Progress with macroeconomic adjustment

Since the advent of Covid19 in March 2020, Bangladesh has faced a series of external shocks. Combined with macroeconomic mismanagement and corrupt practices, the Bangladesh economy nose-dived reflected in rising inflation, plummeting external reserves, sharp depreciation of the exchange rate, falling tax to GDP ratio, falling investment rate and declining GDP growth rate.

The downturn in the economy along with growing unhappiness with an autocratic political regime led to a mass movement, which caused the downfall of the ruling Awami League government. An interim government was established with the task of stabilising the macroeconomy and conducting national election for smooth transfer of power to a democratically elected government.

The national election is now scheduled for early February 2026. A key policy debate is the state of the economy that will be inherited by the new national government and the challenges ahead. The objective of this write up is to provide an assessment of the macroeconomy and identify the key policy challenges in the post-election period. The assessment seeks to be evidence based, using the available macroeconomic database from government sources.

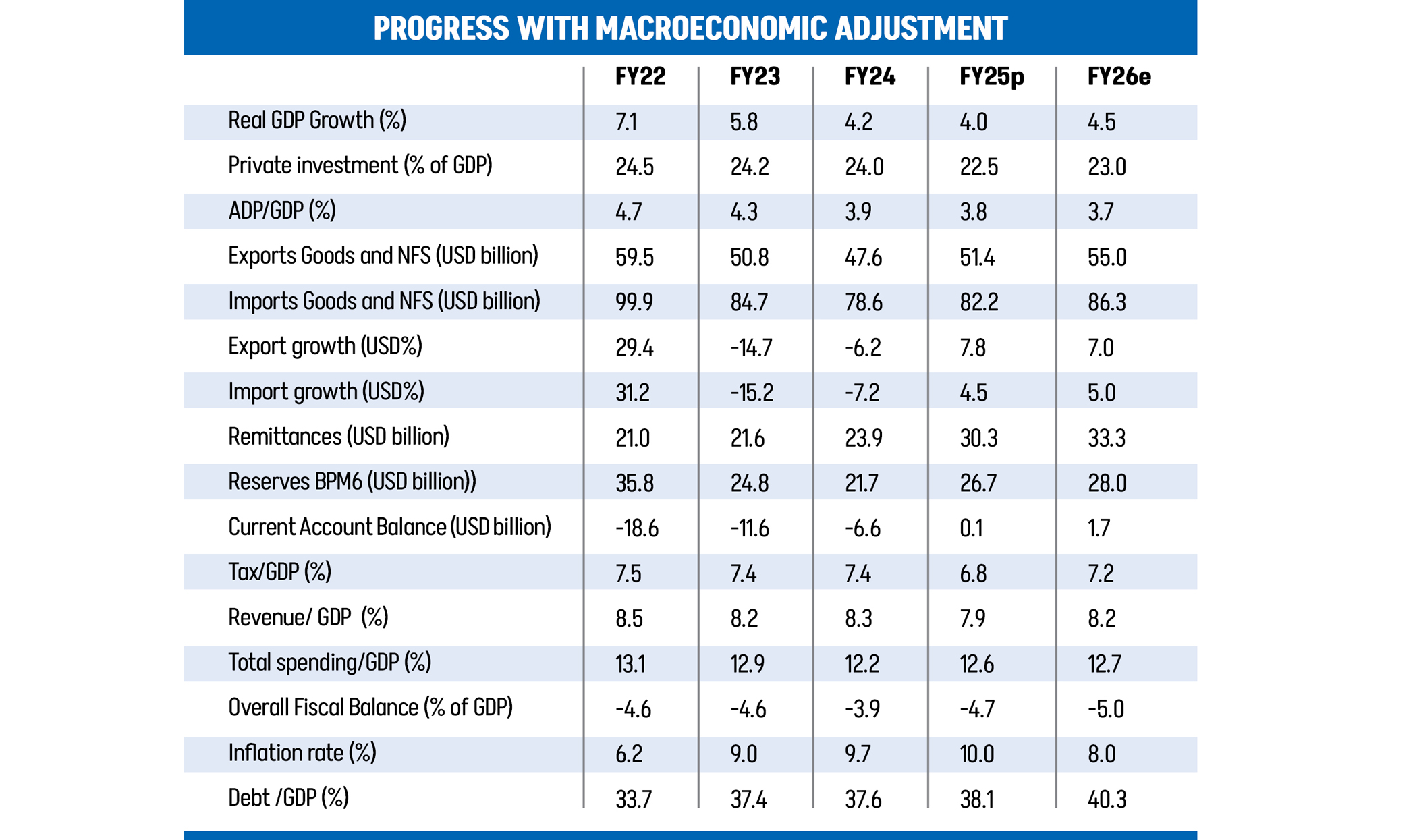

Significant progress has been made in stabilising the macroeconomy (Table 1). The current account of the balance of payments has turned around from a large negative number to positive, reserve run down has been arrested and a modest recovery of reserves is now underway. The upward trend in inflation has been contained with a modest slowdown in inflation. On the other side, the quality of the macroeconomic adjustment has been weak. Private investment rate has fallen significantly. Public ADP spending has been cut sharply. GDP growth has continued to slide, falling to a low of 4 per cent in FY2025.

On the socio-economic front, unemployment rate, especially for the educated youth, has increased. Underemployment is pervasive. There is also evidence of a rise in poverty owing to slowdown in GDP growth, high inflation, falling real wages and slowdown in public spending on social protection.

The weak quality of the adjustment effort is explained by the inability to implement most of the required policies. On the positive side, the two most fundamental reforms have been the establishment of a market-based exchange rate and ending the interest rate controls. Interest rates are now primarily market based with the Bangladesh Bank (BB) using its various policy tools to lower credit and monetary growth that is consistent with lowering inflation. Both policies have helped to improve the balance of payments and reduce inflation.

