Investors in wait-and-see mode as uncertainty persists

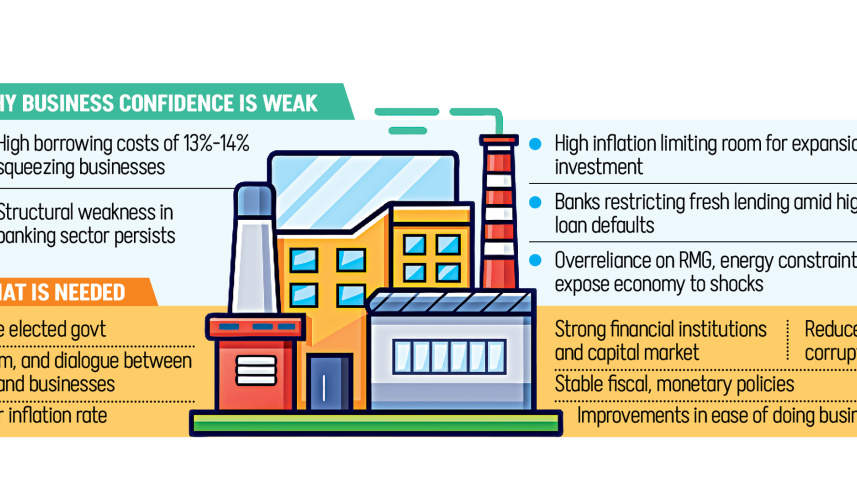

Business confidence in Bangladesh is at a low point as the country navigates economic challenges and political uncertainty, according to Kamran T Rahman, president of the Metropolitan Chamber of Commerce and Industry (MCCI).

Speaking to The Daily Star in an exclusive interview about the hurdles Bangladeshi businesses are currently facing, Rahman pointed to high borrowing costs, stress in the banking sector and a widening disconnect between policymakers and industry as key factors weighing on confidence.

“Without stability, reform, and regular dialogue between the government and business leaders, it will be very difficult for the economy to regain momentum,” he warned.

He said the interim government’s primary responsibility is to hold elections and ensure a peaceful transition to a democratic administration. In the meantime, however, industry leaders say meaningful engagement with decision-makers has been limited, despite repeated attempts at dialogue.

This gap, Rahman noted, has contributed to a slowdown in investment. “Investors are in a wait-and-see mode. They want to see a stable, elected government in place before making long-term commitments.”

Inflation, though down from its peak, continues to affect both consumers and producers, Rahman said, adding that businesses are under additional pressure from high interest rates, which currently hover between 13 percent and 14 percent.

Kamran T Rahman

“Such rates make access to affordable credit extremely difficult. As a result, many mills and factories are struggling to survive,” he said. “Some have already shut down, and more could follow if rates remain this high.”

According to Rahman, a sustainable path forward would involve bringing inflation down to around 5-6 percent, which would create room for interest rate cuts and encourage borrowing and expansion.

He also pointed to the depreciation of the taka against the US dollar. Volatility in the currency market, he said, makes it difficult to plan imports, set prices, and make long-term investment decisions.

Rahman, during the interview, especially emphasised the crises in the banking sector.

Highlighting the sharp rise in non-performing loans, which has crossed 35 percent of total outstanding loans, he said this has made banks increasingly risk-averse and less willing to issue new credit.

He also criticised the use of short-term deposits to finance long-term industrial projects, calling it unsustainable. “We need dedicated long-term financial institutions and a stronger capital market to support industrial financing,” he argued.

Rahman also commented on recent bank mergers, particularly those involving shariah-based banks, where depositors initially faced restrictions on withdrawing funds. He said restoring confidence in the financial sector would require stable fiscal and monetary policies, stronger enforcement of the rule of law, reduced corruption and improvements in the ease of doing business.

“The cost of doing business has gone up significantly, in part due to bureaucratic delays and corrupt practices,” he said. “If we want both local and foreign investors to come forward, these issues must be addressed head-on.”

Turning to the labour market, Rahman highlighted the growing gap between the supply of graduates and the availability of formal jobs. With around 20-25 lakh new workers entering the workforce annually, job creation is not keeping pace.

He noted that many graduates are either unemployed or underemployed, mostly due to a mismatch between education and industry needs. “We need to revise our education curriculum and invest in skills training that prepares young people for the real job market.”

He also drew attention to the earnings gap among migrant workers from South Asia. While Bangladeshis often go abroad as unskilled workers, Indian or Sri Lankan migrants tend to earn more due to better skills and certifications. “Certification matters. We must invest in both education and skill development if we want to compete globally.”

Rahman also called for urgent diversification of the export base. Currently, Bangladesh remains heavily reliant on the ready-made garments sector. “This overdependence is risky. Any disruption in global demand or trade policy could severely impact our economy.”

Rahman mentioned that many factories are running under capacity due to gas shortages or unreliable electricity. “When you invest in a large industrial setup, energy availability is a basic expectation.”

He urged the government to focus on both exploration and extraction of energy resources to ensure future supply, warning that overdependence on imports could drive up costs significantly.

Rahman also called for better infrastructure and public services, which ties back to the issue of revenue generation.

One of the more structural challenges Rahman pointed out is Bangladesh’s low tax-to-GDP ratio, which is among the lowest in the region. “With such a limited revenue base, how can the government provide essential services or invest in infrastructure?”

Despite these challenges, Rahman believes that once a stable, elected government is in place and a clear policy direction is established, confidence will gradually return. However, he warned that the recovery won’t be instant.

“It may take three months, six months, or even a year, depending on the policy environment and political stability,” he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments