans and overdue loans are likely to go up rapidly in the upcoming months, however.

13 May 2024, 00:47 AM

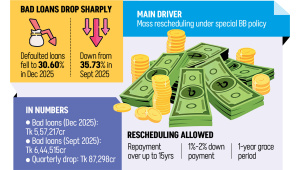

No headway in curbing banks’ bad assets

The FID later backtracked following criticism from different quarters, including the International Monetary Fund (IMF), about the formation of a public corporation since state enterprises have usually underperformed in the country.

12 May 2024, 00:30 AM

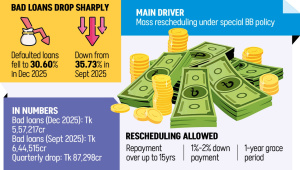

Withdrawals put BASIC Bank in liquidity crisis

BASIC Bank is experiencing a deep liquidity crunch as depositors have been withdrawing money for weeks following news that the state-run lender is going to be acquired by a private commercial bank.

11 May 2024, 18:00 PM

Sikder family loses grip on National Bank

The Sikder family has apparently lost its grip on National Bank Ltd as Bangladesh Bank has appointed a new board for the country’s first private bank.

6 May 2024, 18:00 PM

BB likely to discard SMART formula as interest rate surges

In July last year, the central bank withdrew the 9 percent lending rate cap and introduced the Six-months Moving Average Rate of Treasury bills (SMART).

5 May 2024, 00:00 AM

Where should I invest my money?

Amid persistently higher inflation in Bangladesh for more than a year, the low- and middle-income groups are struggling to meet their daily expenses.

3 May 2024, 18:00 PM

Govt's bank borrowing rises sharply in July-April

From last July to April 22 this year, government loans from commercial banks amounted to Tk 65,432 crore, according to Bangladesh Bank. In the same 10 months or so of fiscal year 2022-23, it was only Tk 5,334 crore.

29 April 2024, 00:17 AM

Bank mergers far from voluntary

In fact, the reactions of the associated bankers and directors, circumstances centring the meetings where the decisions were taken alongside protests in one case confirmed that these had been decided by the government and relayed through the central bank.

28 April 2024, 00:20 AM

Basic, National Bank Mergers: People withdrawing money in panic

A recent rush to withdraw money from the BASIC Bank and National Bank is worsening the situation the troubled institutions are facing.

20 April 2024, 18:00 PM

Anontex Loans: Janata in deep trouble as BB digs up scams

Bangladesh Bank has ordered Janata Bank to cancel the Tk 3,359 crore interest waiver facility the lender had allowed to AnonTex Group, after an audit found forgeries and scams involving the loans.

18 April 2024, 18:00 PM

Bank Asia to take over Bank Alfalah’s Bangladesh unit

Bank Asia is likely to acquire the Bangladesh operations of Karachi-based Bank Alfalah, according to information disclosed to the Pakistan Stock Exchange yesterday.

17 April 2024, 18:00 PM

Bank Asia plans to acquire Bank Alfalah’s Bangladesh unit

Bank Asia is going to hold a meeting of its board of directors next Sunday and is likely to disclose the mater in detail, a senior official of Bank Asia said.

17 April 2024, 12:44 PM