Illustration: Zarif Faiaz

As against these positive policy developments, implementation of other policies, especially fiscal policy, has been weak. The much needed overhaul of the tax system has faced various political and administrative implementation challenges. The reform of state-owned enterprises (SoEs) did not happen. Progress on reform of energy subsidies has also been lack luster. Consequently, the tax to GDP ratio has continued to fall. The SOEs, especially the public utilities, have continued to be a huge drag on the woefully limited public resources. As a result, non-tax revenues have also fallen as a share of GDP.

Resource shortfall along with growing interest cost of public debt and energy subsidies have forced large cutbacks in ADP and social protection spending to contain the fiscal deficit. So, while fiscal discipline has been maintained, the cost of fiscal adjustment has fallen on GDP growth and poverty reduction. ADP spending has fallen below 4 per cent of GDP over the past 2 years. The prospect for a recovery of ADP spending in FY2026 is also bleak. Falling ADP and GDP growth have hurt employment prospects in both rural and urban areas. High inflation, falling real wages and weak employment situation have contributed to rising poverty. The fall in social protection spending has also hurt poverty reduction.

Other growth enhancing reforms like improvement in the investment climate, better availability of energy, lower trade protection, dynamising the micro and small enterprises (MSE) sector, and enhancement in labor skills have similarly lagged behind. Law and order concerns along with political uncertainties have hurt the investment climate. Both domestic and foreign private investment remain subdued. The turmoil in the banking sector along with energy constraints have further added to the weakening of the investment climate. While the flexibility in the exchange rate has benefited the export sector, the absence of any meaningful trade reform has hurt export diversification. After showing some signs of recovery from a low base, exports growth do not show the promise of stimulating an immediate recovery of GDP growth.

Falling investment rate along with the sharp slide in GDP growth have caused the growth of imports to slow down considerably. Capital imports in particular have experienced large negative growth. The growth of intermediate imports also show sluggishness. So, while the slowdown in imports has benefited the balance of payments, this improvement is not sustainable in an environment of rising investment rate and GDP growth unless it is associated with a sharp rise in the growth of exports.

What is the way forward? Unfortunately, there are no quick fixes and a concerted policy reform effort encompassing several reform areas will need to be sustained over an extended period. The upcoming national election presents a major opportunity to turn around the economy. The biggest plus the elections offer is the opportunity to lower political uncertainties and restore the rule of law. A credible and participatory national election will be key requirement for this. Following the election, a quick restoration of the rule of law irrespective of political connection or party affiliation and ensuring the full independence of the judiciary will be critical elements to restore business confidence.

While a credible election and rule of law will help calm down private investor nervousness, the recovery of investment, and in particular, the inflow of foreign direct investment (FDI) will require strong progress with strengthening the investment climate with a focus on reducing the cost of doing business. Further investment deregulation, improving the foreign currency regime with simplified inflow and outflow of foreign capital, tax deregulation and simplification, port efficiency enhancement, and improved availability of skilled labour are all important elements of a strategy to reduce the cost of doing business.

Along with efforts to improve the business environment, the focus on tax collections and public resource mobilisation will be of paramount importance to support the recovery of GDP growth and regain the momentum on poverty reduction. On the tax front important reforms include implementation of the newly created tax policy unit with professional staff and leadership, strengthening the NBR, rapid digitisation of tax filing and payments, simplifying tax laws and tax forms, selective and productive audits, and minimization of tax exemptions.

Some quick revenue gains can be made by reforming SoEs and establishing a modern property tax system. The SoE sector continues to suffer from huge operating losses and absorbs over 2 per cent of GDP annually in terms of net fiscal transfers from the budget. This can be reversed with corporate governance and pricing reforms, which could eliminate the losses and instead enable an 8-10 per cent rate of return on the book value of invested assets, currently estimated at 16 per cent of GDP. This would yield additional non-tax revenues of 1.4-1.6 per cent of GDP.

Similarly, establishment of a proper property tax in major urban centres could yield additional 1 per cent of GDP in government revenues, which could be a major source for improving the delivery of basic urban services.

On the spending front, priority reforms include cutbacks in energy subsidies, elimination of subsidies on remittances and exports (because the market-based exchange rate provides adequate incentives while the cutback in trade protection will also support exports), reduction in interest cost through reduction in domestic financing of fiscal deficits, and greater spending on health, education, water, and social protection.

With the upcoming LDC graduation, the challenge of export diversification needs to be tackled upfront. The LDC graduation has been in the cards for over past 8 years. Yet, little preparatory progress has been made. The most frustrating policy failure is the absence of meaningful trade reforms. Despite demonstrated quantitative evidence showing how high trade protection hurts non-RMG exports, very little progress has been made to reduce trade protection. This is partly because the trade policy reform has been hijacked by the NBR that relies heavily on custom duty revenues and therefore is a major opponent of trade reforms. Progress on reduction of trade logistic cost has also been lack luster. Reduction of trade protection and trade logistic cost ought to be top priorities for the new government.

Along with export diversification that will create new jobs, the jump-starting of the dynamism of micro and the small enterprise sector (MSEs) holds the key to job creation. The reform agenda is well known but reform efforts are lacking. Associated reforms include strengthening MSE access to institutional credit, participation in global value chain (GVC), promoting technology transfer, easing tax and regulatory constraints, and establishing a one-stop shop for MSE promotion in the spirit of the US Small Business Administration (SBA).

Sadiq Ahmed is Vice Chairperson of the Policy Research Institute of Bangladesh. He can be reached at Sadiqahmed1952@gmail.com

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments