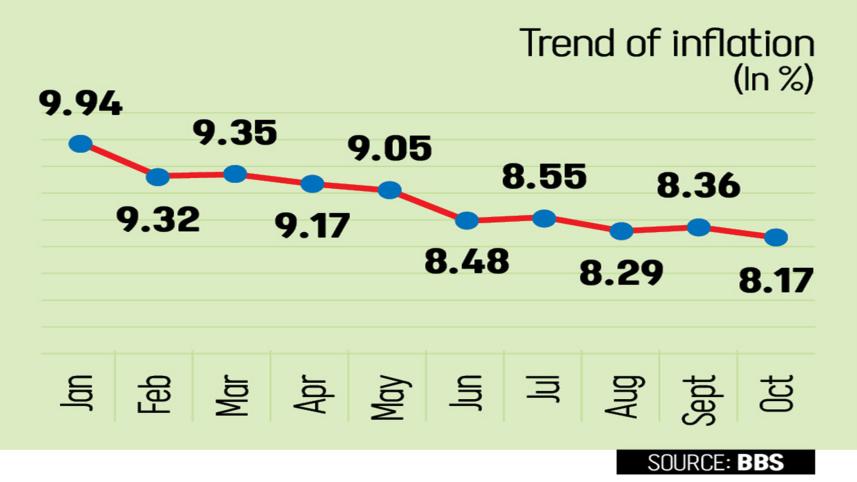

Inflation eases slightly to 8.17% in Oct

- Headline inflation eases slightly as food cools

- Non-food inflation rises, transport and rent

- Base effect masks persistent price pressures

- Wage growth lags behind soaring living costs

Overall inflation fell slightly in October as red-hot food prices cooled a bit, but households continued to face pressure on utility, healthcare, transport and other essential costs.

Owing to a fall in food prices, the headline inflation dropped to 8.17 percent last month, down from 8.36 percent in September, according to the Bangladesh Bureau of Statistics (BBS).

Non-food inflation, however, rose to 9.13 percent in October, up from 8.98 percent in September. This marks a return to a 26-month streak of non-food prices above 9 percent after a brief slowdown in recent months.

Economists say the slight easing of headline inflation offers little relief for consumers, pointing to the influence of last year's prices on current calculations.

"The base effect softens the headline [inflation], but it does not soften the blow," said Zahid Hussain, a former lead economist at the World Bank's Dhaka office.

He said the small moderation in the headline rate was driven mainly by a minor dip in food prices, too slight to signal any real easing of overall price pressures.

Hussain said the key reason for the decline is the unusually high base from October last year. Food inflation then stood at 12.66 percent due to floods and political disruptions that destabilised supply chains.

"When this year's prices are compared with that elevated benchmark, the year-on-year rate appears lower even though prices are still rising," said the economist.

According to him, the base effect is evident in the data.

Food prices rose 2.7 percent between September and October 2025, yet the annual inflation rate fell. "That looks like a paradox," Hussain said.

Despite a sharp monthly increase, the annual figure appears subdued because last year's index was so high. The same dynamic applies to the overall price level, which rose 1.89 percent in October. If this pace continued, the annual inflation rate would exceed 25 percent, he said.

Hussain said non-food inflation tells a similar story, but in reverse.

It stood at 9.34 percent in October 2024 and 9.13 percent this year. Because last year's base was relatively low, even small monthly increases now look larger in annual terms, he commented.

In rural areas, non-food inflation remained steady, while urban areas saw a slight rise.

Both food and non-food components recorded strong month-on-month growth, reinforcing the view that price pressures remain high. "This is not to say the data is wrong; the numbers are accurate. The trick lies in how we interpret them," Hussain said.

Meanwhile, Mohammad Lutfor Rahman, an economics professor at Jahangirnagar University, said the rise in non-food inflation is largely driven by higher transport and housing costs.

"Commuting expenses from regular school trips to office travel have gone up as rickshaw-pullers and CNG drivers adjust fares immediately to keep pace with rising living costs," he said.

"House rent has also increased across the country, especially in urban areas like Dhaka. Transport and rent are the major contributors to the surge in non-food inflation," said Prof Rahman.

October also marked the 45th consecutive month in which wage growth has failed to keep pace with price increases. Wage growth has declined for three months in a row, reaching 8.01 percent last month.

Prof Rahman said the government needs to monitor these areas closely, especially as wages fall despite rising costs.

"It is quite alarming. Most private investors are following a 'wait-and-see' policy amid political uncertainty. They are not ready to take new investment risks until the situation becomes clearer," he said.

"As investment slows, the labour force keeps expanding, but demand for labour has not increased. Naturally, wages remain flat," he added.

"When wages do not rise, low-income workers struggle to meet even their basic nutritional needs," Prof Rahman said, adding that this could have longer-term consequences for productivity.

"If daily wage earners cannot afford proper nutrition now, their productivity will fall, and even when the economy recovers, it may not return to the desired level," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments